All property owners in Bengaluru have to pay the property tax for the financial year 2022-23. The last date for doing so without penalty and interest is June 30th, while with penalty and interest, it can be paid at the convenience of the owner.

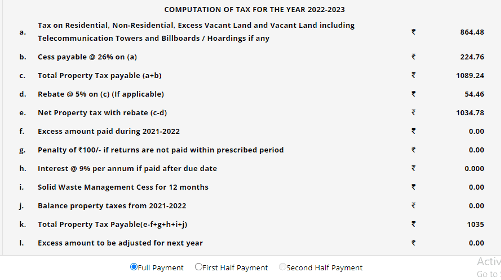

BBMP offers a 5% rebate on property tax payment upto 30th April 2022. Given the challenges of growing circumstances, BBMP must extend the rebate period for one more month (upto May) as was done in earlier years.

There are some issues in the system, BBMP must rectify all bugs and malfunctions in the tax payment portal immediately so that taxpayers can do their part quickly and easily.

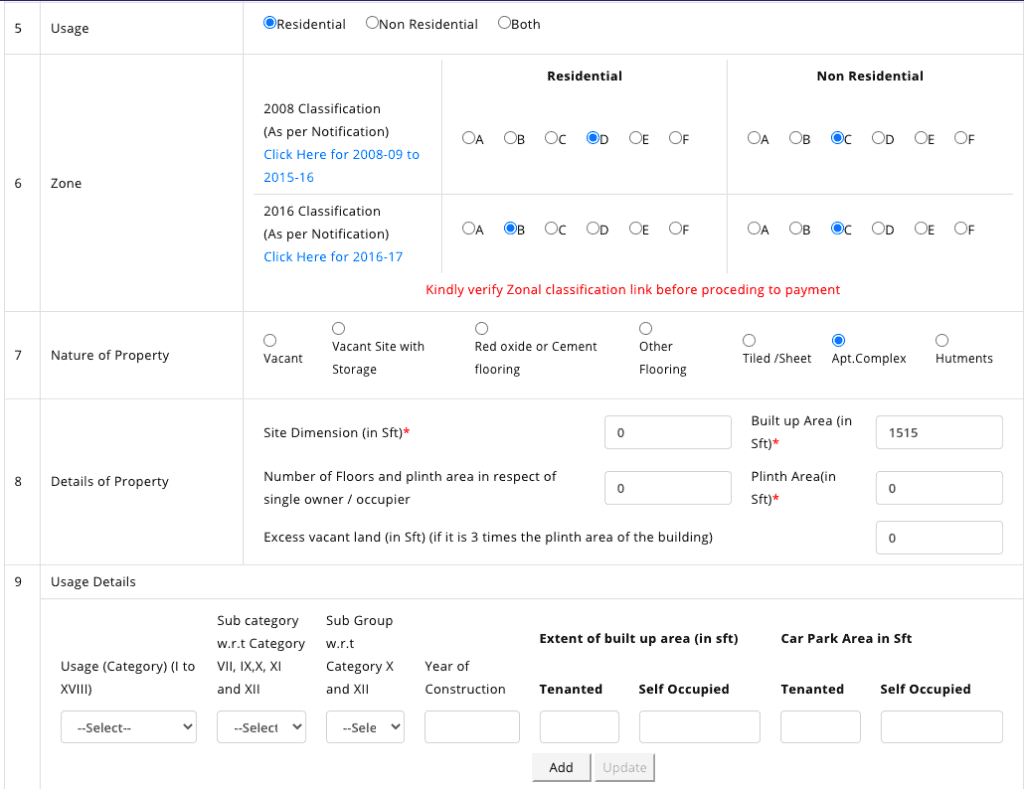

BBMP recently clarified that the online form will have the “zone” field auto populated and frozen, based on the street codes in a scientific way. Properties are classified into six different zones: “Zone A” to “Zone F”, with different rates based on development levels of the neighbourhood. BBMP has done this to prevent misuse of the provision or wrong zonal classification, which has led to leakage of tax revenues for BBMP.

One wishes these clarifications had been given before raising the demand for tax!

