India is urbanising at a fast pace. According to the Handbook on Urban Statistics by the National Institute of Urban Affairs, the urban population is projected to grow from 31.1% (377 million) in 2011 to nearly 39.6% (600 million) by 2036. The increase in urban population will put additional pressure on existing infrastructure and services, while also leading to the emergence of new towns. Towns and cities of India are grappling with delivering basic urban services and developing urban infrastructure.

A World Bank report (2022) estimates that India needs $55 billion annually for a period of 15 years from the year 2022 to meet urban infrastructure demands. Currently, most urban infrastructure funding comes from state and central grants, which fall short of growing demands. Strengthening Urban Local Body (ULB)s’ capacity to generate their own revenue is essential to enhance their creditworthiness and enable them to raise funds through municipal bonds.

Can increased funding guarantee improved urban services, or do ULBs need more than just money?

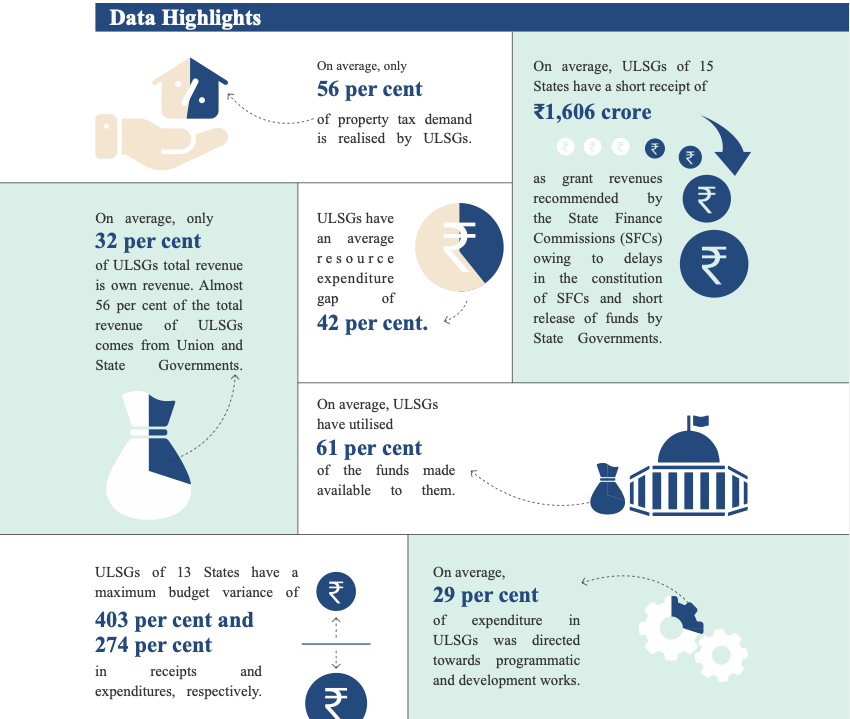

Without clear identification of the gaps in services and robust financial planning, even the largest funding allocations will fail to make an impact. The recent Comptroller and Auditor General of India (CAG) Compendium of Performance Audits shows five of the eleven states recorded fund utilisation below the average of 61%. Jharkhand and Odisha have utilised less than 50% of their available funds.

Robust financial planning can be achieved through a credible budget. A city budget outlines expected revenues—through inter-governmental transfers, taxes, and user charges—and planned expenditures on salaries, operations, maintenance, and infrastructure. When prepared diligently, it serves as a powerful tool to translate a city’s vision into actionable priorities backed by resources for the upcoming financial year.

However, budget preparation in many ULBs is often treated as a statutory formality rather than a strategic tool for financial planning. Incremental budgeting—repeating past allocations with minor adjustments—remains the norm, especially in smaller cities and towns. This approach contributes to unrealistic budgeting, as highlighted in the CAG Compendium of Performance Audits, which reported differences in the budgeted figures and the actual expenditure figures (budget variances) of up to 403% in receipts and 274% in expenditures across Urban Local Self Governments (ULSGs) in 13 states.

So, what drives such dysfunctional budgeting practices? A mix of political, regulatory, and capacity-related factors lies at the core. Politically, the absence of elected municipal councils in many cities weakens the participation of representatives elected by citizens and thus reduces accountability and strategic oversight. On the regulatory front, municipal Acts do not prevent ULSGs from preparing budgets by simply inflating the previous year’s receipts and expenditures, leading to unrealistic and ineffective financial planning.

Finally, capacity constraints are a major challenge—most ULSGs, particularly in small and medium towns, lack adequate staff. With limited personnel already stretched thin managing routine functions, meaningful budget preparation is often sidelined.

Read more: How citizens can use audit reports to be effective watchdogs

What should effective budgeting look like for a ULSG?

Identifying service and infrastructure gaps is the first step in budgeting. Active citizen participation ensures these gaps are accurately captured. When their inputs are compiled, project feasibility assessed, budgets estimated and funding approved by the Municipal Council, the outcome is a realistic, inclusive and effective urban budget.

We make five recommendations that will certainly ensure ULBs are able to budget realistically and democratically.

Define clear roles and responsibilities of all stakeholders: Effective budget preparation requires a mix of bottom-up and top-down approach, with both executive and legislative leadership taking ownership of the process. It is a comprehensive exercise that demands the active participation of elected representatives, the executive head, and all functional departments—be it works, non-works, or revenue.

Budgeting should not be seen as the sole responsibility of the accounts department. Their role is to facilitate and compile the budget document, but only after each department has completed its respective estimations and input.

Sensitise ward councillors: As part of the bottom-up process, budgeting process should have provisions for collecting inputs from ward councillors. States should invest in educating councillors about their critical role in the planning and budgeting process. As elected representatives of their wards, councillors must engage meaningfully with residents to understand neighbourhood-level needs and priorities and convey them to the budgeting team during the process.

Ensure citizen participation: ULSGs should systematically collect ward-wise citizen inputs through online platforms, organising community consultation and awareness campaigns. An active citizen grievance redressal at the ULSG level can also prove to be an effective avenue for citizen participation.

Develop user-friendly digital tools: Digital tools can streamline the entire process of budgeting from gathering of data to collation to communication between different wings of ULSG and finalisation of budget.

Read more: Civic participation essential for effective BMC budget, say experts

States should collaborate with internal experts or external knowledge partners with a proven track record in municipal finance and reforms to design easy-to-use templates for data collection, estimation, and projections. Involving officials from ULSGs in the design process can ensure that the tools are practical, grounded in on-the-ground realities, and tailored to the specific needs of each state.

Build capacity on expenditure planning and management: States should conduct targeted workshops across departments in ULSGs—including revenue, works, sanitation and establishment—to train officials to use these templates and scientific methods of budget estimation and projection. These trainings will lay the foundation for more accurate, transparent and realistic budgeting practices at the ULSG level.

Reforms aren’t achieved overnight—persistence is key. ULSGs require consistent nurturing by the state, supported by a strong, dedicated team at the state level and sustained capacity-building efforts. Embedding incentives into the system—via Central and State Finance Commissions (CFC and SFC) and Centrally Sponsored Schemes (CSS)—can further drive performance and accountability.