The alarming air quality in the National Capital region (NCR), comprised of Delhi and adjoining areas, has found fresh mention in the Economic Survey 2017-18 tabled in Parliament on January 29th.

It is well known by now that the average annual levels of PM2.5 – one of the most critical contaminants in the air we breathe – remain at above three times the prescribed level in this region.

The Survey reiterates the four main reasons for Delhi’s worsening air quality – crop residue and biomass burning; vehicular emissions and re-destributed road dust; construction, industries, and power plants; winter temperature inversion, humidity and absence of wind – and suggests that each of these source problems must be addressed systematically, through coordination between agencies and Central and State Governments and sustained civic engagement.

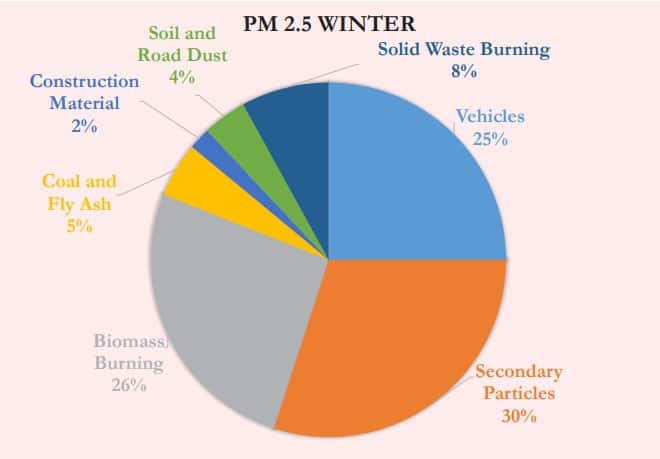

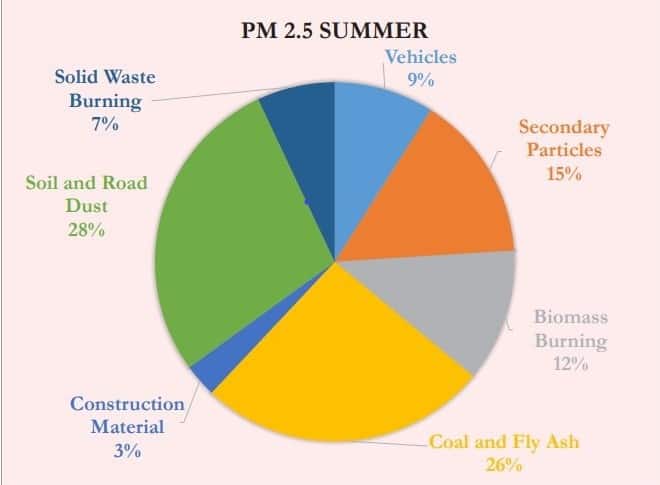

Citing a two-season study (summer and winter of 2015) by IIT Kanpur, the Survey pegs the approximate attributions to each of these sources as follows:

Action recommended

Keeping in mind the proportion of and causes behind each of these pollutants, a combination of emergency plans and medium-to-long-term actions have been recommended.

Short-Term Emergency Plans are to be implemented when the PM2.5 exceeds 300-400 mg/m3 over a 24-hour period. Measures include

- Strict enforcement through heavy penalties on agricultural waste burning, aided by use of satellite based tools to detect fires and mobile based applications

- Incentive payments to farmers, coordinated across states and NCR.

Medium and Long-Range Actions suggested include

- Congestion pricing for vehicles

- Expansion and improvement of the public transport system that will reduce private vehicle use and expansion of modernized bus fleets in particular

- Phasing-out of old vehicles

- Acceleration of BS-VI standards (already notified and to be commenced from 2020).

Use of technology

The Economic Survey also emphasizes technological means, implemented through agricultural cooperatives, local bodies etc, to tackle pollution arising out of the burning of agricultural waste.

One such potential solution identified is the Happy Seeder machine that sows seeds without the need to remove paddy straw, and works well when the straw is spread evenly on the field through the straw management system.

It encourages development and implementation of business models with private sector and communities and incentives to shift to non-paddy crops.