On October 1st, the Bruhat Bengaluru Mahanagara Palike (BBMP) launched the process of issuing e-khata on the e-AASTHI website and published the application procedure. The BBMP states that 21 lakh out of 22 lakh properties with khata in Bengaluru have their draft e-khatas listed on the site. Property owners can view their draft e-khata and apply for the final version by uploading additional information.

However, many Bengalureans are confused about the process or are unable to access their property listings on the website. Here is a simplified guide on e-khata, how to apply, BBMP’s approval process and some common challenges.

For more recent updates and answers to frequently asked questions about e-khata, also check:

What is e-khata?

E-khata is merely the digitised version of your khata details. However, it is supposed to be a more exhaustive document than the khata certificate or khata extract.

“E-khata has a combination of details present in the khata certificate and khata extract. Additionally, it would have photos of the property and the property owner, the property’s GPS coordinates and schedule (description of location and boundaries),” says Ketan Vyas, Assistant Revenue Officer (ARO), Domlur sub-division.

The e-khata will also assign a unique 10-digit e-property ID to all properties, irrespective of whether they are A or B khata properties. In the case of A khata properties, the e-khata will show both the new e-property ID and the existing Property Identification Number (PID).

Read more: Navigating apartment property legalities: A comprehensive checklist

What is the difference between A khata and B khata?

The khata certificate shows that a particular property is owned by a specific person. The khata extract, on the other hand, provides details from BBMP’s khata/assessment register, such as the property’s size and use. Together, the khata certificate and khata extract are referred to as A khata.

BBMP records the tax collection details of properties in unauthorised layouts/revenue sites and those violating BBMP bylaws in a separate register called B register. These accounts are unofficially known as B khata.

For more info on sale deed, encumbrance certificate and other property papers, see ABCs of Property Papers.

You can apply for an e-khata only if your property already has an A or B khata. Once you upload your details on the e-AASTHI website, the e-khata for the property will be generated automatically, and you can download it by paying a fee of ₹125, without visiting any BBMP office.

However, if you want to do a property transaction, you have to approach the ARO with your e-khata to get it verified.

“In the e-AASTHI system, we are issuing e-khata after matching the person’s name across different documents including their sale deed, Aadhar, BESCOM connection number and property tax acknowledgement. If two people have the same name, the first person’s name will also match across all documents of the second person, and he may be able to put his name and credentials against the second person’s property. Hence verification by the ARO is essential before property transactions,” says Munish Moudgil, BBMP Special Commissioner (Revenue).

From this month, e-khata is mandatory for registering any property transaction in Bengaluru. For those without a BBMP khata, a separate application module will be added on the e-AASTHI website within 7–10 days.

How to view your property listing on e-AASTHI?

- You can log on to https://www.bbmpeaasthi.karnataka.gov.in/ by entering your phone number and the OTP you receive on your phone.

- On logging in, click on the ‘Get e-khata’ tab, which will show you the list of zones and wards.

- Click on your ward to see the list of properties. You would then have two options to search for your property — ‘property ID’ and ‘owner name’. Here, ‘property ID’ refers to the e-property ID that would get generated in the e-khata (not the property’s current PID).

- So, if you are checking the site for the first time, your only option is to search by ‘owner name’. (Previously multiple options such as SAS application number could be used for the search, but these have been removed).

- If searching by ‘owner name’ does not show results, you can also scroll through the property list. After selecting the ward name, all property owners in the ward will be listed alphabetically, making it easier to find your name.

- If you have already downloaded your e-khata and want to view your property listing again, you can use the ‘property ID’ option for the search.

Data on 21 lakh properties available

According to the BBMP, 21 lakh property tax records across 5,500 registers have been scanned and digitised so far. BBMP had outsourced the digitisation process to a private agency, but BBMP’s revenue officials are supposed to verify the digitised records.

