Two major announcements were made in February 2024:

- Karnataka Assembly passed the BBMP Amendment Bill 2024. Bengaluru development/Deputy Chief Minister DK Shivakumar on X (twitter) hailed it as a taxpayer-friendly Bill. The amendment was projected to benefit around 13-15 lakh people in Bengaluru, including 5.51 lakh taxpayers, by reducing the penalty on property tax arrears by 50%.

- This was followed, on February 20th, by BBMP’s draft notification proposing a new property tax calculation structure in Bengaluru. The new structure, based on Guidance Value (GV), is expected to begin during the next financial year, starting April 1st.

Tax computation

Municipalities in India compute property tax using these three methods:

- Capital Value System (CVS): Percentage of the market value of the property, which the government decides and is based on the locality of the property. Mumbai follows this system.

- Unit Area Value System (UAS): This is based on the expected returns from the property, depending on location and usage. Municipalities in Delhi, Kolkata, Bengaluru, Patna, etc. follow this.

- Annual Rental/Rateable Value System (RVS): Tax that is calculated on the yearly rental value, decided by the municipal authority based on the size, location, condition of the premises, proximity to landmarks, amenities etc. Hyderabad and Chennai follow this system.

In 2008, the newly formed BBMP adopted Self Assessment Scheme (SAS) for property tax collection. This was computed using two major components that determine the amount to be paid (for both residential and commercial): Zones and Taxable Capital Value.

Here is an explainer of how the property tax is computed based on the revisions made:

Revision of property tax

The basis for the new structure – “Under section 144 of CHAPTER XIII TAXES of BBMP Act 2020 – guidance value of property under section 45B of the Karnataka Stamp Act 1957 (Karnataka Act 34 of 1957) shall form the base for payment of tax applicable during each block year”.

This effectively replaced the existing ‘A, B, C, D, E’ zonal classification system with taxation based on guidance value.

The rationale was, depending on the zone, owners have to pay higher tax for the same built-up area.

Proposed Guidance Value (GV) based property tax System – (per sq. ft per year)

The tax varies:

- Self-occupied and tenanted properties

- Residential (lowest), commercial, industrial and star hotels (being the highest)

- Vacant land – Lowest 0.025% to 0.75% (Star hotels)

- Construction cost varies from Rs.1,500 to Rs. 4,000 per square feet (psft)

- Depreciation rate @ 3% per annum subject to an upper limit of 60%.

| Residential properties: | |

| a. Tenanted property/lands/ | 0.2% of the guidance value |

| b. Self-occupied property/lands | 0.1% of the guidance value |

| Commercial properties | 0.5% of guidance value |

| c. Fully vacant land (both residential/commercial) | 0.025% of the guidance value |

| Tax is based on 2 parts built-up area and vacant area | A+C or B+C as applicable |

| Depreciation rate | @3% per annum subject to an upper limit of 60% |

| Construction cost: – Independent houses – Commercial | 1,500/- psft 2,000/- psft |

Proposed tax for a house built on a 30’x40′ site in JP Nagar 2nd Phase:

- Self-occupied ground + 1st floor

- GV : 81,000 / sq mtr (Divide by 10.76 for value in sq ft) = Rs. 7,528

| Current property tax as per SAS | Proposed GV based tax |

| FY 2023-24 property tax under SAS for Zone C = Rs. 5200, including 26% cess | 1. Cost of land: 90,33,600 (1200 sq ft X 7,528 GV per sq ft) 2. Cost of construction: Rs. 20,62,500 (Built up area [891 + 584] = 1375 sq ft X 1500/- per sq ft) 3. Building value (cost of construction after 60% depreciation) = Rs. 8,25,000 4. Property value = (90,33,600 + 8,25,000) = Rs. 98,58,600 |

| FY 2024-25 (assuming an increase of 20% tax) = Rs.6,240 | Proposed GV based property tax: 0.1% of G V = Rs.9,859 Cess (26%) = Rs. 2,563 Total property tax = Rs. 12,422 |

| The same will be constant for the entire block period 2024-25 to 2027-28 | A 5% increase YoY |

Tax will be payable as per A khata GV rates. In addition to taxes on building and vacant land, properties with hoardings, telecommunication towers or electronic devices will pay an annual fee of Rs 20,000 each of device/structure. Annual composite tax of Rs. 300 towards huts, slums and other government-built houses for the poor.

BBMP will not reduce existing property taxes if the new system results in lower payable taxes.

Read more: Audit report: BBMP, other Urban Local Bodies powerless and cash-strapped

Issues with revised tax computation

There has been a severe backlash from citizens; apart from the steep increase in the property tax computation, which will put an additional burden on residents, especially those retirees in ancestral properties, the new structure doesn’t help plug wrong disclosures.

