The Tamil Nadu government increased property tax for all local bodies in the state earlier this April. This means that the residents of Chennai’s core areas would have to pay at least 50% more than what they have been paying for over two decades.

The Greater Chennai Corporation has as many as 13 lakh property tax assesses with an annual demand of Rs 800 crore. The revision came into effect from April 1, 2022 with an aim to increase the civic body’s revenue generation capacity, which plays a critical role in providing better services and improving infrastructure.

Here is an explainer of how the property tax is computed based on the revisions made.

Revision of property tax

Chennai saw a general revision of property tax in 1998. The added areas (annexed to GCC in 2011) and surrounding municipalities saw a revision in 2008. A Government Order was issued in 2013 for a property tax revision. However, it was stopped in 2019 owing to various reasons. Later, a committee, which was formed to provide recommendations for general revision, looked into the market rates, inflation, gross state domestic product (GSDP) and cost inflation rate.

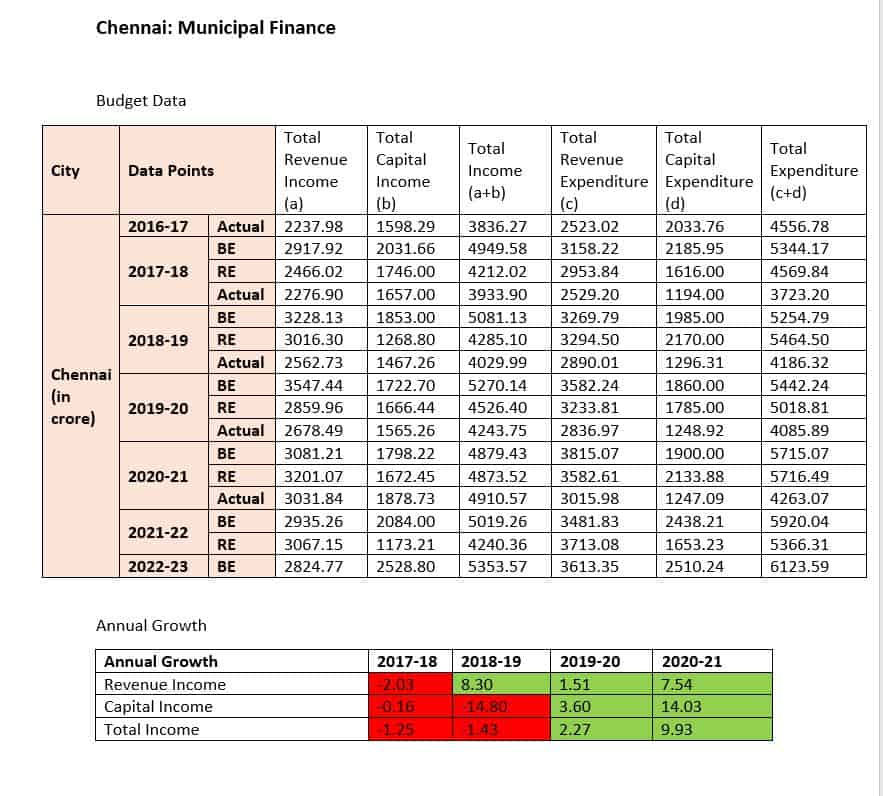

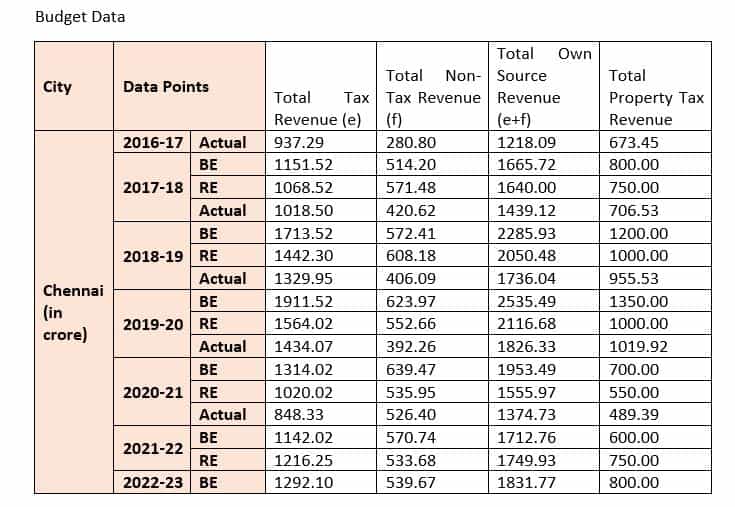

It was found that the wholesale price index had grown by 2.98 times from 1998 to 2022. Even as other growth parameters were on the rise, the property tax rates remained the same. Expenditures for the civic body too had risen while the source of revenues for local bodies has traditionally been limited and heavily reliant on taxes. This has put municipal finances under strain, leading the government to revise the property tax rates after over two decades.

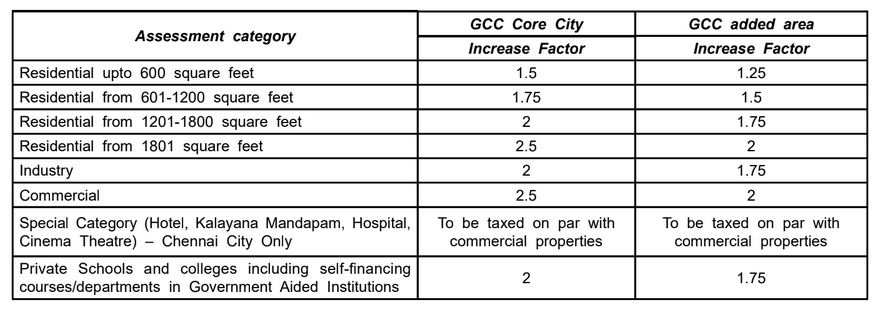