“In each zone, our case workers have to verify 100% of the digitised records. Of these, 25% will be randomly selected and sent to the Revenue Inspectors. Fifteen per cent will be sent to the ARO, 10% to the Revenue Officer, and 5% to the Deputy Commissioner and Joint Commissioner of the zone. So at every level, officers will check for errors,” says Ketan. After this verification, the information gets generated as the property’s draft e-khata.

If your property already has an A or B khata but isn’t listed on e-AASTHI, the website suggests checking again after a few days, as the details of one lakh properties are yet to be digitised.

If you do see your property listed, you can click on the ‘Draft eKhata’ option to view or download it. For several listed properties, the draft e-khata is not showing up currently; BBMP AROs say these will be up in the next few days.

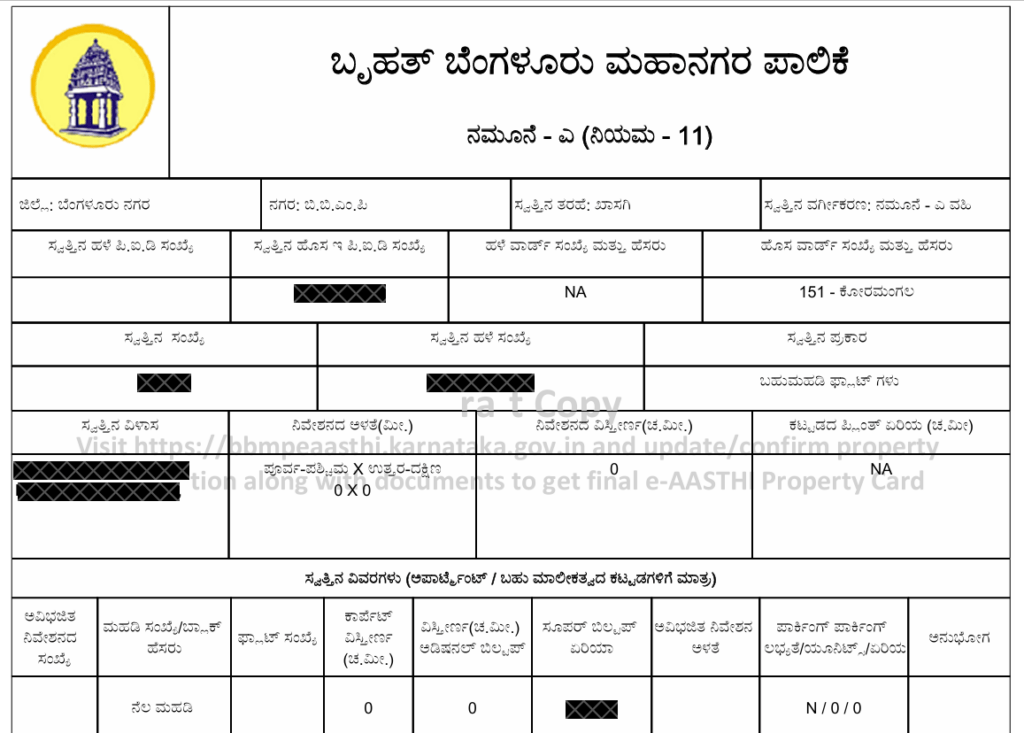

Understanding your draft e-khata

For properties which have a draft e-khata, the document shows limited information, such as the property owner’s name and location, the extent of the property and the PID number. “Draft e-khata is populated with few fields now because that’s the only data available in BBMP’s digitised khata registers. The remaining information has to be filled in [by property owners] during the e-khata application process,” Munish says.

What to do in case of property disputes or errors?

Any citizen can raise an objection against a draft e-khata within seven days of its publication on the e-AASTHI website. Objections can only be filed to demand that an e-khata not be issued if there is a property dispute. In such cases, the objection must be filed in writing to the ARO, along with supporting documents. The ARO will then hold a hearing and make a decision.

