Delhi is perhaps the only state government so far to set up a committee specifically to help revive the city’s economy.

Headed by Jasmine Shah, a technocrat, the 12-member Committee on Economic Revival of the City, comprising representatives from the government, municipal corporations and trade and industrial bodies, is drawing up plans to enable the informal sector, small shops and businesses in particular get back on their feet. In its first meeting on July 8th, the committee, decided to focus on revisiting licensing norms and increasing demand to push trade and industries.

Jasmine is an M Tech in Mechanical Engineering from IIT Madras and also has an MPA degree from the School of International and Public Affairs at Columbia University, New York, where he was a Fulbright-Nehru Fellow. He has also been the Vice Chairperson (with the rank of a Minister) of Dialogue and Development Commission, an advisory body to the Delhi government, since November 2018.

Reforms push

Delhi was among the first cities to open in June and as the unlock process has gained momentum, more and more sectors have been allowed to open for business. But as Shah pointed out, “We need to learn and live with Corona and people need to follow strict health safety norms like wearing masks, social distancing and washing hands regularly.”

“By opening up the lockdown early and putting a robust health care strategy in place, the Delhi government has set the right ground conditions for economic recovery in the capital,” says Shah. “By working together with industry stakeholders, the Delhi government is keen to come out stronger from the economic shock caused by COVID-19.”

The committee’s main focus will be on accelerating the pending reforms related to ease of doing business.

However, there has been no meeting of the Committee since the first one on July 8th.

Jasmine shares that over the next three to six months, the focus will be on ensuring the survival of businesses and various industry sectors by revisiting licensing norms, simplifying COVID-related regulations and taking measures to revive demand. Several industry members expressed the urgency of undertaking measures to revive demand, by taking industry-specific measures such as permitting outdoor sitting and extending the hours of operations of restaurants.

Officials insist labour is not an issue in getting businesses going. Many workers are returning and over 10 lakh migrant workers have registered in the portal opened for registration of migrant labours. But the challenge is finding jobs for all of them.

Looking for rebates, writeoffs

“Proposals on rebate on commercial power bills, at least for the lockdown period, and automatic renewal of all licences and no-objection certificates, including those in the areas of trade, factory operation, fire and environment, till March 31 2021, were tabled at the meeting,” said Brijesh Goel, AAP MLA and a member of the committee, who represents trade bodies.

Goel, who is convenor of Chamber of Trade and Industry, said: “Business is slowly improving and markets have opened. The biggest challenge to traders is online trading that had virtually become the norm during the time of the lockdown. Now, with the festival season approaching, business is picking up in all the large markets and offline shops. It will take time for trade to pick up in the markets.”

Will Diwali bring the magic bullet?

Traders and businesses are pinning all their hopes on the November Diwali season. While upmarket shopping areas like Khan Market are seeing a very tepid response, the bargain hunter markets like Lajpat Nagar and Sarojini Nagar are seeing rising footfalls each week, giving traders and shopkeepers in these markets hope that the losses of the past few months will be somewhat made up.

“Customers have increased by 10-15% compared to last month,” says Prem Goel, a shopkeeper at the Sarojini Nagar Market. “We are hoping that the festive season will be good for both buyers and sellers.”

The catch is that these are markets where crowd control and social distancing is virtually impossible. And with Delhi ramping up testing to around Rs 50,000 a day, a surge in cases from people crowding these markets is a real fear.

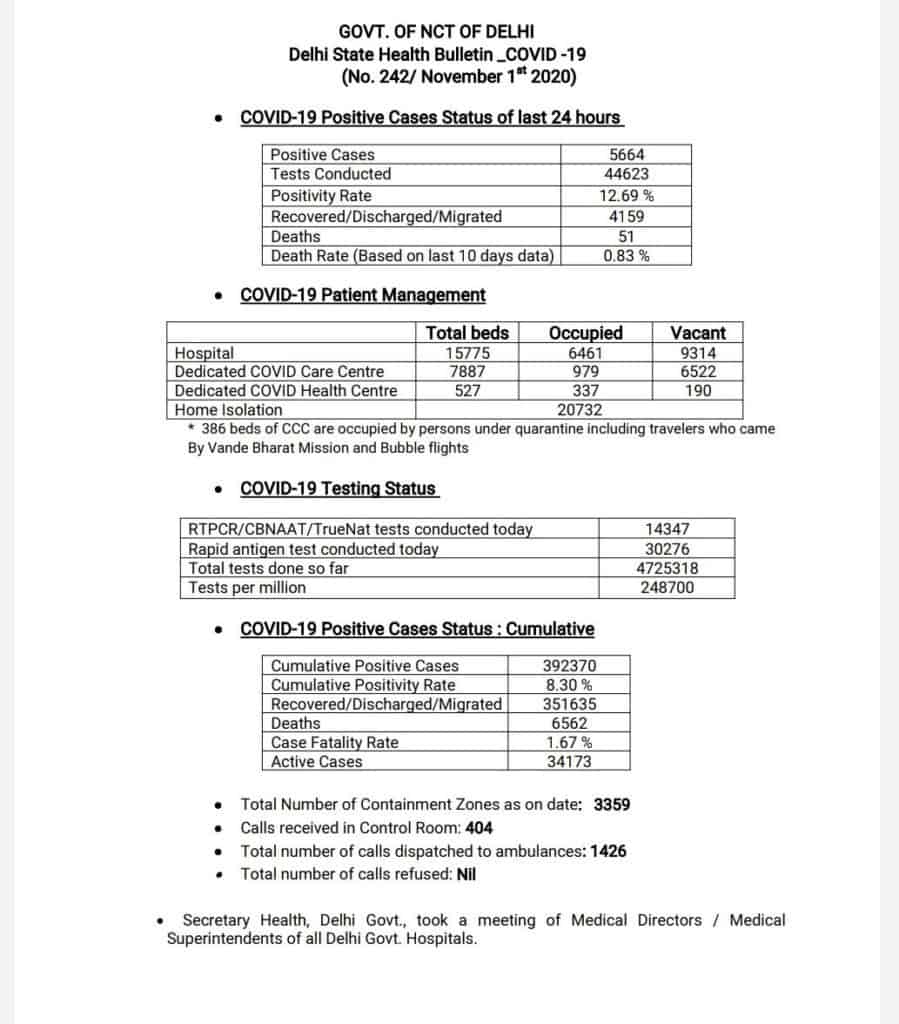

According to latest available figures (November 1st), the total number of deaths in the capital due to the COVID 19 pandemic stands at 6562 while the total number of cases tested positive stood at 392K, while those who have recovered from it was 351K.