The cash strapped Bruhat Bengaluru Mahanagara Palike (BBMP) has been on a quest to improve its system, which will enable it to widen its property tax net. BBMP was one of the first municipal corporations in the country to embrace technology and implement an online Self Assessment Tax system.

Whilst the effort has been in the right direction, it is however, constantly in the news, quite often for the wrong reasons. Now, even as it manages the brickbats and high praise, especially for its COVID management, BBMP has thrown a shocker to the public – a Property Tax Demand Notice to thousands of property owners pertaining to taxes paid under the wrong zone.

Property tax has two major components which determine the amount to be paid (for both residential and commercial) – Zones and Taxable Capital Value.

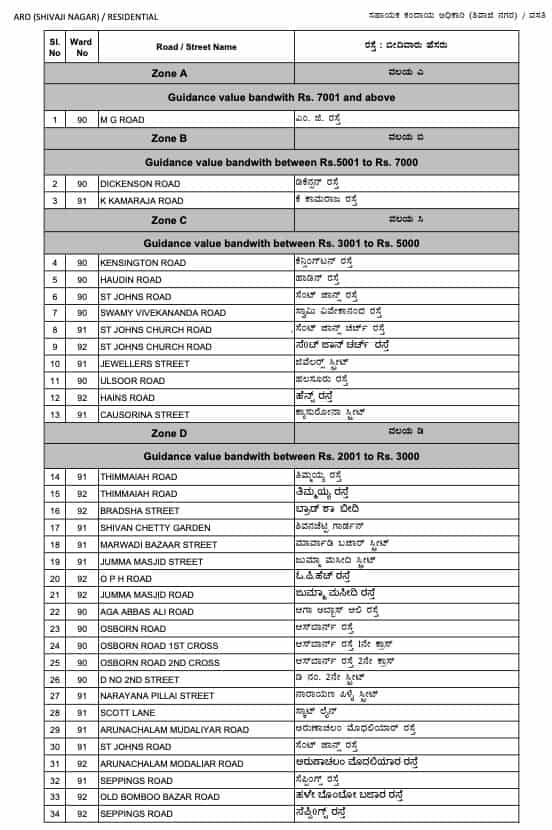

Zones: Chronology of zonal classification

In the 1990s, Dr A Ravindra, the then commissioner of Bangalore Mahanagar Palike (BMP), had mooted the idea of a Self Assessment Scheme for property tax collection.

Based on the property’s registered value data given by the state’s Department of Stamps and Registration, BBMP divides an area into several zones.

| Period | Self Assessment Scheme and Zonal Classification chronology |

|---|---|

| Jan 24, 2000 | The format for Self Assessment Scheme for property tax collection was presented at the Bangalore Agenda Task Force (BATF) summit on January 24, 2000, by V Ravichandar, which was endorsed by the then Chief Minister S M Krishna and implemented by Jairaj, BMP Commissioner and Vasanth Rao, BMP Finance Head |

| April 1, 2000* | The first reclassification was done by BMP for three core city areas, West, East and South. It divided an area into five zones – A B C D and E – with Zone A attracting the highest tax and Zone E the lowest. |

| 2007 | Seven City Municipal Councils (CMC), one Town Municipal Council (TMC) and 110 villages were merged to form Bruhat Bengaluru Mahanagara Palike (BBMP). |

| 2008-09** | Rules were revised under various categories, and BBMP divides an area into six zones – A B C D E and F (Most of the new areas which were added were classified under Zone F) |

| 2016-17 | Second Zonal reclassification |

**Exceptions: There are some areas which do not fall under any zone, for example Queens road, the stretch between the cricket stadium and Cubbon park. No property sale is allowed In this stretch and hence does not come under any zone. For such areas, the rules say: Tax shall be calculated based on the highest rates applicable to the nearest neighboring/street/area/locality.

Read more: How to reform BBMP’s perpetually flawed budgets

Each zone would comprise a range of property values:

Zonal re-classification is based on the development of an area. In the process of re-classifying city areas into relevant zones, some streets get shifted from a lower tax zone to a higher tax zone. In some cases they have shifted two tax zones higher. In order to keep the increase incremental, a cap has been provided whereby even if there is a shift to two or more higher zones the shift is restricted to one higher zone only.

