When we were moving to Mumbai, one of the major relocation tasks was finding a suitable house to live in. Suitable as in proximity to children’s school and husband’s office, size, furnishing, rent, amenities, and the like… things people look for while choosing a house. We knew a few people who were already living in the area and they indicated that the most efficient way of going about this would be to approach one (or more) of the many real estate agents who had set up shop for people like us (and for owners who had bought the houses but were not in a position to live in them themselves).

Apart from holding the keys to the houses so that they can show them to prospective tenants, the agents are important influencers of the prevailing rents at any point of time. Given that they demand brokerage fees equivalent to one month’s rent from both parties, it is in their benefit to push the rents up or move tenants to better properties.

The agents take the responsibility of drawing up the rental agreements (called Leave and License Agreements) and getting the parties to sign. Leave and License Agreements in Mumbai are required to be registered with a sub-registrar’s office as per law.

Th agents fix the appointments for registration and also handle the other administrative procedures with the building society to enable the tenant to occupy the newly rented house.

For opening a few doors, the business is lucrative, but estate agents make you believe that the paperwork that they handle to seal the rental deal is complex and the rates are justified. Especially when you want to renew the agreement. This time they do not need to open any doors for you, but they will still demand 15 days’ to a month’s rent as brokerage for the paperwork (though they have nothing to broker!). Even if you have gotten to know the owner reasonably well, both you and the owner are in the agent’s clutches till the time you remain in the house. This can be rather expensive.

Our rental agreement was reaching its expiry date (pre-Covid) and we were looking to move to a smaller house. It was just as well, as we later found out that our owner was interested in selling the place. This was an opportunity to get ourselves out of the agent’s web. We looked for a house ourselves and found an owner who was happy to save on brokerage. This was the easy part. Now to get the agreement done and get it registered. For this we would surely need an agent? No! We did it ourselves and here is how you can do it too.

A Leave and License agreement can be registered either online or offline by physically visiting a sub-registrar’s office.

Register your Leave and License Agreement online

Visit https://efilingigr.maharashtra.gov.in/ereg/. This is the Department of Stamps and Registration’s e-registration portal.

Here a citizen can:

– Prepare the agreement

– View the draft

– Modify if required

– Execute (sign) it

– Submit it for registration

– Get it registered

– Get the status of registration through SMS.

To do this, one needs to have/fulfill the following:

– Biometric Device (Thumb Scanner)

– Webcam

– Internet explorer 9 & above

– Aadhaar number of all parties to the document and the identifiers/ witnesses (with valid mobile number linked to Aadhaar)

– Pay Stamp Duty and Registration Fee online through GRAS https://gras.mahakosh.gov.in/echallan/igr/.

A step by step user guide is available to help you navigate the portal and complete the registration process http://www.igrmaharashtra.gov.in/OnlineServices/eRegistrationUserManual.pdf

If you are unable to do the online registration process yourself and need help, there are many Authorised Service Providers (ASPs) listed on the portal http://www.igrmaharashtra.gov.in/OnlineServices/eReg/ASP-Mumbai-List.xlsx who can help you for a fee.

ASP may work out cheaper if you do not have ready access to a biometric device. A technical representative of the ASP will visit you at your doorstep and take thumb impressions for verification of the documents, and do everything else required. So you can get the rent agreement registered without leaving your home. The fees charged by ASPs are in the Rs 700-1500 range. Please do your own due diligence before engaging with the ASPs.

Register your Leave and License Agreement offline

1. Draft the agreement and sign

A format of the agreement can be found here. The terms and conditions should be reviewed to suit the property and the Licensor (owner) and Licensee (tenant).

Print the agreement on white or green legal size paper. Depending on the period of the agreement and the financials, Stamp Duty will be payable. If you are paying the Stamp Duty through stamp paper, then you should print the agreement (or part of it) on the stamp paper. Leave some space on each page for the sub-registrar’s numbering. Printing can be done on both sides of the paper (back to back). If you are paying the Stamp Duty through franking, you need to leave space for franking.

There is no need to assign page numbers while printing. All pages of the agreement should be signed by both parties. In case of any corrections, the parties need to countersign with their initials. On the last page of the agreement where both parties sign next to their names, left thumb impressions need to be affixed and photographs stuck. The PAN numbers of both the parties should be recorded next to the names.

