Bengaluru Political Action Committee (B.PAC) submitted strong objections to BESCOM’s proposal for increase of electricity tariff by 0.85 Pa for FY-19 based on extensive data analysis. Submissions were made during Public Hearing held at Karnataka Electricity Regulatory Commission (KERC) office.

Revathy Ashok, Managing Trustee, B.PAC and T.V. Mohandas Pai, Vice President, B.PAC made the submissions before the commission on February 19, during the public hearing conducted by KERC.

Highlights of B.PAC’s submissions:

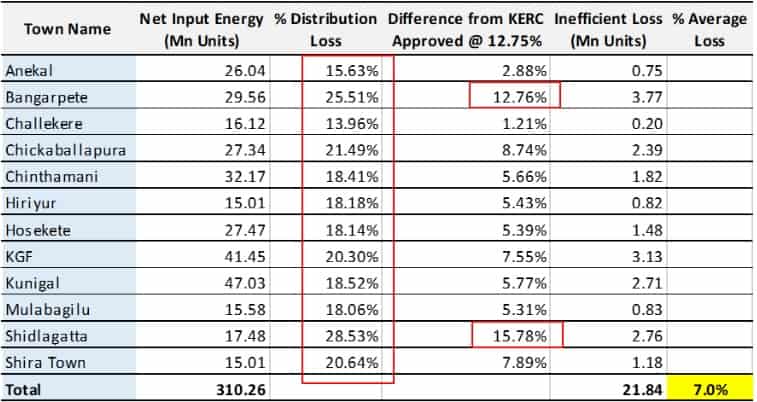

Distribution Loss:

KERC has approved distribution loss of 12.75% for FY 18 (up to Nov 2017). BESCOM distribution loss is presented at 11.86%. Further analysis of data of energy audit for towns and cities shows that distribution loss in 5 towns varies between 18.41% to 28.53%, while few towns have been able to bring down the distribution loss from 9.56% to 7.45% and 10.32% to 6.74% and from 10.91% to 4.87%.

- The table in next page shows that from a sample of 24 towns obtained from BESCOM (Energy Audit Report Pg. 5), 12 towns faced a loss upwards of the permitted 12.75% as directed by KERC. The average loss across the 12 towns works out to be 7%, or 3.5% across the entire sample size. The divisions where the distribution loss is higher than the commission allowed limit of 12.75% distribution loss indicates the inefficiency in losses.

- As shown in the above table, All divisions/towns in BESCOM with distribution loss above 12.75% should be borne by BESCOM and not to be loaded to the consumer. We propose that BESCOM must bear 3.5% of the total power purchase cost, which amounts to INR 479.53 Cr.

Power purchase:

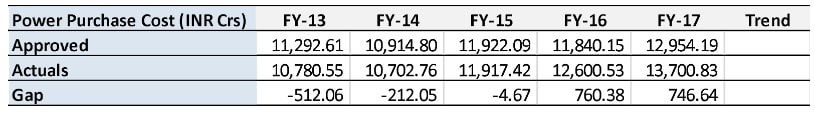

- BESCOM has been overshooting the approved limits of the total Power Purchase Cost for the past two years as shown in the above table. This indicates BESCOM’s poor power purchase planning when power in the open market is available at lower cost.

- The variable cost of power purchase in Thermal Stations has been abysmally poor as shown in below table. Most of the below producers do not meet the Approved Variable Costs sanctioned by KERC.

- We urge commission to not only disallow that INR 214.62 Cr, but also enforce the inclusion of the losses due to inefficient purchasing by the BESCOM to be included in their annual reports hereon in the above format.

HT Sales:

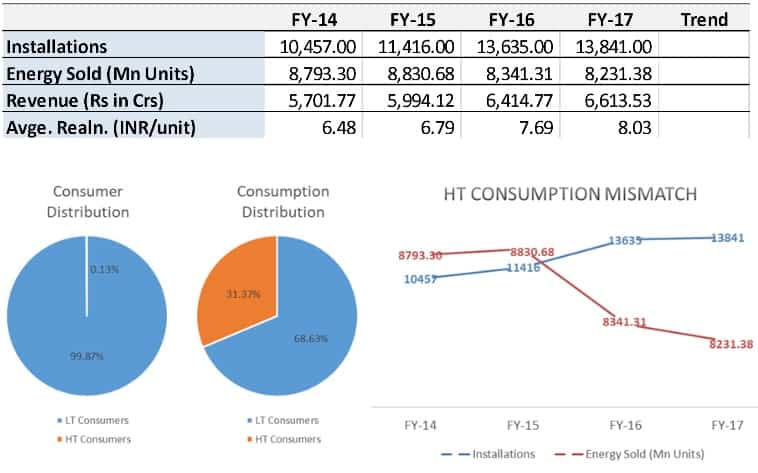

At a time where Bangalore Metropolitan Region and its adjoining districts are prospering, and Karnataka is growing at 8.5% CAGR (ECONOMIC SURVEY OF KARNATAKA 2017-18), many businesses are being set up (as can be seen from the increase in the number of installations). It is disheartening to see that these businesses are choosing not to procure power from the BESCOM (energy sold units are falling), this is solely driven by the unfair & uncompetitive increasing rates by BESCOM in HT category.