According to the revised property tax in Chennai, the tax on residential properties less than 600 square feet will increase by 50% in old city areas and 25% in added areas. For residential properties of 601 to 1,200 sq ft, the increase will be 75% in old city areas and 50% in added areas. Residential properties of 1,201 to 1,800 sq ft and industrial buildings will pay 100% higher in old city areas and 75% more in added areas. Residences bigger than 1,801 sq ft will pay 150% more in the old city and 100% more in added areas.

Non-residential buildings, hospitals, marriage halls, theatres and lodges will pay 150% more in the old city and 100% more in added areas. Educational institutions will pay 100% more in the old city and 75% more in added areas.

However, since April, the GCC has received over 3,000 complaints from Chennai residents against the property tax revisions.

Read more: A guide to understanding the revenue and expenses of Chennai Corporation

Why is it important to increase the tax?

Property tax is the most significant and stable source of self-generated revenue for the local bodies. It is necessary for the sustainability of local bodies, to meet the expenditures incurred and to provide better service for the public. “Property tax in Chennai and across the State has not been revised for decades. Even when the erstwhile government tried to revise the property tax earlier, they were forced to roll back as the residents were against the hike,” noted K R Shanmugam, Director, Madras School of Economics, who welcomed the tax hike.

With the Union government making property tax revision mandatory for the State governments to seek grants, the state is now left with no other option but to revise the tax. The tax revision was also part of the recommendations made in the State Finance Commission and 15th Central Finance Commission (CFC) reports.