There are also questions on the guidance value computation itself:

- Guidance value is not constant. It is revised every year, in fact, on October 1, 2023, the GV was increased by a whopping 50%

- Not all properties have clear GV assigned to them

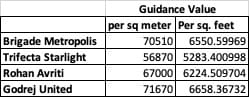

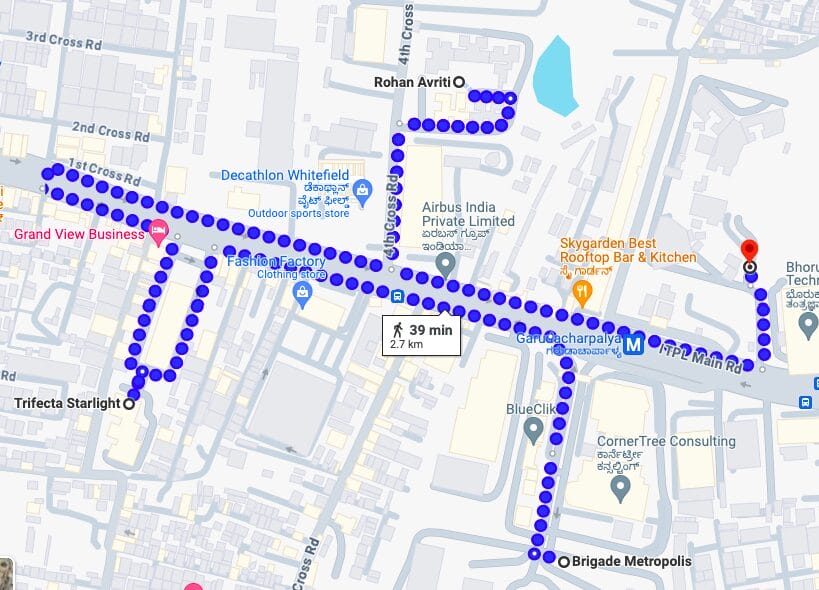

- The GV for properties is not uniform; it can vastly fluctuate- a case in point, in Mahadevapura, four apartments with similar amenities, hardly within 500 metres range on the same road, have multiple GV values varying around Rs.14,800.

Apartments are in for further shock as, according to section 8 (xiv) of the draft notification, 50% of the per square foot rate is payable for common areas in any building or apartment. Further, open spaces and parks will attract 0.025% of GV, as prescribed for the fully vacant lands or areas.

The taxes for most apartment flats/units are determined by the super built-up area, which includes common area amenities. If the total super built-up area of all apartments matches the approved plan’s total super built-up area, there should be no grounds for imposing additional taxes on common areas.

There have been several complaints where BBMP officials sent notices to apartments asking for property tax for common areas, despite residents having already paid BBMP property tax on the super built-up area.

Citizen reactions

According to Vishnu Gattupalli of Bangalore Apartments’ Federation (BAF):

- The net increase in property tax can be 100% in several areas, especially the apartments with high guidance value. Such an increase in guidance value, without much development on the ground level, is a bit baffling.

- While in the first glance it may appear that the taxes are only 0.1% or 0.2% of the guidance value, there are many conflicting components which add up to the final total tax.

- This is a departure from the previous zone-wise classification approach. A ‘zone’ was classified based on the development of an area, such as BBMP-provided, roads, parks, lakes, footpaths, waste management facilities etc.

- With this guidance value approach, the same apartments which are just 100 metres away from each other have a big difference in the property tax (even more compared to individual homes).

- There is a mention of 3% depreciation on the land-based constructions, but the apartments or buildings guidance value has gone up. It is not clear how the depreciation will be applied to older buildings.

- There is an ambiguity about whether there would be different charges for common areas of apartments, facilities like clubhouses, open areas if any, and whether these components will be added separately to the apartment’s tax.

The depreciation cap of 60% works out to just 20 years, forcing heritage buildings to pay huge taxes. Priya Chetty Rajagopal of Heritage Beku, a citizen initiative to maintain and preserve Bengaluru’s fading heritage, has requested BBMP to exempt heritage buildings and spaces, remnants of glorious city history, from BBMP property tax payment as they have a potentially detrimental impact on heritage buildings.

Read more: Why BBMP is caught in a vicious cycle of low municipal revenue

Why the sudden change?

52% of BBMP revenue generation comes from property tax; its per capita revenue, just Rs. 1,567, is much lower when compared to other cities. For Mumbai, it is Rs. 5,458 and for Delhi it is Rs 3,843. The Economic Survey of 2016-17 estimated that Bengaluru is realising between 25% and 40% of its revenue potential from property taxes.

As per the 2023 BBMP budget, the civic body’s property tax revenue collection was 60% lower at Rs. 2,400 crores, against the estimated demand of around Rs. 4,000 crores.

To boost its already dwindling tax revenues, BBMP tried enhancing its tax base via GEPTIS (GIS Enabled Property Tax Information System), with some success. A whopping 78,524 undervalued properties were served notices to pay up their tax arrears, which resulted in public backlash and owners getting stay orders from the court. The recently passed BBMP Amendment Bill 2024 halved the penalties on property tax.

Whilst there is a necessity to boost revenue generation, the question arises whether BBMP should pursue such a drastic changes in the absence of an elected council. It has been four years since the last BBMP election!