Some citizens have reported errors in their draft e-khatas. Valli Srinivasan, a property owner, says her name and the name of her layout have been misspelt.

“These property owners can collect their e-khata now, but we will add the module for correcting errors in names and addresses in a couple of months,” says Munish. Allowing name changes on the website is an elaborate process, as people may have minor changes in their names across different documents. Besides, the provision could be misused for property grab if not implemented properly, he says.

How to apply for your final e-khata?

Whether your draft e-khata is available on the site or not, you can click the option to ‘Submit information for final eKhata’.

On clicking this option, you will have to provide:

- Sale deed details: If your property was registered after April 1st, 2004, you only need to enter the registration number of the sale deed. This will fetch the sale deed from the Stamps and Registration Department’s Kaveri 2.0 website. If your property was registered before this date, your sale deed wouldn’t be digitised, so you have to upload it. The e-AASTHI website allows you to upload any of these documents — sale deed, gift deed, encumbrance certificate, property tax receipt, etc. However, the document has to be a title document (such as a sale deed or gift deed) that was registered with the Stamps and Registration Department, says Ketan.

- Encumbrance certificate (EC): The EC should be dated between one day prior to your sale deed registration and the current date. Apply for the EC on the Kaveri 2.0 portal and check the ‘Help’ section for details. If your property transaction occurred after April 1st 2004, you should receive the EC within three days of your application. Otherwise, it may take longer. Ensure you upload your EC in the e-khata application form within seven days of issuance.

- Documents to prove you have an A khata: These could be your khata certificate, khata extract, among others.

- Other details: These include property tax-related details such as your SAS application number

- Your PAN number

- Aadhaar eKYC

- Your photo and your property’s photo

- Your GPS coordinates: You can select these on the website

- Your 10-digit BESCOM connection number

The verification process

The website gives you the option of saving your application progress and returning to complete it later.

Your application gets verified automatically on the e-AASTHI website as it is linked with the Kaveri and BESCOM databases. “If there is a match, you will get your e-khata immediately. If there is any mismatch, the application goes to the ARO, (who will inform the applicant about the mismatch and correction needed). The caseworker and ARO will also check the applications of properties for which they had not finished the digitised records’ verification,” says Munish.

If a property owner does not have all the required documents, they can visit the e-khata help desk at the ARO’s office. On October 9th, BBMP issued e-khata to an NRI who didn’t own an Aadhar card. “In such cases, the application is processed through the alternative login given to caseworkers,” says Ketan.

BBMP has not yet given a deadline for citizens to apply for e-khata. Hence, most applications are now coming from those who need e-khata for property transactions.

GPS exercise not linked with the e-khata process now: Munish Moudgil

Recently, BBMP’s teams started going door-to-door to collect GPS coordinates of each property. Munish Moudgil clarified that this process is parallel and independent from the e-khata issual process.

“The GPS coordinates collected by these teams will be seeded into BBMP’s property tax list, which is separate from the khata list. But later, under another programme, we will link the property tax list with the digital khata list,” he says.

When you don’t have a khata for your property

Some 5-7 lakh properties, mostly in the city outskirts, don’t have a BBMP khata. These properties were in the 110 villages merged with BBMP by 2008. Properties developed in these areas post-2008 merger were added to BBMP registers, but those from before 2008 remain in old village records, despite owners paying taxes to BBMP.

Kochu Shankar, a resident of Banjara Layout, Ramamurthy Nagar, is one such owner who couldn’t find his property on e-AASTHI.

“The village lists containing these property details are available, but they are 16 years old, so we can’t trust them. So, the process is different for these properties,” says Munish.

A separate module will be launched on the e-AASTHI website within 7–10 days for these property owners to file applications. As digitised records for these properties are unavailable, BBMP will issue A or B khatas based on the sale deed and other provided documents.

Citizens raise concerns

Other than the glitches in accessing property records, citizens have raised concerns about the privacy of their e-khatas. Currently, anybody can view a draft of an e-khata on the site.