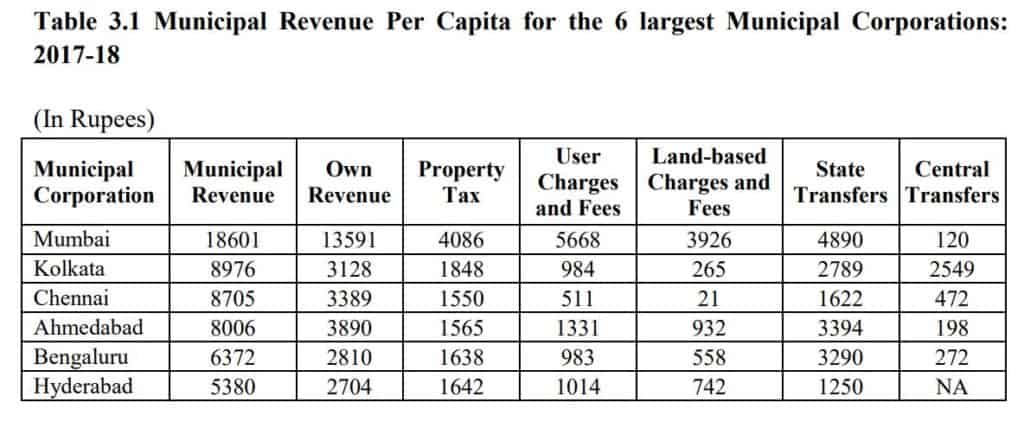

“If the government had hiked the property tax marginally every year, the residents would not have felt the recent hike so sharply. Even after revision, Chennai has low tax rates compared to other major municipal corporations,” Shanmugam added, citing a study conducted by Indian Council for Research on International Economic Relations (ICRIER) for the 15th CFC. The study also showed that per capita property tax collections were lowest among the six largest municipal corporations in the country.

Pic: A study conducted by Indian Council for Research on International Economic Relations (ICRIER) for the 15th Central Finance Commission (CFC)

The tax hike would also help in reducing the local bodies’ dependence on state transfers. “Municipal Corporations will continue to be dependent on state transfers until their own revenue situation improves significantly or the central government steps in, in a big way,” read the ICRIER report.

Yet another impact of not revising the property tax is the inability to borrow from market sources. Municipal Corporations require the state government’s permission to borrow from market sources. Their deteriorating revenues adversely affect their creditworthiness making it difficult for them to borrow from market sources.

Currently, property tax is the major source of revenue for Chennai. “However, the city governments should get a share in all revenue charges including GST and income tax, while the grants from the Centre or State can be a reform-based incentive grant for the city governments,” said Meghna Indurkar, Program Manager of Transforming Urban Governance, Praja Foundation.

Revision of property tax rates should strictly be done at periodic intervals. The city government can give rebates, instead of exemption, to a certain section of society or on certain occasions (like pandemics or floods, etc). “This will help ensure 100% coverage and create a base towards increasing the property tax and in turn the own source revenue of Chennai. When all citizens register as property tax payers, they not only become consumers but can also demand accountability from the service delivery agency,” Meghna added.

Issues with revised tax computation

Following the complaints received by many residents, the revenue officials have been conducting meetings with the residents who filed a representation against the property tax hike in Chennai. Jaishankar B, a resident of Valmiki Nagar, who attended one such meeting, said that he was not against the tax hike as such.

“We understand that property tax has a huge role in municipal finance and also welcome the move. However, we are concerned only about the exponential hike. I have been paying a sum of Rs 3,280 as half-yearly property tax. According to the recent GCC notice, I now have to pay a sum of Rs 8,200 as half yearly property tax,” he said.

During the meeting, the officials had made it clear that there would not be any further reduction in property tax and had explained the rationale behind the hike to the residents. “While I understand the consideration for a possible reduction in certain sectors like a registered factory, educational institutions or commercial property, the officials mentioned that there would be special considerations even for residential establishments converted to hostels. If you had converted a big house into a hostel before the outbreak of COVID and none had occupied it due to the pandemic and if the house remains empty now, it could be given some exemption, the officials mentioned. This sounded quite unusual,” Jaishankar added.

Read more: Why does actor Rajinikanth pay less tax than Nagarajan of Nanganallur?

The main contention of the residents from suburban areas was that the basic street rates (BSR – one of the factors in computing property tax) were high in added wards than in the core areas. V Rama Rao, a civic activist from Alandur said that the BSR in areas like Alandur (erstwhile municipality) is Rs 2.50, while the same in core areas like T Nagar or Nungambakkam ranges from Rs 0.90 to Rs 1.50.