How is Property Tax calculated?

Every year BBMP collects tax on an annual basis for the financial year ending on March 31st with a grace period of a month or two, though in the last two years, due to the pandemic, the grace period (where you get a rebate of 5%) was extended to June 30th 2021.

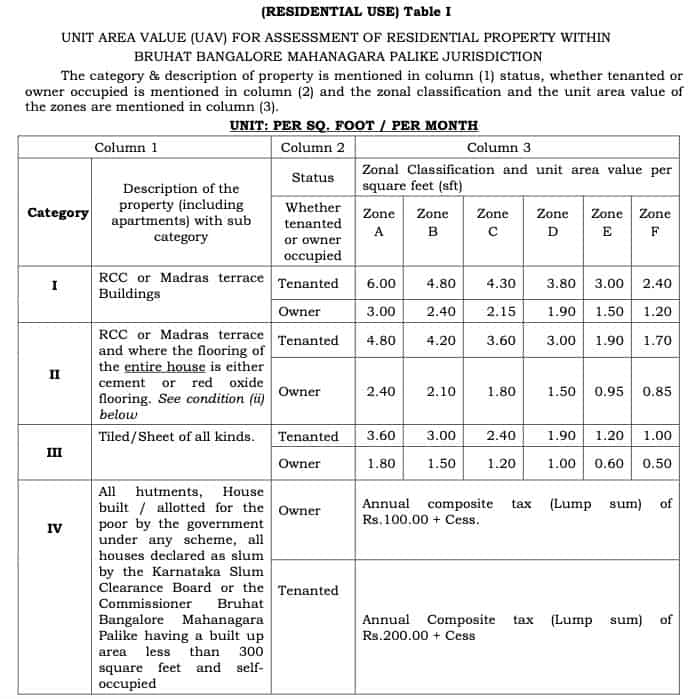

Net property tax payable is calculated as follows:

- Built up area x Unit Area Value* x 10 months = Total 1 (T1)

- T1 minus the Applicable Depreciation = T2 (Taxable Annual Value)

- T2 x 20% = T3 (Property tax)

- T3 x 24 % = T4 (Cess)

- T3 + T4 = T5 (Gross Property payable)

- T5 x 5% = T6 (Rebate for early payment)

- T5 minus T6 = Net property tax payable

*Unit Area Value is based on the expected returns from the property depending on location and usage. Since the unit of calculation is based on per square foot per month (UNIT) and for a particular location, street (AREA) and multiplied by a rate (VALUE), this method of assessment of property is called “Unit Area Value” method.

How to arrive at the Unit Area Value (UAV) for Residential properties

Read more: BBMP’s plan to fix property tax gaps and loopholes

What triggered the current tax demand notices

Early this year, in an attempt to increase its tax collection, BBMP started the mammoth task of using GIS Enabled Property Tax Information System (GEPTIS) to track each property’s tax status. With this new system, one of the flaws rectified is the automatic linking of reclassified zones to the relevant streets, which the earlier SAS system was not doing.

This resulted in identification of properties which are undervalued. A whopping 78,524 under-valued properties are now being served notices to pay up their tax arrears.

The following components have been used for computing arrears adding that arrears amount has to be remitted within 30 days, else 2% interest would be charged per month and further action initiated if needed under Rule 27 of Schedule-III of Part-III of KMC Act 1976.

| Sl # | Category |

|---|---|

| 1 | Property tax for 2016-17 to 2019-20 (4 years) |

| 2 | Cess (increased to 24%) |

| 3 | Property tax with cess |

| 4 | Penalty (double the amount of property tax due) |

Property tax can increase due to the following reasons

| Sl # | Classification | Remarks* |

|---|---|---|

| 1 | Change of use – owner-occupied to tenant. | Tenanted properties attract higher tax |

| 2 | Zonal re-classification – locality is moved to another tax zone | Higher zone attracts higher tax |

| 3 | Change of area – remodelling and expansion | If there is a reduction in built-up area, the Area Revenue Officer (ARO) will have to verify and approve |

| 4 | Category change – Residential/Commercial | ARO approval is required for shifting from Commercial to Residential |

People’s views

“During the process of revamping the property tax system, done under the direction of the Honorable Commissioner and Administrator, several discrepancies were observed, where a large number of owners were found to have undervalued their properties. Undervaluation can happen due to 3 reasons – wrong zone, built-up area and usage. We have issued notices to such owners.”