Cross subsidy level:

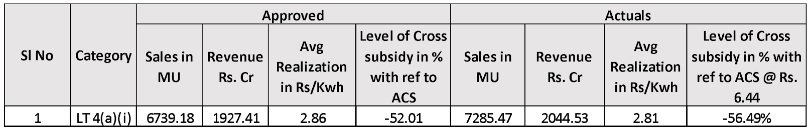

- The approved sale was at 6739.18 Mu at revenue INR 1927.41 Cr with average realization of 2.86. The sale has gone up to 7285.47 Mu at INR. 2044.53 Cr with average realization of 2.81 with a cross subsidy of 56.49%. The subsidy is INR.2647 Cr. This entire amount should be paid by Govt since it is Govt’s policy to give free power and not through metered power. This is no reason for consumer to pay for Govt policy decision. This should come as general revenue

- BESCOM has not given details of LT4(a) Irrigation Pump sets (< 10 HP) in it’s filing document. We request the commission to direct BESCOM to furnish details of this category as shown in other categories. The amount of revenue forgone needs to be quantified and displayed transparently and we propose Direct Benefit Transfer (DBT) to be done to farmers’ bank from Govt.

This will bring in full disclosure and ensure benefit of multiple IP sets does not accrue to a single individual. DBT of INR. 40,000 per IP for each farmer holding up to 2 ha be provided. We also proposed subsidy for dry land farmers similar to “Raita Belaku” scheme for the economic independence of dry land farmers from Karnataka State Budget 18-19

- All CSS should be shown as a line item in the electric bill, so that the consumer will know the amount he is paying under this line item. This will be a way of bring transparency in BESCOM operations.

Annual Accounts:

- BESCOM filing document available for public does not contain the Audited Annual accounts FY 2016-17 as has been normal practice, instead only the unaudited half year accounts FY18 as on 30th Sept 2017 is attached. This may kindly be provided to public at large for their perusal.

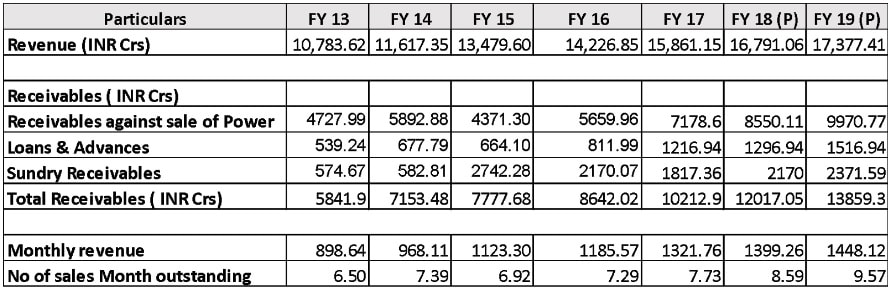

BESCOM’s collection efficiency

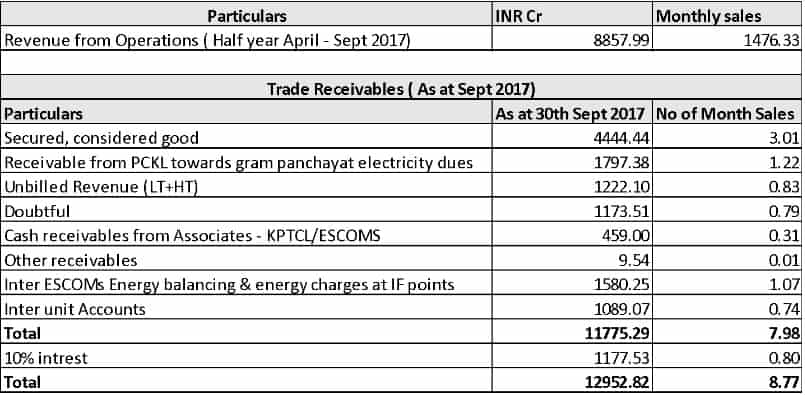

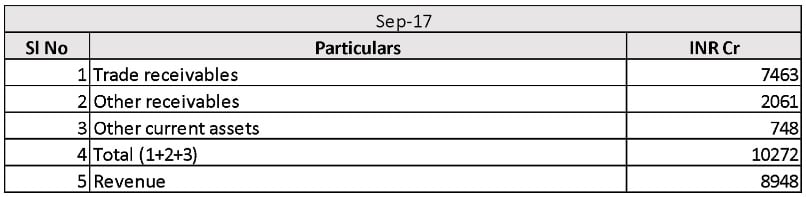

- From the above table, we see BESCOM’s collection efficiency has drastically worsened from 6.50 months sales to 7.73 months sales and for FY 19 is projected at 9.57 months sales.