Two witnesses also need to sign. Choose witnesses who have proper photo ID cards (such as PAN card/ Aadhaar card/ Voter ID card) and who will be able to be present at the time of registration.

If any party has given Power of Attorney (POA), a photocopy of this needs to be attached to the agreement. Photocopy can be back to back. Photocopies of the PAN cards of the Licensor/ POA holder, Licensee and photo IDs of both witnesses need to be attached to the agreement. Photocopies of all the IDs can be done on one paper or back to back.

The agreement needs to be registered within four months from the date of signing.

Tip: When registering, both the sides of the paper, blank sides included, are numbered. Scanning charges are based on the number of pages so it is preferable to use both sides of the sheets while printing and making photocopies to append to the agreement.

2. Pay the Stamp Duty and Registration Fee

First you need to calculate the Stamp Duty and Registration Fee.

The amount of Stamp Duty is 0.25% of the sum of

– Total monthly rent paid for the period

– Non-refundable deposit

– 10% of the refundable deposit * no. of years (or part thereof) of agreement.

This amount is rounded off to the nearest Rs 100.

e.g. If the agreement is for two years, monthly rent is Rs 20,000 for the first year and Rs 21,000 for the second year, refundable deposit is Rs 1,20,000, non-refundable deposit is Rs 20,000, then the stamp duty is calculated as follows.

Total monthly rent = (20,000 * 12) + (21,000 * 12) = 4,92,000

Non-refundable deposit = 20,000

10% of refundable deposit for 2 years = (0.10 * 1,20,000) * 2 = 24,000

Stamp Duty = 0.25% of (4,92,000 + 20,000 + 24,000) = 1340 (rounded off to 1300) – Pay 1300

Registration is flat Rs 1000.

Do a cross check using the calculator on the IGR Mah Helpline website http://www.igrmahhelpline.gov.in/stamp-duty-calculator.php or Maharashtra Stamps Dept website https://efilingigr.maharashtra.gov.in/ereg/.

Note that Stamp Duty can be paid through e-challan, franking, stamp paper, e-stamp, e-SBTR, etc.

Stamp Duty and Registration fee can be paid online or over the counter. The fee can be paid either by the Licensor or the Licensee.

Payment through GRAS is a convenient mode and seems to be preferred at the sub-registrar’s office. To do it this way, click this link https://gras.mahakosh.gov.in/echallan/igr/.

If the Licensor is paying the amount, enter his/her name first. In case of more than one Licensor, enter the first name and write “plus one other” or “plus two others” as the case may be. Print the challans. Note down the GRN no. (it will be in the format MH xxxxxx) separately for Stamp Duty and Registration. This is called payment through e-challan.

3. Get your Public Data Entry (PDE) number

To do this visit the PDE website https://pdeigr.maharashtra.gov.in/.

Before you actually start, read the iSarita user manual. It will give you an idea of what to expect.

https://pdeigr.maharashtra.gov.in/iSaritaPublicDataEntry_UserManual.pdf.

Also, keep the SARATHI helpline no. 8888007777 (the executives are very helpful) and website http://www.igrmahhelpline.gov.in/ at hand. In case you get stuck at any point during data entry, call them for help or check online.

This website is no showpiece and a bit difficult to use. You could encounter a few irritants, but nothing that you cannot overcome.

Keep the agreement that you have signed at hand. You will need information that is contained in it to be entered in the Public Data Entry form. You will also need the Survey No./ CTS No./ Plot No. of the property. This will be somewhere in the Sale Deed and would be available with the building society.

The password you enter is important. Note it down.

You will need to choose the SRO Office. You can choose one that is convenient for you, but remember that it is not compulsory to go to that office for registration. Registration can be done at any of the offices that fall in the jurisdiction of the property, irrespective of which you choose here. A full list will appear at the end of the data entry process.

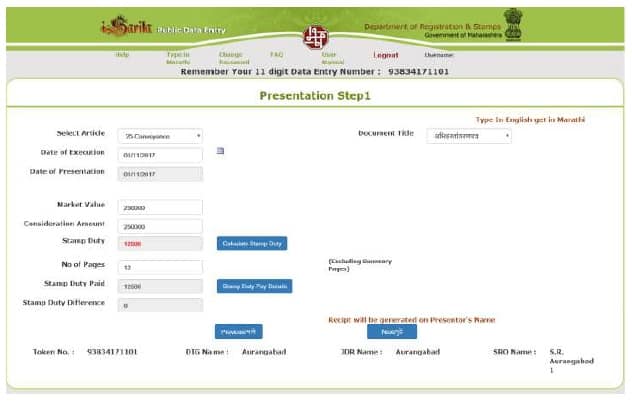

Data entry starts at the page titled Presentation Step 1. Choose “36-Leave and Licenses”.