Munish responded that apps such as the Survey department’s Dishank already show ownership details. “This is a part of the transparency, in my view. E-khata only shows that the person owns this property, not other details like their mobile number. Since e-AASTHI is on blockchain and is integrated with the Kaveri database, chances of misuse have been reduced. The sub-register can verify the digital records before a transaction.”

Meanwhile, the Karnataka Home Buyers Forum has raised concerns about builders not bifurcating and transferring land khata to individual flat owners. “The builder is supposed to bifurcate land khata, and transfer it to the individual flat owners. Some builders in Bengaluru have done it, but most haven’t. So, the land khata remains in the builder’s name. This issue should be sorted before e-khatas are issued,” says the Forum’s convenor Dhananjaya Padmanabhachar. Though the Forum has been approaching top BBMP officials to make the process compulsory, BBMP has not responded yet.

[Update: On October 30th, BBMP issued a press release saying that property owners no longer have to submit EC when applying for e-khata. EC is needed only if you are applying for property registration or mutation at some point.]

Dear Navya Madam

Through your channel please bring the below challenges and Gaps faced on e -Aasthi portal from the property owner.

Unable to upload online EC if the property is registered in 1998.

Unable to upload EC obtained from 98 till 31 March 2004 bcos it’s manually issued.

The window period of 7days expires by the time you get EC from any of these office bcos they have case load and can’t issue within the stipulated time frame.

Geo location for multi story flats is useless

Rest all info has been with bbmp for existing khatas. Hence this ekhata process is of no real use and is creating fresh burden on property owners for multi story apartments

Bbmp needs to generate ekhata on their own without asking for same information repeatedly and asking for irrelevant info like geo location for 100’s of flats who have same location

Fantastic move, hope this system will eliminate wrong registration and corruption.

Hi,

Please also post on how to get the same in Bangalore Urban Gram Panchayathis and not part of BBMP limits.They are not even bother about e-khata

Is there possible empty site to register ekatha

A very detailed article covering all the aspects & procedures of E khatha.

What do they mean by photo of the property? In case of the apartment, is it a full photo of the apartment or specifically the flat?

Their is big issue of square feet and square meterin new system.

If you appartment is mentioned in square feet than u need to pay 10 times more stamp duty because new system doesn’t convert square feet to square meter. And in new system their is only option of square meter.

Example.

My appartment is 964 square feet I uploaded my document and It was showing 964 square meter and asking to pay stamps duty 10 times more sinc it doesn’t convert square feet to square meter.

Facing the same issue but could not find any resolution. Planning to visit BDA office to get clarification.

Let me know if your issue is solved because I have not found any solution yet.

BDA officer said me to visit MS building

Please add a option to modify the final e khata application if there is any error in the application after it has submitted, so that we can correct it online. If we have a khata certificate & khata extract which option we have to select Please clarify.

Big time mess is what government has created; don’t know how traumatic it is to do anything online, when they don’t have infrastructure to handle how can they make it mandatory? To get your property details no filtering option, if you cross the maize it will ask for Kaveri Doc, who the hell knows what’s Kaveri doc… some bird brain is behind it. So much rhetoric on vikasit..

BBMP is asking for digitised versions of documents, e.g. sale deed, etc.,that are already available with the vatious sub-registrar offices.

With better coordination between BBMP and the registrar’s offices, the burden of uploading documents on property owners could have been avoided.

1.For a property whose sale deed was registered on 26/03/2007 , the eAsthi portal is not accepting the EC issued from 25/03/2007 till the date of application.The prompt suggests that EC should be from 01-04-2004 .This is causing delays in the uploading of documents.

2.EKYC feature using Aadhar is not working.Owners are forced to visit the ARO in person.

3.Though EC was applied 10 days ago I received it only 2 days ago.The portal is not accepting it as the date on which EC was applied for is more than 7 days old.Why should the owners suffer because of the delays in the issuance of ECs?