The Gazette notification issued by the government on April 11, 2022 said that existing basic street rates would be used in the revised property tax as well. “While they should have reduced the BSR for annexed wards first and then revised the tax, they have only reduced the multiplying factors for added wards by 0.25 times. This is not fair,” said V Rama Rao.

In response to the complaints on BSR, the corporation council adopted a resolution in May to bring down BSR in some extended areas to be at par with, or lesser than, that of core areas. However, the notice issued to the property owners has no explanation of the computation process or the revised BSR.

In yet another case, Rama Rao observed that a change in ownership of property resulted in a tax hike. “For instance, if an apartment has 12 dwelling units, say for 800 sq ft, the property tax for all was same for all units. However, if the ownership of one dwelling unit has changed from one person to another, the revised property tax for that was at least Rs 1,000 higher than all other dwelling units. This is done in the name of reassessment,” he added, adding that the government should give a proper explanation in such cases.

How is property tax computed?

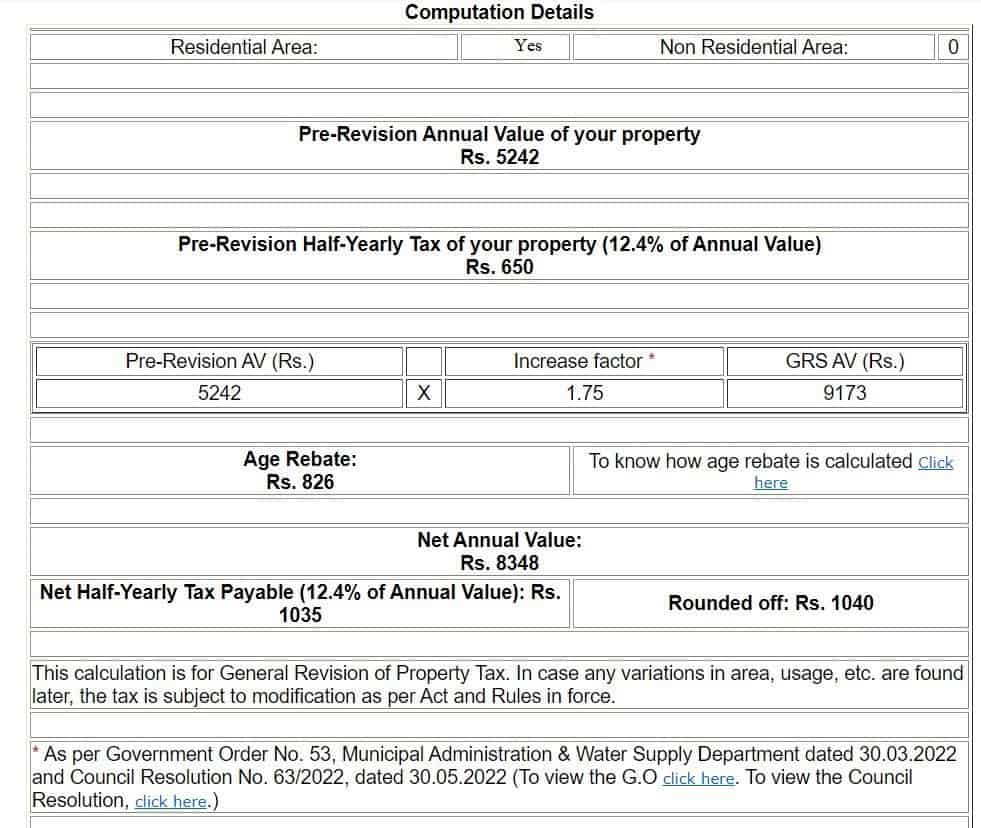

According to the computation details furnished by GCC on its website, the net half-yearly property tax payable is 12.4% of the revised Annual Value (AV) of the property.

The basic formula used in the revision of AV is pre-revision AV multiplied by the increase factor (given in the chart above). The age rebate is then subtracted from the multiplied value.

