Every year, the Bruhat Bengaluru Mahanagara Palike (BBMP) collects property tax during the months of April and May, and a 5% rebate is accorded to encourage timely tax payments. This year, however, BBMP has extended the 5% rebate period for property tax payments till July 31, 2024.

One of the key differences in the SAS Property Tax Payment is the addition of a field for capturing latitude-longitude. According to the BBMP website, the benefits of latitude-longitude seeding are:

- Your property gets BHU-Aadhaar ID

- BBMP will not allow anyone else to create Property Khata on the same spot

- Your property rights are better protected

Read more: Explainer: How is your revised property tax being computed in Bengaluru?

What is BHU-Aadhaar ID?

Bhu-Aadhaar or Unique Land Parcel Identification Number (ULPIN) is a 14-digit unique identification number issued to each plot of land in India as part of the Digital India Land Records Modernisation Programme (DI-LRMP) or erstwhile National Land Record Modernisation Programme, which started in 2008.

The ”Aadhaar for land” programme enhances transparency and accuracy in land records management by assigning a unique identifier to each piece of land. Identification is based on the longitude and latitude coordinates of the land parcel, and is dependent on detailed surveys and geo-referenced cadastral maps.

Due to technical glitches and the difficulty experienced by the elderly or those who were not tech savvy in filling GPS coordinates, BBMP was forced to make the GPS field optional.

Step-by-step guide to paying property tax online

Keep these handy before you commence:

- Mobile number – for OTP

- Your previous property tax paid receipt. For a first time payee – keep your Khata certificate ready

- Details of changes; new area (dimensions), type of construction etc. (if applicable)

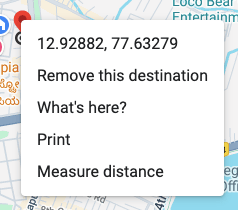

- GPS Coordinates – the numerical values starting from either 12/13 and 77. The coordinates can be found on Google maps when you right click on the location pin

Login to SAS Property Tax Payment Portal and enter any of these 3 details, along with 3 characters of the property owners’ name :

- Property identification number (PID) No ( refer to Khata certificate)

- Enter 10 Digit Application No (or)

- 2008-2015 Renewal Application No.

PS: Those with arrears/demand notice, can utilise the ‘One-Time Settlement’ OTS scheme under the notification tab.

This message will appear: “Check this box if there are any changes either in the property usage, extent of built-up area or its occupancy”. Click the checkbox only if there are changes, else ignore.

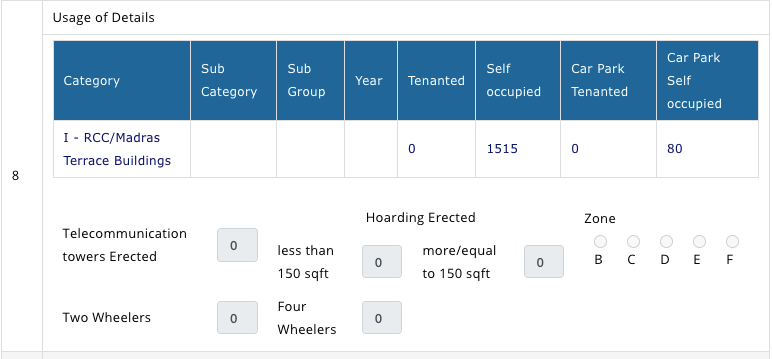

First segment – property details

Computation of tax

A major component of the tax is CESS:- Four types of cess are levied as part of property tax: Health cess, land transport cess, beggary cess and library cess. At the OpenCity data jam held last year, the team found that although typically cess forms approximately 26.6% of property tax collected, in 2022-23, cess was 45.73% of the property tax collected. The data does not provide clarity about how the cess was spent and the reasons for the expenditure.

A frustrated tax payer, John Peter, encouraged people to demand better services from BBMP. He shared this message on a public Whatsapp group called BBMP Property Tax Notices – “Dear all, I assume that everyone in this group have been paid the property taxes, which includes the cess amount, and they have forcibly collected the amount from everyone by demanding separate charges of zone and commercial taxes. But after collecting the taxes, BBMP has not been working in a right manner for cleaning the garbage in the entire Bangalore city, where we can find garbage thrown on the streets and roads. So, if anyone can assist on this to file the petition, I will be grateful. Simultaneously, I request everyone to file the petition to the BBMP Commissioner and try to capture photos and share it on Twitter and post it to BBMP Commissioner. Let him understand the same pain that everyone has suffered. Let him do his work honestly”.