Tips: Date of Execution needs to be current or previous date. This means that you can do data entry only after having executed the agreement. When entering the rent, you need to enter the average for the whole period. E.g. if the rent is Rs 20,000 in the first year and Rs 21,000 in the second year. The average rent for a month will be Rs 20,500.

Once you have entered the rent and deposit amounts, click “Calculate Stamp Duty”.

Then click “Stamp Duty Pay Details”. You can now enter the Stamp Duty payment details. After you have done this, click “Save”. The details will appear in a box at the bottom of the screen. You can make changes to the entry at any time by choosing “Select”. Once your info is correct, click “Close”. This will take you back to the Presentation Step1. Check that the data entered is correct. On clicking “Next” you will be taken to the next screen “Property Details” where you will have been assigned a Public Data Entry number. This is important. Note down this number.

Proceed to enter the details at each screen. Remember to click “Save” at each screen to save the data before going to the next screen.

You may encounter a message “Data not in proper format”. The system usually does not tell you what is wrong so you will have to figure it out. There may be a missing field or there may be a special character that is not allowed. Call the SARATHI helpline if you are starting to feel exasperated.

While entering names, ensure that all the fields (surname, first name, middle name) are filled. Blank fields especially for the witnesses (Identification Details) will not be accepted. If there is no middle name put a hyphen (-).

Both the Licensor and Licensee names need to be entered. To add a sheet for data entry click “Add”. To correct an entry, click “Select” in the saved box at the bottom of the screen. Then change the info you want and click “Update”. While entering the names of the Licensor and Licensee, take care to mark who has paid the Stamp Duty (to match the e-challan/ payment of Stamp Duty) and the Presentor. If there is a Power of Attorney holder in the picture, this needs to be mentioned along with the name of the person who is being represented. There is no specific field for this, but it can be put next to the name or under Identification Mark.

Special characters in Marathi translation may not be accepted. To type in English and get Marathi click the link of this name and it will take you to a new screen where you can correct spellings and write anything else required.

This data entry is the most important step as the information entered here is what is accessed at the time of registration. Ensure that the information entered here matches the information entered in the agreement that has been signed.

The data entry info is saved as you go along, so you can log out at any time. To return to continue you will need to go to the first screen and enter your Public Data Entry No. and password.

Once you have completed the data entry, it will take you to a screen where you can review the details and print. This is the “Public Data Entry Report” or “Nondanipurvgoshwara Report”. You need to carry a print with you when you go for registration.

The last screen displays the all possible offices where the registration can be done. The parties can go to any of these offices.

4. Fixing an appointment

One could fix an appointment using the online Token Booking System http://igrmaharashtra.gov.in/TokenBooking/tokenbook.aspx . This doesn’t seem to work currently.

Here you can check the booking chart to see free slots and actually do the booking. You will need your Public Data Entry No. to do a booking. Once you have booked a slot, take a screen shot of the booking confirmation (the Receipt tab sometimes does not work). You can also rebook the appointment to move it to a different slot. Booking needs to be done two days in advance i.e. today you can book for day after tomorrow. Take a print out of your booking confirmation.

From experience, the token booking seems to have no consequence. When you go to the sub-registrar’s office, you need to give your papers for checking at which time you will be given a running serial number, irrespective of the token number you have. There will be many people (agents) who walk in at any time. Anyway, it is good to make an appointment. If you get delayed you can take out the token and create a fuss.

5. Put together your papers

The following are the papers you should have:

– Print out of your appointment token

– Public Data Entry (Nondanipurvgoshwara Report) print out

– Stamp Duty paid challan (if paid through GRAS)

– Registration fee paid challan

– Original Agreement duly signed by Licensor, Licensee, two witnesses

– Power of Attorney (if applicable)

– Photocopies of the PAN cards of Licensor, Licensee, POA holder (if applicable) and ID proofs of the two witnesses

– Original PAN cards of Licensor, Licensee, POA holder (if applicable)

– Original ID proofs of the two witnesses

You also need to carry:

– Cash to be paid towards scanning charges of the agreement and annexures (Rs 20 per page, blank sides included)

– Stationery – pens, stapler

– if possible – your laptop with internet connection. This in case there is an error in your data entry and you need to correct it.