Revised AV = Pre-revision Annual Value (AV) of the property (x) increase factor (-) age rebate

Here is an illustration of the computation details furnished to a resident of a core area in the city:

For the given property, the pre-revision Annual Value (AV) of the property is Rs 5,242 and the increase factor for residential buildings (600 to 1,200 sq ft) is 1.75.

Revised AV (before age rebate) = Rs 5,242 (x) 1.75 = Rs 9,173

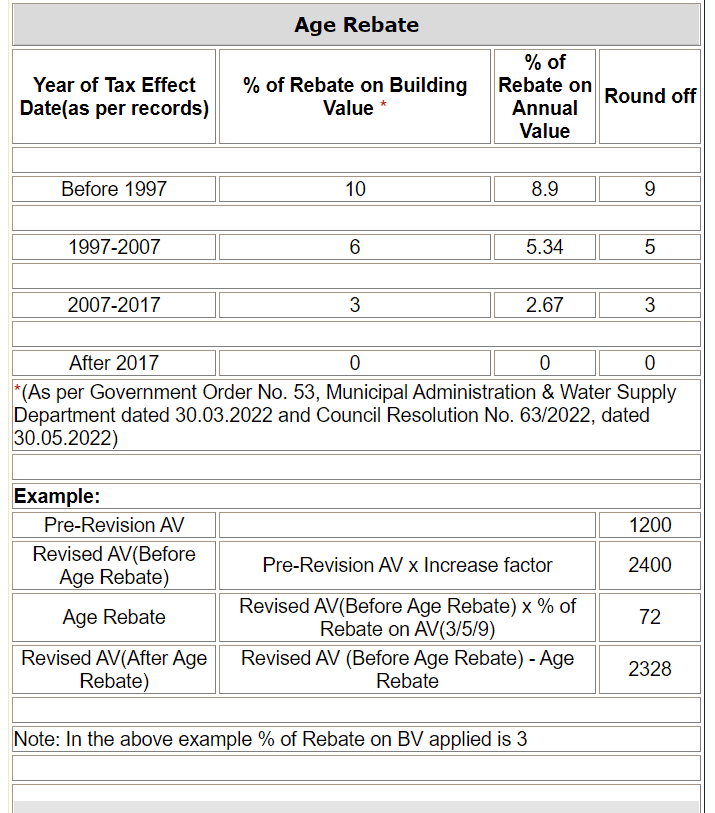

For the given property, percentage of rebate on AV is 9. (Rates and calculation of age rebate is shown through another example in an image below)

Age Rebate = 9,173 x 9% = Rs 826

Revised AV (after age rebate) = Rs 9,173 (-) Rs 826 = Rs 8,348

Hence the net half-yearly property tax payable (12.4% of revised AV) = Rs 1,035 (which is rounded off to Rs 1,040)

Grievance redressal on property tax hike

An official from the Revenue Department of the GCC said that authentic complaints are being considered and looked into, while generic complaints on the hike would not be entertained. The computation process has been shared via the individual accounts of the respective property owners.

For further clarification, the residents can approach the respective zonal offices. Helpline number 1913 is also available for residents to call. They can also raise a complaint on the citizens’ portal within 15 days of receiving notice.

The move has also been challenged legally. A petition filed by K Balasubramaniam of Teynampet sought to quash the property tax general revision notice for 2022-23 issued by GCC on June 28th, citing that it was against Section 100 of the Chennai City Municipal Corporation Act, 1919.

On July 27, the Madras High Court imposed an interim stay on the enhancement of property tax by GCC and directed the local body to file a counter explaining how the revised tax amount was arrived at.

Further hearings and the final verdict on the case are awaited.

What is the revised property tax for ahouse in Tambaram sanatorium which is now coming under Tambaram corporation. It has about 2500 dq ft residential and 2000 sq ft commercial.pl give me the correct sq. Feet rate. Thanks

Revised tax is very high Annual tax 150/- or half yearly tax