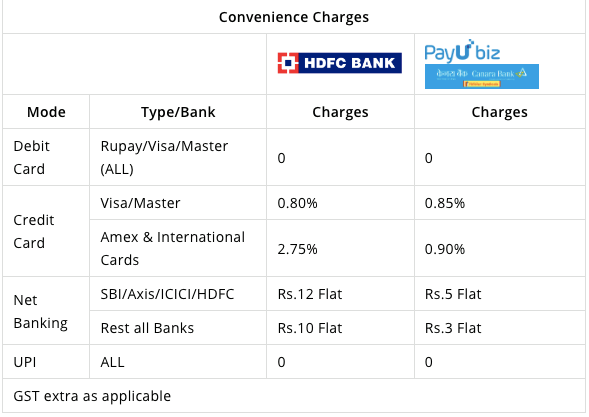

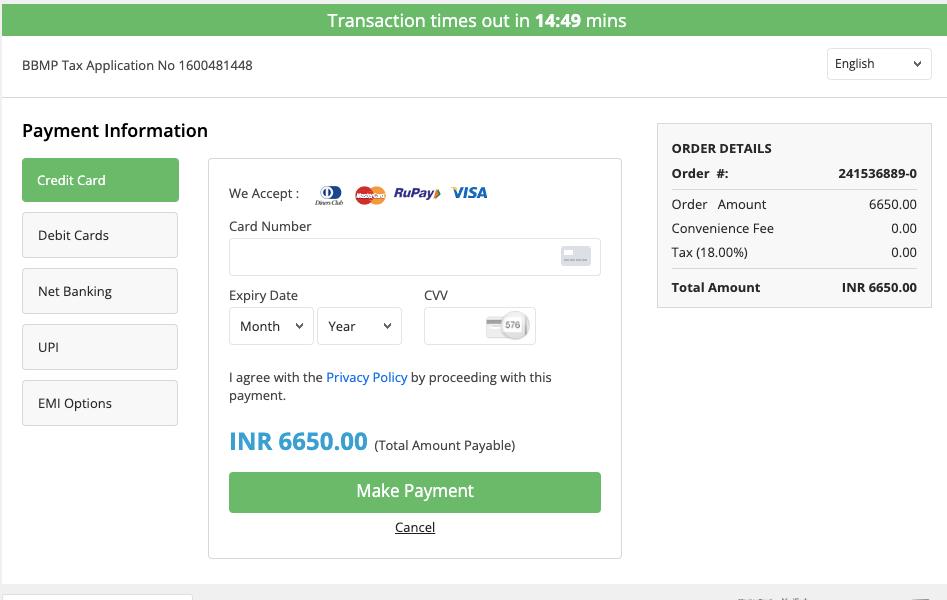

Payment information & convenience charges applicable for online payment

Please note: Refunds or chargeback requests for property tax payments made through PayUMoney or HDFC Bank will only be processed by BBMP. You can raise a ticket in the Grievance section for questions regarding chargebacks.

Incorrect taxation zones and notices: A timeline

- In 2021, BBMP served notices to 78,524 under-valued properties to pay up their tax arrears. These were largely due to incorrect taxation zones, which was heavily contested, with cases filed in the consumer court.

- In September 2023, the government issued a notification waiving off penalty, but not arrears and interest.

- In January 2024, Munish Moudgil, Special Commissioner (Revenue), is reported to have said that BBMP has issued notices to 20,000 property owners and SMSes were sent to over six lakh owners, who owe “about Rs. 500 crore” to the BBMP. Moudgil stated that several shops and small hotels that were functioning in residential areas must be categorised as ‘commercial’ and must be paying tax as a commercial unit.

- In February 2024, Karnataka Assembly passed the BBMP Amendment Bill 2024, which is projected to benefit around 13-15 lakh people in Bengaluru, including 5.51 lakh taxpayers, by reducing the penalty on property tax arrears by 50%.

- On February 20th, BBMP issued a draft notification proposing a new property tax calculation structure in Bengaluru. The new structure, based on Guidance Value (GV), replaced the zonal classification. The new property tax structure was expected to begin during the next financial year, starting April 1 2024.

- On March 16th, Lok Sabha elections were announced, to avoid code of conduct, BBMP was forced to postpone the revised GV based tax calculation structure. Thus the calculations will be the same as previous year’s. BBMP has extended the rebate till June 30th.

- A ‘One-Time Settlement’ OTS scheme where penalty equal to evaded tax and complete interest waiver on all property tax arrears was offered by BBMP until July 31st.

I have been trying to pay BBMP property tax quite unsuccessfully because BBMP site does not permit more than six decimal digits for the longitude. But the site insists on 9 decimal digits while making the payment. Kindly advise if you have any solution. Thank you.

I am trying to pay BBMP house tax for the past three months. The site is not active. My chance to save 5 percent discount is missed. Now the last date to pay is 31st December 2024. If I don’t pay then there will be fine to be bourn.