6. Go to the sub-registrar’s office to register

The Licensor, Licensee and two witnesses need to go on the day of registration.

Tip: To ensure that your papers are in order, you could go a day or two earlier and show the papers to the duty clerk. This way you will be sure that on the day you will not face any problems, especially as there will be at least four of you going.

Give your papers to the duty clerk to check. He will assign a running token number so you will know how long you may need to wait. In case there is a POA holder, a separate declaration will need to be signed and appended to the agreement.

Once your papers have been certified to be in order by the clerk, the sub-registrar will take a look and give orders to proceed. The document is next given to the numbering clerk for numbering. Both sides of every sheet are numbered. The data entry checker will check for any typos that have occurred because of translation. Corrections, if any, can be done here. Then the parties and witnesses are photographed and biometric left thumb prints taken. A print out of this sheet needs to be signed by the parties and witnesses.

In the meantime, the Stamp Duty and Registration receipts will be retrieved from the internal system by the clerk and defaced as “paid”. Scanning charges need to be paid in cash and a receipt for registration plus scanning charges will be issued. The Presentor of the documents will need to sign in the register and he/she will need to return in about an hour to collect the original document and the scanned copy in CD form. In case the Presentor cannot go back, he/she can give an authority letter to a representative for collection.

Tip: By registering your Leave and License Agreement, you are adhering to the law. No one is doing you any favours and neither are you. Be patient but assertive. Resist offering any speed money. If your documents are in order, the whole process should not take more than an hour. If there are problems with your documents, find out what they are and solve them then and there. You are likely to find many people (most likely experienced agents) willing to help with no strings attached.

Congratulations! You have done it! What few have done before!

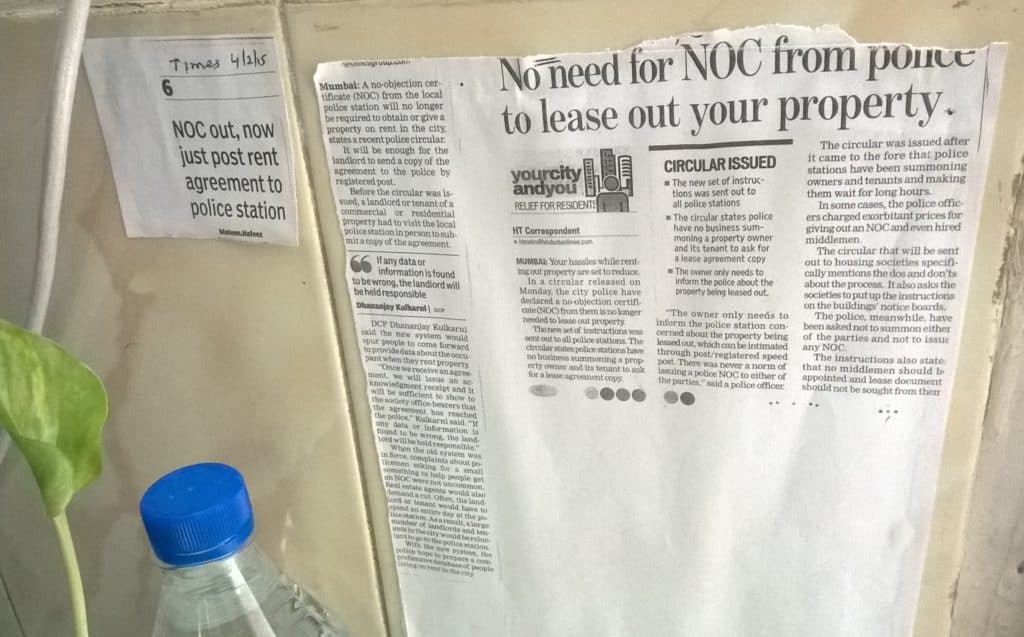

7. Police verification

Owners in Mumbai are supposed to inform the police when they rent out their houses. Building societies sometimes ask for a police verification paper before they allow tenants to move in. