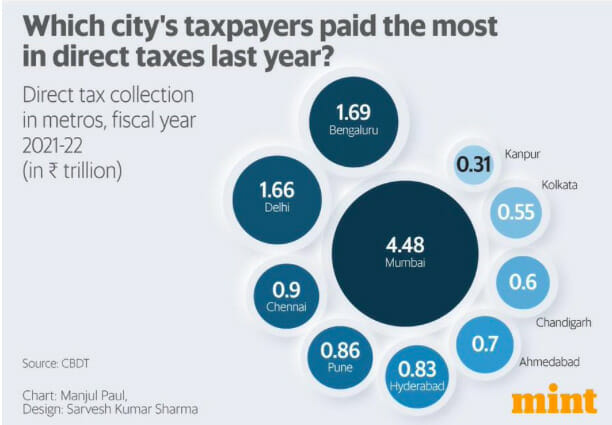

An infographic by Mint (@livemint) went viral in Bengaluru as the frustration of taxpayers found collective expression on social media. Most people are unaware of what happens to the taxes they pay. Who actually gets that money and how does it get used by the government?

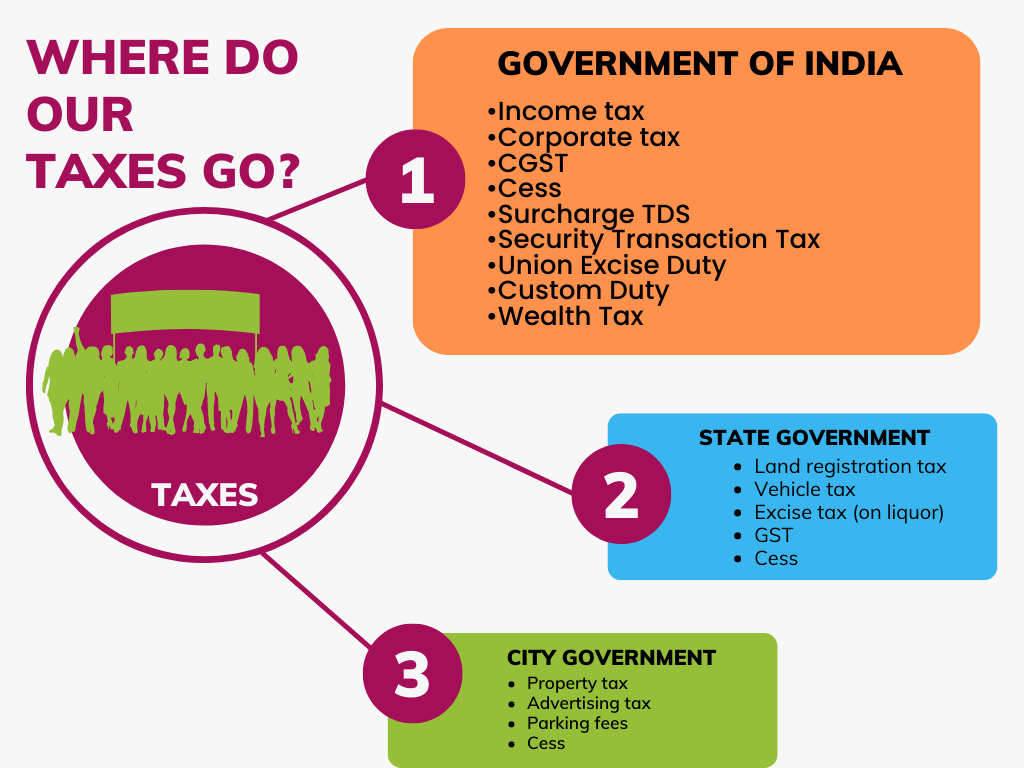

First things first: All the taxes we pay in our cities, go to one of the three tiers of Government.

- Union Government (Government of India)

- State Government (Government of Karnataka, Maharashtra etc.)

- City Government (Bengaluru Corporation BBMP or Mumbai Corporation BMC etc.)

Tax distribution

Most of the taxes go to the first two tiers of government and very little goes to the City Government. Every single income and corporate tax rupee goes to the Government of India. Every single rupee of land registration tax and excise tax (on liquor) goes to the State Government. We all know that GST has two components CGST (Centre) and SGST (State GST). The City Government gets all the property taxes, advertising tax, and parking fees collected, and all of this amounts to very little.