Here are the steps for paying property tax online:

1. Keep these handy before you commence:

- Mobile number – for OTP

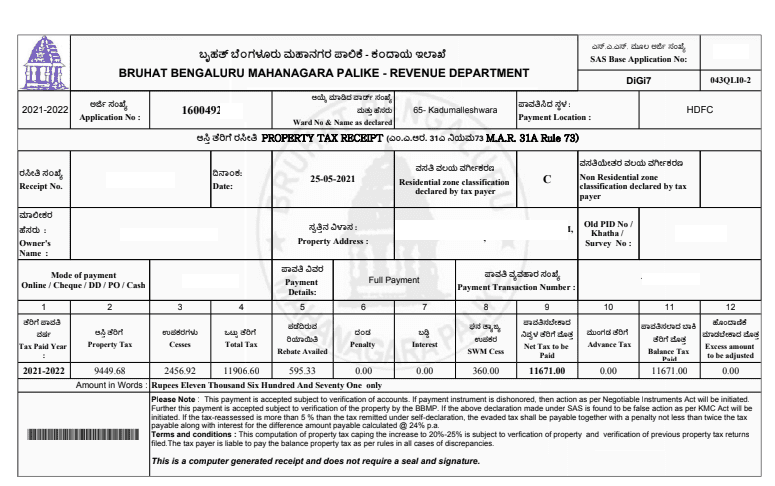

- Your previous property tax paid receipt

- Details of changes; new area (dimensions), type of construction etc. (if applicable)

Read more : How does BBMP compute Property Tax

2. You can either go to the main BBMP site, bbmp.gov.in and select ‘Get Started’ in ‘Pay Property Tax’ box or you can go directly to the tax portal: bbmptax.karnataka.gov.in.

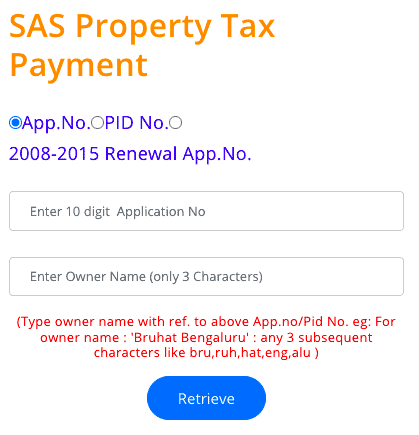

3. A box appears on the right side of the screen ‘SAS Property Tax Payment’. Select between the three choices:

- App. No. Enter 10 digit Application No. – (Type the application number provided during 2016 tax payment).

- PID No. – (Type the PID number of the property).

- 2008-2015 Renewal App.No. – (Type that application number).

4. On the box below, type three characters (alphabets) of the property owner’s name and click the blue ‘Retrieve’ box.

BBMP SAS Property Tax Payment. Pic credit: bbmp.gov.in

5. Details – owner’s name, ward details; name, number and office will appear. (In some cases, multiple details will also appear, where data entry by BBMP is wrong.) Select the correct owner details and click ‘Confirm’.

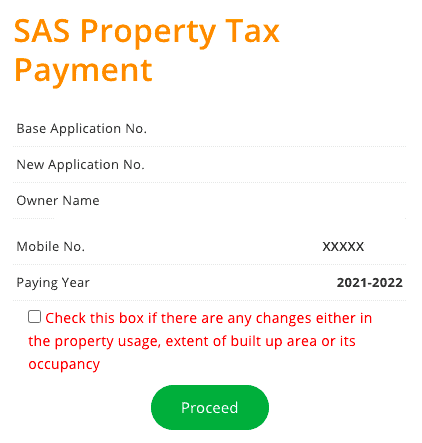

6. Details such as; Base and New Application number, owner’s name, mobile No. as well as the tax paying year will be displayed.

7. “Check this box if there are any changes either in the property usage, extent of built-up area or its occupancy” message will appear. Click the checkbox only if there are changes, else ignore.

Read more : BBMP’s plan to fix property tax gaps and loopholes

8. For those properties which have received arrear notices, as well as those indicating changes in property, an OTP is sent to the given mobile number and after entering it, the form will open.

9. Even if you have NOT clicked on the changes checkbox:

- For properties that have not received the ‘ARREARS NOTICE’, or those properties where there is NO change in the zone, Form IV will open.

- For those which have received the notice OR there is a change in the entered zone, Form V will open. (This is because of the capping facility extended in 2016, where the classification had moved more than two zones).

10. For Form IV applications, check the contact details, address etc. Change if it is different or wrong; One can give an additional ‘Communication’ address if need be. Then proceed to the section where the tax calculated amount is displayed. Compare the details with your last year’s receipt and if you find it the same, click the acceptance box at the bottom of the screen.

11. Now you have to select the choice of payment – Challan Payment OR Online Payment. Note: One cannot change the mode of payment after selection.

12. On selecting Challan Payment, the challan will be generated and the link will open in another page, where you can download it. Next, get a printout of the challan and pay at the designated banks, within the validity period (last day of this month).

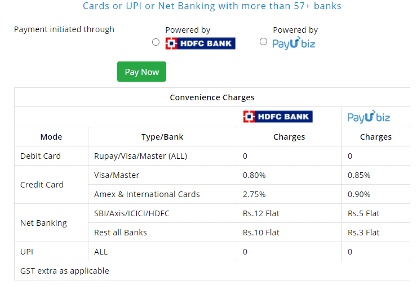

13. On selecting the ‘Online Payment’, it will lead you to another portal and you can pay online. (Bank charges based on different modes – Debit Cards / Credit Cards / UPI / Online transfer and types – TWO powered gates apply for taxes exceeding Rs.2000/- for this mode).

14. For those selecting the “Changes” checkbox as mentioned in step 8, check the address, contact details and enter changes as per actuals. Click on ‘Go to Next Page’ which will show you the amount calculated. Verify the calculation and proceed for payment as per instructions mentioned above.

NOTE:

- The portal is time based and times out if you have it open too long, taking you back to the home page, where you have to redo the whole thing from scratch!

- BBMP has made the zonal classification auto populated this year, and the owner does not need to verify or enter it. (This software update was the reason for the delayed demand of property tax)

- The message in Form V to “verify the zonal classification link before proceeding to payment” is visible and the link for zonal classification for both the years as “Click here for 2008-09 to 2015-16” as well as “2016-17” is visible, However it has been deactivated, so there is no point in trying it!

[DR Prakash has been writing property tax payment guides for Citizen Matters since 2008. This explainer has been validated and also shared with the BBMP Commissioner for the benefit of Bengaluru’s public.]

Very informative. Thanks for posting. A small clarification please. I have received arrears notice last year in view of revised zonal classification. This year I found no change in computation in the website. So should I update or wait for auto-updating. Thanks

Dear Dr,B R Venkatesh,

The notices are still in ABEYANCE. It is yet to be decided and the matter is lying on CMs table. You have nothing to do with it.

But verify, tax for the year 2022-23, which may be more and as the clause of capping, a reduction would have been given. It it is so, check your zonal classification and the tax calculated.

This article is really useful.

Thanks for writing this.

I have one question, how do I get to know what is the correct zone to which my property belongs to?

On the home page, go below and you’ll find the zone lists provision of 2008 to 2015 and 2016. You can download and check.

There is a provision to calculate depreciation value of our property…but unfortunately it cannot be done online…we have to run around to different offices to get it done…but still no proper support for tax payers. Request the authority to please look into this.

For a non-residential (commercial) property, the BBMP officials mention that the Unit Area Value (UAV) will be the same for a building and for a shed (temporary structure). i.e. If the tax rate for a building is Rs.17.5/- then the same tax is also applicable for a shed (with sheet roof) erected on a vacant land. They insist that the provision of a lesser tax for sheet roof is available only for residential building and not for non-residential. However, clause V under the non-residential section mentions that for covered or stilt parking area, the tax is 50% of UAV. I do not understand BBMPs argument as to how a temporary sheet structure will garner the same UAV as that of a proper building.

Can you please clarify whether the UAV for a temporary shed (with sheet roof) will be the same as that of a building – both of which lie adjacent to each other on commercial land.

After giving the application number and the first three letters of the name, property details are displayed correct.

But after selecting the property and submitted, getting blow error.

“Payment is refrained due to missing Street Name. Kindly contact concerned ARO for further details”

Pls suggest how to proceed

Looks like BBMP added a new filed street name and its mandatory for tax payment. We need to reach BBMP officials for updating street name I guess. If anyone has latest info please share here.

Please go through the details requested by me above and act accordingly.

I tried to pay online for 22-23. Nothing new. last 7 years I paid online but after added details like application no and first 3 digits of name, while tried retrieve, the portal says that check address and contact ARO. I could not understand the meaning after paid tax for several years. Any advice on what to do.

After giving the application number and the first three letters of the name, property details are displayed correct.

But after selecting the property and submitted, getting blow error.

“Payment is refrained due to missing Street Name. Kindly contact concerned ARO for further details”

Pls suggest how to proceed

I too getting same error “Payment is refrained due to missing Street Name. Kindly contact concerned ARO for further details”. Sent mail to concerned ARO linked to my application number but no reply since week. Not sure how to proceed. Any help would be appreciated.

Sir, I used to pay debit card, each time getting error/failed E308 and 2nd when trying to make payment getting another type E500. Headache system.

Payment is refrained due to missing Street Name. Kindly contact concerned ARO for further details.. Recieved this error, even opened a ticket with ARO. No response yet.

I’m getting the same error. Haven’t heard back after raising a grievance

Dear Bianca Madamji,

Expecting a response from BBMP is a LUCK based. Check your previous year receipt and if NO address is printed, go to your ward office with TITLE document and meet the ARO / Inspector / Data entry assistant and get it rectified.

MAKE IT FAST TO AVAIL THE REBATE.

Received an error ‘Payment is refrained due to missing Street Name. Kindly contact concerned ARO for further details’ and unable to proceed. Tickt is created with ARO. Waiting for the issue to be resolved.

Please look above for my request and act accordingly.