AGENTS ARE CHARGIN RS. 12,500/- FOR THIS JOB !!! TERRIBLE IT SHOULD BE EASY TO DO ONLINE RATHER THAN A AGENT WHO SAYS THAT 60% GOES TO ARO & BBMP

Latest public notice issued by Revenue Minister and also Chief Commissioner BBMP have urged public to file copy of either of any one namely…adhaar, passport or Voter’s id to upload documents.Many NRIs, OCI card holder settled abroad are not eligible for Adhaar card.

They can only file copy of their passport.Present BBMP website is not enabled to upload only Adhaar and not passport resulting more difficulties to such owners who are not having Adhaar.

Navya avare

Namskara, and a nice post

A clarification:

There is NO “A” Khata and “B” Khata, there is only a “Khata” [paper-based] and a “e-Khata” [digital / electronic,] that’s all

Let me explain…

A property that is related to a lawful and legal transaction gets a Official “Khata” or government property record

A property which is illegal for various reasons does not get a “Khata” or property record

But Government [both State Govt and Municipal Authority] want money from the people who are benefitting even though the transaction is illegal, and for infrastructure development purposes

So the people [the “aam janata” (to fool themselves into getting a false sense of “security & assurance,”) the government people (for reasons mentioned above,) and the politicians (obviously for vote bank purposes,) all of them] thought of a good way to “earn more money” and that is how a Unofficial but “pseudo-official” record came into the picture

And for “convenience” [and to “somehow legalise” an illegal transaction] the terms “A” Khata and “B” Khata came into local parlance

Hello, namaskara.

For a new property whose possession is 1-2 years down the line, how does the Khata work? I was told by the builder that the Khata will be available after OC / possession. But for bank loan, now banks are asking for Assignment Agreement to be registered at sub-registrar office, and for that the Khata needs to be provided. Can someone please help?

Regards

Hello, namaskara.

For a new property whose possession is 2 years down the line, how does the Khata work? I was told by the builder that the Khata will be available after OC. But for bank loan, bank is now are asking for Assignment Agreement to be registered by sub-registrar, and for that the Khata needs to be provided.

Regards

@ARO and RO, No option provided yet to correct incorrect details in draft eKhata. Assessment number is wrongly mentioned. Pls provide option to rectify. Don’t play with common people without having proper preparations in place.

eKhata application is stuck on the eKYC screen, asking for Aadhar number details. As an NRI I don’t have an Aadhar card. But I have other documents (Passport and OCI (overseas citizen of India) Id card

Thee is no option to move forward, hence can’t get eKhata, very frustrating as I need to sell my property

May I help

Assessment number is wrong in Draft eKhata and there is no option given to concerned ward ARO and RO’s to correct the assessment number as per link document records

This is really stressful and we don’t know when they are going to update the system.

What is the fees or charges to be paid to change From Khatta A to Khatta E?

Is it a big amount calculated @ of % based on the purchase amount ( in ur sale deed) of the property?

Or a fixed charge for all property owners

On clicking on the zone to get property details, it gets stuck there. Probably a technical clutch that needs to be rectified as one can’t move forward.

Recently I faced an issue – Name entered into the e-Aasthi system or bbmp book is incorrect. Even though my name in the bbmp portal doesn’t match with Aadhaar, post authentication it states name matched. There is a flaw in the authentication process.

property is my mother name .she is no more. ihave only sale deed,property was very old .not tax paid yet. how to proceed further.officials giving confussing idea.please guide me.

you can pay property tax based on application number in your tax reciept and later you can search for the property record in e aasti portal and apply for mutation based upon inheritance

Unable to download the final Ekhata even the application status is showing as Approved. When contacted ARO, he is asking to visit the BBMP office to get the final EKhata Then what is the point of making this online, when citizen is unable to download the Final Ekhata by themselves.

