A budget is a statement of accounts; it is an estimate of planned expenditure and receipts of the government or any organisation or a company in a particular period of time. And while this document really gives us the planned allocations and expected income of the local body, every financial year, citizens look at the Greater Chennai Corporation (GCC) budget to form an idea of the various new civic or infrastructure projects that the municipal government of the day is prioritising.

But what are the sources of income for the Corporation and what are the various heads on which the money is spent?

In the financial year of 2020-21, for example, Chennai Corporation passed its budget for an estimated expenditure of Rs 3,815 crores for various projects which included laying Bus Route Roads (BRR), strengthening the streetlight network and restoring the parks. But while these are usually written about or discussed, what escapes public attention is that the GCC has to pay Rs 63 crore as salary for its 18,000 permanent staff in all the 15 zones.

To understand the finances of the GCC, we must make an attempt to understand its sources of revenue and list of expenditure heads.

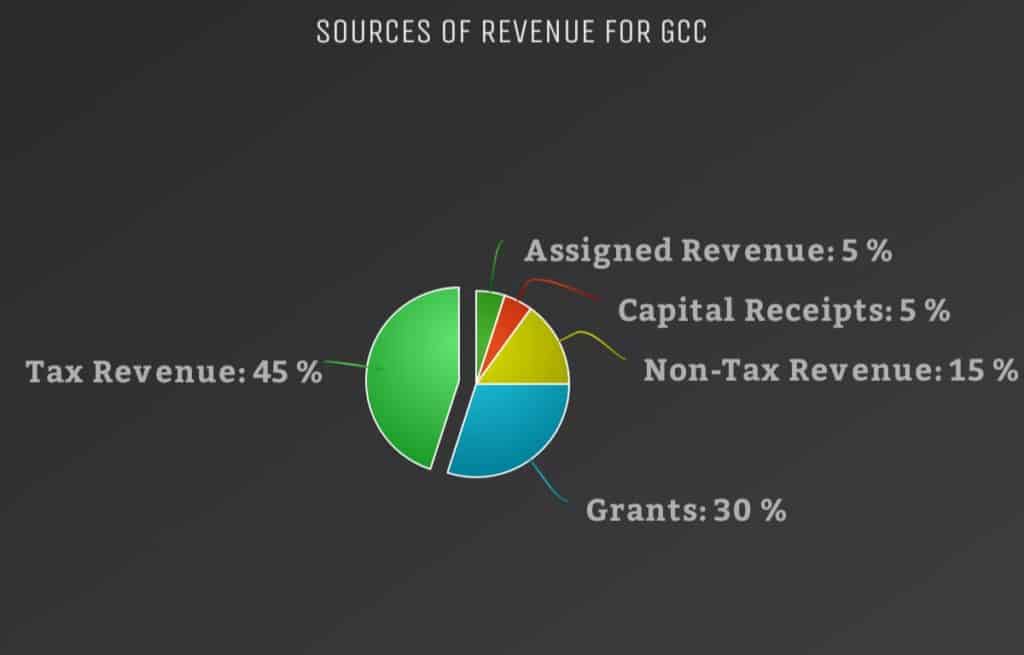

Five sources of revenue

Tax revenue

It is the revenue earned by the civic body from various items such as property tax, professional tax, trade license, company tax, entertainment tax and advertisement tax. Tax revenue accounts for 45% of the funds for GCC.

Did you know that a part of your salary goes to GCC as professional tax and a percentage of what you pay for a movie ticket is collected as entertainment tax?

- Property tax: Citizens who own commercial/ residential property must pay property tax once in six months.

- Professional tax: A part of your salary is deducted by your employer to pay tax to the GCC once in six months.

| Salary slabs of employees | Half-yearly profession tax (in effect from April 2018) |

| Up to 21,000 | Nil |

| Rs 21,000 to Rs 30,000 | Rs 135 |

| Rs 30,001 to RS 45,000 | Rs 315 |

| Rs 45,001 to Rs 60,000 | Rs 690 |

| Rs 60,001 to Rs 75,000 | Rs 1025 |

| Rs 75,001 and above | Rs 1250 |

- Trade licence: Anyone who runs a business has to pay trade licence fees to GCC. Restaurants pay the highest tax of Rs 12,500 (if it is beyond 500 sq ft) and Rs 6,250 (less than 500 sq ft) a year. Saloons pay the lowest of Rs 200 for below 500 sq ft and Rs 250 for above 500 sq ft, as shared by T A Nidhipathi, Assistant Revenue Officer of zone 9.