- From the above table, pertaining to Half year ended Sept 2017, it is to be noted that BESCOM receivables have gone up even further to an alarming 8.77 months sale, further BESCOM has claimed Rs. 1173.51 as doubtful receivables.

BESCOM has claimed in the submission that it is facing liquidity problem (PG 33).

- The demand for FY 17 is INR. 15861.17 Cr, collection is INR. 15762.50 with 99% of collection is realized. The liquidity crisis in the system is because the cash has been used to finance other ESCOMs and others without charging interest. This inefficiency is passed on to consumers through increase in tariff.

- As on half year ended Sep 2017, receivables and other current assets makes up 114% of sales. If one assumes receivables at 16.6%. i.e. 2 months of sales it amounts to approximately INR 2983 Cr and adding another 20% of this for other receivables makes it to INR.3579 Cr.

-

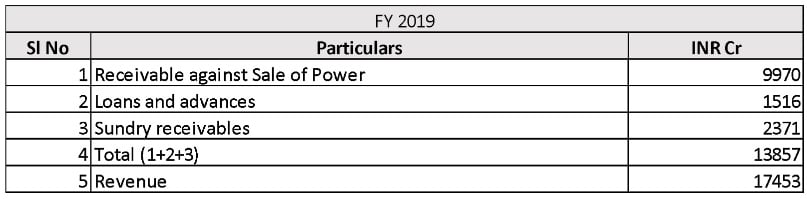

- From the above table as projected by BESCOM for FY 2019, above line items make 79% of sales. If one assumes receivables at 16.6% i.e. 2 months of sales it amounts to approximately INR 3000 Cr and adding another 20% of this for other receivables of INR 560 Cr makes it INR.3600 Cr.

- An excess of INR. 10,357 Cr is shown as receivables, loans and advances showing total lack of financial discipline and lack of collection efficiency. At an interest of 9% on this amount to about INR. 925 Cr.

- We urged the commission to take note of this and direct BESCOM to bring in discipline in collecting receivables. Consumers should not be made to pay for BESCOM’s inefficiency

- Further, the BESCOM has made a huge provision of Rs.1173.51 Cr towards doubtful debts. The commission should direct the BESCOM to identify the names of the doubtful receivables and furnish the same to commission and make it public and disallow Rs. 1173.51cr from truing up exercise.

- Therefore, proper management of incremental power purchases/purchase of power at lower rates from exchanges for at least 2000 Mu per year and reduction of sundry receivables, loans and advances to 2 months sales will do away with the need for any increase in the tariff.

Calculation of depreciation

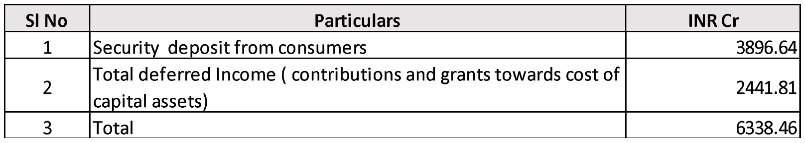

- As indicated in the below table, BESCOM has received security deposit from consumers of INR. 3896.64 Cr and Govt contributions and grants towards capital assets treated as deferred income in the Balance Sheet to the tune of INR.2441.81 cr. Both these items total to INR.6338.46 and need to be reduced from the cost of fixed assets and deprecation should be claimed only on the residual amount for tariff purposes.

Specific consumption of IP sets:

The commission should disallow Rs. 664.05 Crs excessive consumption by IP set consumers and direct BESCOM to collect the difference amount from Govt. This clearly indicates in the name of farmers an excess of Rs. 6,668 Crs is being robbed. It is obvious that in the name of farmers there is large scale robbery of power and Government is turning a blind eye for various reasons.

Regularization of illegal IP sets should not be considered for any Cross Subsidy or tariff hike to be paid by other consumers. Any regularization of pump sets should be paid for fully by Government and not by the consumers.

Duplicate and multiple IP set per farmer should be removed to avoid subsidy to the rich. To bring in transparency, Direct Benefit Transfer (DBT) to be done to farmer’s bank/shadow accounts and full charges can be debit.

Current cost of subsidy is INR. 86,826/IP set. We propose Subsidy to be limited to INR. 40,000 per IP set for only farmers holding up to 2 Ha. This would be in the lines of subsidy for dry land farmers similar to “Raita Belaku” scheme for the economic independence of dry land farmers from Karnataka State Budget 18-19

After making submissions T.V. Mohandas Pai, Vice President B.PAC said “We made the submission before the Hon’ble commission giving all the data and urged the regulator to protect the interest of citizens of Bengaluru in an unbiased manner and not the interest of BESCOM while determining the tariff for FY 19.”

Link to detailed presentation submitted to the commission.

Note: This is a press note shared by Sharath SR of BPAC, shared here as part of Message Forward, a space meant for nonprofit public interest messages.