While physical Katha issued by BBMP carries proper sequence of joint holders name and their spelling. The same is reflecting in the annual tax paid receipts. No mistakes here also.

In draft e katha which is in kannada, we find the sequence of joint owners is wrong, and also glaring mistakes in name which results in a different name.

Where to address this and get it corrected?

When my apartment was registered there was no aadhar and now when I applied for ekhata it has gone for endorsement by the ARO because my name in BBMP registers and AADHAR there is a mismatch in the first name. Am not sure how this will be resolved easily

I had applied for ekhata a month ago and nothing moved since then. Had to visit BBMP office and then they asked to provide physical copy of sale deed/aadhar/BBMP latest tax receipt. Now have to wait for another 7 days to move forward. Not sure now they will come up with what document discrepancies now.

For a new property whose possession/OC is 1-2 years down the line, how does the Khata work? I was told by the builder that the Khata will be available after OC / possession. But for bank loan, now banks are asking for Assignment Agreement to be registered at sub-registrar office, and for that the Khata needs to be provided. Can someone please help?

While selecting the measurement unit the site is giving an error. Has someone been able to download the ekhata successfully?

Hope less and wrost implementation, without proper knowledge they have implemented .finally public are sufferers,who given this idia to govt ? ,huge loss approximately 100 cr Per day ,atleast parallel old method to accept

its high time now please update the khata and issue us the PID no proper online communication

Bcoz of upgradation of BBMP digital reords and setback in methodology of digitilisation , some temporary solution to be given for sellars/buyers. Let them apply for e khata to BBMP and acknowledgement can be given for processing the sale transctions by registration offices.

BBMP DRAFT e-KHATA for many of the properties has every field blank even though the SAS application number and taxes are paid for many properties.

The Online processes typically do not function, since lot of internal dis organisation is seen. Many records are not uptodate. PID a unique identifier for 10 to 15 yrs aging flats is still not done by BBMP staff.

WE HAVE PROPERTY DOCUMENTS UP TO DATE TAX PAID FOR THE YEAR 2024-25 ALSO. BUT OUR PROPERTY DETAILS ARE NOT APPEARING IN A -AASTHI PORTAL AND I AM RUNNING FOR THIS FROM PAST 3 MONTHS, NO USE AND ARO IS SHOUTING LIKE ANYTHING. PLEASE SUGGEST ANY SOLUTION FOR THIS.

if data is not available in e aasti site new epid needs to be created by case worker in bbmp. if they are not doing it you can file an RTI online asking for EPID for your property, but before you apply read about limitations to file RTI

It is impossible to get digital e Khata . You need to

be a genius to get it .

On your website everything is written in Kannada .

Is help available for non Kannada illiterates. Is there

an English version .

BbMP have created a nightmare situation.

That nightmare wouldn’t have happened if you would have learn local language of where you stay. While it’s not mandatory to learn the local language, being familiar with locallanguage can certainly help when navigating services in those region.

Visited Bangalore one office today to upload the documents. details of our property not available. asking us to get epid no from bbmp. who will generate and provide. no details regarding this. if property is not registered by bbmp, how to get it done or added

Search with previous owner name by yourself in bbmp e aasti website, else you can try assesment number i mean khata number

how much time it takes for a e-khata to reflect in Kaveri

There appears no visible progress on easing this process of getting khata for owners who have issues. Draft not appearing, names or dimensions not correct etc.,

Is something happening or everything has stopped?

I have house in thathaguni. i purchased land in 2014 at that time there is katha registration. we did sub registration. Now i want to apply for e-katha. please let me know. even property tax not paid till now becuase of katha issue in thathaguni some of them illegally obtained katha but we are not yet. Please help me for this

you need to apply for BBMP new khata creation, since you don’t have khata.

https://bbmp.karnataka.gov.in/NewKhata/login.aspx

I have house in thathaguni. i purchased land in 2014 at that time there is no katha registration. we did sub registration. Now i want to apply for e-katha. please let me know. even property tax not paid till now becuase of katha issue in thathaguni some of them illegally obtained katha but we are not yet. Please help me for this

All these E-Khatha is a big scam by govt fooling people to make money through Agents by doing the website server slow & hanging & asking for bribe to be done by agents. Agents are rights & lefts of our so called politicians & ministers of this govt. How will the people get their documents digitized if the property is older than 50 years? Simply imposing a burden of visiting BBMP offices to get it done by agents by paying huge bribes. This E-khata is not necessary. People who are already paying taxes, Electricity, water , etc can be tracked by govt as all these services are digitized. No need of digitizing the khatha above these.

well said . Why E Katha when you have Katha

Another gimmick by the current govt to raise funds for his freebies. Been trying from several days and every time with lots of hours spent each day manage to get a step ahead. Stuck at EKYC as when I click on it, it says server not found.

For people who are not in need of selling, maybe wait it out, until the drama falls.

How to generate e khata in engine version. My e khata has generated in kannada version but I need in english version also. Kindly help me to get e khata in english version. Thanks

Is 2024 and 2025 data uploaded? I have transferred A khata from builder to my name in June’24 and still builder name is reflecting in draft E khata. ARO asked to wait until 2024-25 data gets uploaded.

A simple query,

I bought a flat in resale , complete the registration in 2023, but did not get the khatha transferred done on my name.

Do I need to first get the normal paper khatha transferred to my name and then only get this ekhatha, or now there is no need of older process.

Tax receipt is still in previous owner name.

Guidance would help.

I’m going shuttling between BBMP – RO – Commissioner – Sub Registrar office everyday from November 4th till date . I’m writing this message at 2:48 AM because I’m restless and worried . I cannot express the enormous stress this has created . I had an agreement to sell my property which is a combined one with two E Khatas .

Both Ekhatas came with glaring errors ( date entered by BBmP after taking 20K ) . Waited 1 week for correction module , got the errors rectified , one came back with more errors and another has gone missing . Not to be found in any system under any login . And nobody to help !!!!! I planned to sell this property to come out of my financial issues and I’ve got myself into bigger ones now .

For all the people here , can we please form a WA group and then may be go wherever to get our issues resolved. Atleast in big numbers we may be heard .

For anyone willing to join please message me : 9900511100

How to check the status of final e-katha application status, if you applied for the same through Bangalore-one?

You may check status of your application in bbmpeaasthi.karnataka.gov.in

where can i check..?? can you please provide steps..

There are lapses in the newly introduced eKhaatha system. A repeat of this data collection will happen after few years in future. This is an ongoing harassment to the citizens and opportunity for bribe taking.

The e-khata system is a game-changer for property management in Bengaluru, offering transparency and ease of access.

The detailed explanation of the process and distinctions between A and B khata properties is incredibly useful. Mandatory e-khata for transactions ensures authenticity and eliminates loopholes.

Thanks for sharing this comprehensive guide—property dealings just got a lot simpler!

THOSE HOW ARE HAVING ISSUE IN GEETING E KATHA OR ANY HELP YOU CAN REACH ME on my number. i will help as much as possible.

SEVEN,THREE,FOUR,NINE.ONE,NINE,TWO,TWO,THREE,ZERO SANTHOSH k reddy

My property is registered from previous owner, but khata transfer was not done. When we were about to do, this eKhata came into picture.

Now the scenario is:

a. Tax paid receipt is in the name of old owner

b. Registered sale deed as got from sub-registrar server gives the name of new buyer.

This gives a mismatch between names in tax paid receipt and ownership records.

Because of this, the ekhata is not happening.

Either there is an option for Khata transfer in this ekhata. If there is an option could anyone please help.