- Company tax: All public limited companies pay Rs 1000 every year to the GCC.

- Advertisement tax: A part of the amount an advertiser spends on hoardings and advertisements in the public spaces of Chennai goes to the GCC. But, as there is presently a ban on hoardings, there is no cash flow to the civic body as advertisement tax.

Non-tax revenue

This is recurring income earned by GCC from all sources other than taxes such as user charges, licence fees and rental income from community halls, fish markets, stadiums and other commercial spaces. Non-tax revenue forms 15% of the GCC’s funds. For example, every shop owner in the shopping complex constructed by GCC at Pondy Bazaar pays a monthly rent to GCC. This is a constructive example of how non-tax revenue gives funds to GCC.

Machinery usage fees in some companies and fees to apply for licenses are other sources in the non-tax revenue.

Assigned revenue

It is the fund collected by various state government departments on behalf of the local bodies. Surcharge on stamp duty and land revenue are a few examples. In other words, a part of the money you pay to the revenue department to register your property goes to the GCC. Assigned revenue accounts for 5% of the GCC’s funds.

Grants

The 73rd Constitutional Amendment requires both the centre and states to allocate funds to the local bodies. Grants from the State Finance Commission (SFC) and the Central Finance Commission (CFC) form 30% of GCC’s revenue. Many projects in the city such as Smart City, construction of toilets under the Swachh Bharat Mission are funded by SFC and CFC.

Capital receipts

Capital receipts are in the form of fund flows from various sources such as the World Bank, Asian Development Bank (ADB), external aided projects and other state government agencies. It accounts for 5% of GCC’s revenue. For example, the World Bank has sanctioned funds of Rs 2000 crore to GCC for constructing 110km of mega streets in the city.

View GCC’s balance sheet for 2017-18 here.

Expenditure of the GCC

The 12th schedule of the 74th Constitutional Amendment Act of 1992 covers a list of 18 items that falls under the urban local body. It includes regulation of land use and construction of land buildings, urban planning, economic and social development, urban poverty alleviation, water supply for domestic, industrial and commercial purposes, fire services, public health sanitation, conservancy and solid waste management etc. To know the complete list of subjects under the ULB, click here.

GCC spends its funds primarily on establishing civic infrastructure, administrative expenses, such as pension and salaries of the staff (administrative) and loans for the projects taken. “We spend Rs 20 crore per month as interest charges for the various loans taken over the years,” says Deputy Commissioner (Revenue & Finance), Meghanath Reddy.

In the budget 2020-21, the estimated capital receipts and capital expenditures are Rs 1,796 crore and Rs 1,900 crore respectively.

The chief (planned) allocation of funds is towards:

- Laying Bus route routes, at Rs 384 crore

- Construction of new bridges, at Rs 512 crore

- New LED street lights, at Rs 120 crore

- Restoring the existing parks, at Rs 70 crore

View GCC’s budget here.

GCC has other responsibilities too. Just like other state government departments give a part of their revenue to the civic body, GCC has to pay a percentage of its revenue to other departments. “A part of the tax revenue collected by GCC goes to the Library and the state education departments,” said a tax collector with the Chennai Corporation.

How does the civic body manage the funds during emergencies?

“GCC relies on funds released by state and central governments. The funds released by the State Disaster Response Force (SDRF) helped us a great deal to mitigate COVID-19. We send them the budget proposals attaching the expenditure.”

Meghanath Reddy, Deputy Commissioner (Revenue & Finance)

[ With inputs from Meghanath Reddy, Deputy Commissioner (Revenue & Finance); T A Nidhipathi, Assistant Revenue Officer of zone 9; Tax collectors working with GCC and budget documents from GCC. ]