Dr Sri Basavaraju.S, IAS Special Commissioner (Revenue)

According to an article by N S Mukunda of Citizen Action Forum’s (CAF) How to reform BBMP’s perpetually flawed budgets, Bengaluru has around 33 lakh properties. But of these only 18 lakh are in the tax net. And even among these, a significant number is not up to date in paying taxes.

Instead of focusing on tax evaders, law-abiding citizens are being penalised under ‘Tax evasion’ rules by levying a higher rate, whilst non-compliance attracts only a 2% penalty, Mukunda’s article pointed out.

So what is the way forward?

“I believe the enhanced tax needs to be paid for the past years,” says Ravichandar V member of who was member of the erstwhile Bangalore Agenda Task Force (BATF). “However, given the poor communication and the system not using technological aids to alert people that they need to pay as per revised zone, BBMP should waive penalty and interest costs. Citizens should pay the past taxes due. That would be a fair resolution”.

Present status

There have been several appeals by the affected citizens against this notice demanding tax arrears. And while they are ready to pay the taxes, they find the penalties to be very high. Discussions are currently on regarding the next course of action. Of the 78,524 under-valued properties being served notices, total amount due is Rs 120 crore tax + Rs 240 crore penalty which adds up to Rs to 360 crore. With other charges, the total due is over Rs 400 crore.

Of this, 8817 people have paid Rs 14.59 crore till date.

East Zone, with 17,565, has got the highest number of notices.

A very informative report by Sandhy. This helps understand the way the system works. BBMP clearly targets the middle class who never have fought for rights. Now is the time to bring our the gross faultlines in the system

I am not sure how this GIS enabled correction work!

But in our case it has put our property in Zone A where as per 2016 zone classification, Hoodi area does not even have ZoneA residential property, and our property falls under C/D. I am not sure of how to fight this notice!! Not much of help from Mahadevapura BBMP office when I raised this.

Honest tax payer is penalised for BBMP Revenue officers mistake. Kindly wave penalty and interest which could be adjusted in the next year’s tax

A very informative article by Sandhya. Exactly what has happened in BBMP in imposing Tax and penalty is clearly said.

Citizens also must follow BBMP in calculating their property taxes while expecting good infrastructure.

After visiting many times to zonal office in Indra Nagar, I paid the penalty and interest although my tax payment was update. Before getting the defaulter notice, I was never informed. Most of the official present there , only reply you should have seen the website. If you want remedy, go to commissioner. I asked, please tell me now now, in which zone my property belongs. They themselves were unable to do the honours. Very very pathetic situation for honest tax payers

This is very wrongful done by BBMP implementing hefty penalty,most of them are senior citizens doesn’t know the tech savvy,and which is very pathetic technology design which accept payment on wrong zones, I think this is intentionally done by BBMP, also BBMP knowingly the wrong why they delayed for four years.PLEASE WE NEED JUSTIFICATION ON THE ABOVE SAID FROM CONCERNED AUTHORITIES.

I have a commercial property in Bilekahalli. I have paid the taxes regularly online. I received a notice to pay Rs. 282000/-. The difference was only around 60000/-. They included the fine cess and so many things. I have paid that urge amount to avoid harassment. I hope they realise their mistake and return the excess amount

The tax has been paid as per the challan generated in the BBMP site, once u enter the PID or 10 digit number. Individuals cannot tamper it. As demand upto 2020 was paid accordingly, demanding tax for any reason, not attributable to the owner, is bad in law and not justified. Request needful withdrawal and for those who have paid, be adjusted for future. Retrospective levy is tobe discouraged. In addition, tax is collected without providing basic infra.

Can anybody tell me how a same street in the locality have different zone classification. Next, how can there be a different zone classification for different floors in a multi storeyed building??? Ridiculous isn’t it???

If the BBMP has all the GIS-tagging in place, why on earth are they not having their website automatically update the zone based on the property? They share no information, do not alert the tax payers of the change, do not include the required checks/validations in their site and then later conveniently sent notices demanding exorbitant amounts. This is nothing short of daylight robbery.