Apply for Khata using the sale deed. The Tax paid receipt will still have the name of the old owner. As long as the property tax is upto date, this should not be an issue. Once the Khata is applied for, they simultaneously change the name on the Tax paid receipts as well. If this is not done, you can complain to the RO.

I have to go to BBMP office more than 10 times just to get the ekhata approved. And now after getting ekhata and going for registration through kaveri, it is failing becausing north, south, east , west is empty in my ekhata. How does apartment have these values ? and they were not even required fields in ekhata application. Now i have to run to bbmp office again daily and the sad part is they also dont know how to fix it. Why is this ekhata made mandatory without understanding the basics of how things operate at the ground level. Utter incompetence of the government and the sarkari babus. This will surely make me think 100 times before investing anything in real estate in bangalore.

same issue with me now they have made dimensions north south east west mandatory for flats also but what value should I fill there

as there is no dimension of flat in sale deed there is only sq ft listed

DATAS ARE AVAILALE WITH THE BBMP ALREADY. DO NOT QUEEZE THE PROPERTY OWNERS REGARDING THIS.

THE BBMP ITSELF CAN DO THE JOB OF GENERATING E-KATHA AND SEND THE SMS TO THE PROPERT OWNERS TO DOWNLOAD IT BY PAYING THE PRESCRIBED FEE ONLINE.

THIS MAKES THE JOB EASY–NO HURDLES TO THE PROP.OWNERS—IF THER IS ANY DISCREPENCY–THE PROP.OWNERS THEMSELVES WILL ACT AUTOMATICALLY.

I have an A-Khata Certificate and Extract but not sure which option to choose in the field: “A-Khatha claim based on”. Please help/advise.

Were you able to get through this issue?

you need to upload dc convertion copy or land convertion copy and betterment charges paid by the land owner to convert the property to A khata, if you don’t have any documents you can simply select no document available.

I am also facing similar issue. I have A khata but not sure which option to choose in the field: “A-Khatha claim based on”. Please help/advise.

E khata service is available in Bengulure only?

My A-Katha is currently registered under dual names , between my brother and myself. While completing the final e-Katha online, the system does not allow me to enter both our Aadhaar for eKYC verification.

Anybody had a similar issue ? and if so, how to resolve it ?

The e-khata procedure looks simple & straightforward on paper. Implementation however is absolutely pathetic. There were no standard formats for sale deeds earlier, yet the current system assumes so – eg. for car parking area. It rejects application if there’s no area mentioned. I filed three times since Nov 2024 for availing e-khata to proceed with registration – still shows as pending. The documents & details were uploaded by BBMP case workers themselves (after pocketing some “fees”). Property transaction is stuck because of the stupid rule that makes e-khata immediately mandatory without resolving ground level issues. Just another scheme for a scam & bribes – & harassing honest, taxpaying citizens. Shame BBMP!

There was a column for the BWSSB Water Meter number in the ekhata application, does it mean the RR number what we see on the BWSSB bill or something else?

I need help in guidance on getting a khata from my flat which is not being issued by Panchayat office on how to proceed to get Khata?

really liked the information that you have provided mam.

Good information

Hello, I am trying to submit new eKhatha application but the KYC page is not opening. Tried many times and the page doesn’t work at all. Can you please help or suggest me an alternative way to get the eKhatha? thank you

This is a very helpful guide for Bengaluru property owners! The detailed steps for applying e-khata on the e-AASTHI website, understanding A and B khata, and viewing draft listings make the process much clearer. A must-read for anyone looking to digitize their property records efficiently.

Biggest issue is ekhata document does not have option to print in ENGLISH.

This is show stopper , to know if there are mistakes done by operators in Bangalore 1 , Karntaka one and Janasevaka camps.

I have seen cases where a couple Buyer A and Wife B , with seller C and wife D have been mentioned wrongly as Buyer A with wife D and Seller C with wife B .

All these can be avoided.

50% population has migrants and many kannadigas also do not know to write in Kannada properly . Election cards issued have many such errors as well