Dear Mr. / Ms. Vijetha, Manish, Amit B., Gautham & Maithri,

This is a NEW problem which was NOT there previously. Hence to direct you properly, please send me a copy of your previous tax paid receipt. I can check and give you clarification OR raise the issue with the IT section of BBMP.

You can send them directly to my mail dearpe_21@hotmail.com

Dear Sri Kalasaiah. V,

When did you try ? If the servers of bankers / UPIs gets overloaded, errors of different types will be popping up. Try once again and let me know.

Dear Ms.Meghana,

What is the purpose of the shed used for ? Is it built by getting a plan approved by BBMP ? When you claim it is temporary, what are the documental evidence you have ? Please provide them for a clarification.

Dear Mr.Umesh,

Is your property a new one OR old one ? Depreciation was calculated at the beginning of block period and there is NO variation of it and hence NO provision to calculate depreciation.

Hi, were you able to get resolution for the “Payment is refrained due to missing Street Name. Kindly contact concerned ARO for further details”.

Thanks!

Did you send the details to the mail ID given ?

Sir, Can you please help with email id again. Not able to find it anywhere in the queries above.

My zone has been shifted from D to E in the present SAS online tax payment form. What should I do

Details would have been provided at the bottom of zonal classification.

Please check that with the list of zonal classifications for 2016. If it is RIGHT, you have to pay the demanded tax.

Please furnish details as to how you made the payment on 30th April ?

NO total tax is reflected / demanded by BBMP. Even if you are due for any number of years, tax is collected year after year after the payment of the last default year gets entered in the account which takes a few days every time.

If you have any difference, send me all the receipts for a clear guidence.

I had made payment on April 30 2022 and I see that amount is deducted from my account for the property tax. I am trying to get challen and getting “Payment is refrained due to missing Street Name. Kindly contact concerned ARO for further details”

Please advice on how to get it fixed.

The property tax for year 2021-22 was in arrears. As per the details of tax payable in the tax payment application for the Year 2021-22 and 2022-23 a single payment for the total amount was proceeded with. What I notice is the total amount is reflected for year 2021-22 and there is no bifurcation of the years 2021-22 and 2022-23 even though the tax payable for year 2022-23 is included in the total income. How to proceed in such case.

I am unable to pay tax for the year 2022-23, its giving error saying missing street name.No response form BBMP or ARO . we have raided a ticket and sent out email

Refer to my clarification given earlier for the same issue.

I see a few queries on the street name missing error while trying to make property tax payment for 2022-23 and here is how I got it resolved. I raised a grievance ticket, on submitting a grievance ticket, you would get a person to be contacted along with the contact number. I reached out to the person on the mobile number, he helped fix the issue by updating the street name field. The person to be contacted changes based on the ward your property belongs to.

Its good your ticket was answered and you could get it done.

The simple way is to approach your ward office and meet the ARO / Inspector / Data entry person and give details.

Hello Prakash,

I paid using below link. entered application number and 1st 3 letters of owner name then it pulled up the details and showed the amount. using net banking made the payment.

https://bbmptax.karnataka.gov.in

Regards

After making payment it did not generate receipt. later when I tried to get the challen then it started showing this error.

Dear Mr.Chaitanya Kaggal,

Due to some mal-functioning of the portal, your property window might have got opened.

As your property address is NOT available, the receipt generation would have got blocked. Hence go to the ward office with the Title deed and get the address entered to get the receipt.

Hello Prakash,

Thank you so much for the advice. Let me follow your directions.

Regards

derape_21@hotmail.com

unable to proceed to pay tax for this year as I see an error — ‘Payment is refrained due to missing Street Name. Kindly contact concerned ARO for further details’

I have even sent mail to my ward ARO. yet no reply, Waiting for the issue to be resolved.

Dear Madamji,

Please follow the instructions given by me above.

Dear All,

The complaint of “Missing Street Name” is a NEW one developed this year. The problem for it is due to the LETHARGIC data uploading by the BBMP. But we are at the mercy of them and suffering with NO FAULT of ours.

As the time is running out for the rebate, please do the following :

1. Check your address in the last year’s receipt. Whether it is missing OR wrong.

2. Take your TITLE deed and go over to your ward office and meet ARO / Inspector / Data entry assistant and get the address filled appropriately.

3. Then you can pay the tax for the year 2022-23.

A COMPLAINT HAS ALREADY BEEN RAISED WITH THE SENIOR BRASS OF BBMP, BUT HAVE TO DO OUR PART TO GET THE BENEFIT OF REBATE.

When opening my property tax folio form V is appearing. How to get form IV for updating certain data

For some property owners automatic populated Zone shown is wrong. What do I do if wrong Zone is shown. Can I correct the Zone by checking the box and going to Form V? Or Can I correct the Zone in Form IV itself? Or Do I have to go down to local BBMP Office to correct the Zone?