The tax structure of diesel and petrol has been discussed quite a lot, recently, due to spiralling costs related to international crude oil prices. Essentially, we pay taxes to both the centre and the state as well as cess to the centre alone.

Read more: Audit report: BBMP, other Urban Local Bodies powerless and cash-strapped

Meagre tax share to city government

Let us take petrol, for example. The person paying the tax on petrol is expecting better roads, parking facilities, etc. Roads in the city (which are used more than highways), and parking facilities are to be provided by the BBMP! However, the city does not receive any share of the massive tax collection.

Every time a new motor vehicle is bought, a lot of taxes get paid. But to whom? The Government of Karnataka. Does any of that money go to BBMP? Not a paisa is shared with the city government, even though the very reason the motor vehicle is bought is to ply it on city roads.

Bengaluru is one of the most dynamic cities in the world, Asia’s Silicon Valley, a start-up capital, an employment-generating city for the entire country, and a global brand carefully built over the decades. Should it not get a fair share of taxes collected in Bengaluru? The answer is a resounding yes but the reality is, unfortunately, no.

Why fair share of taxes is not happening

Simply put, the mechanism for sharing taxes with cities is not in place. There is a Central Finance Commission (an independent constitutional body like the CAG or Central Election Commission) that determines the formula for sharing a central pool of taxes – this commission determines how much money goes back to each state based on development indices and other factors agreed upon by everyone.

This process evolved over decades to eliminate or reduce discretionary powers of unions (before the 13th Finance Commission, Union Governments used to exercise discretionary powers to grant funds to states where they have political interests and deny them to other states ) and a consensus formula for devolution was arrived at after a wide range of consultations. So, Karnataka does get a share of all income tax, paid by Bengalurians, to the Central Government. The same goes for corporate taxes paid by companies based in Karnataka.

Read more: When Karnataka showed the way with a pioneering Right to Information law

What happens to the taxes collected by the State Government?

How does it get shared with the towns, cities, districts and villages? Well, this is where the big problem is. The 73rd and 74th Constitutional Amendments introduced State Finance Commissions (SFC) to strengthen local self-government. Just like the Central Finance Commission (CFC), each state is expected to have a State Finance Commission (SFC), convened by the Governor for a period of five years, to hold consultations and deliberations and come up with a formula that leads to equitable development of all regions of the state. The state government is expected to share tax collection funds with cities and villages. Unfortunately, barring a few states, the SFC is non-functional and state governments enjoy discretionary powers over all the taxes they collected.

Therefore, the income tax you paid in Bengaluru went to Delhi and a part of it came back to Karnataka but it did not make its way back to BBMP. The vehicle registration tax went to the Government of Karnataka and no share of it came to BBMP. While the taxpayers expect BBMP to provide good roads, potable water, and clean air, all we give them is property tax, which is not substantial and certainly not enough to meet the needs of the city administration.

The state government does give a share of money to Bengaluru and all other cities and towns, but there is no scientific formula that dictates the share. . Funds to cities are given as grants – a gift from the Chief Minister to the city and even named such as “CM Nagarotthana Fund”. As if we are begging for funds!

Until and unless SFC becomes a strong institution, like CFC, we will always be denied a fair share of taxes collected in Bengaluru by both State and Central Governments.

The need for a State Finance Commission

By not constituting an SFC that conducts studies to determine the devolution framework, and by not taking their recommendations seriously, the state government is violating the constitutional provisions put in place to strengthen local governments. As responsible citizens, seeking systemic changes, we must collectively demand a State Finance Commission that ensures a fair share of taxes for all cities and villages of Karnataka, not just Bengaluru.

A very insightful article!!

We need to overhaul our tax system which needs to be bottom up instead of top down.

Basically, a larger share should go to the place where the taxes are collected from. An increasingly smaller pie than goes to the larger region, then to States and then to the Union.

The Union will still be getting taxes from all over.

If this happens, the individual smaller regions will develop faster and collect more taxes. The State and the Union will have more in its coffers.

We need to collectively demand a fair tax system which is being used as a tool for a tax payer- it’s in the form of cess for different reasons like PF, Gratuuity and other expenses of the utility like power, water and municipal taxes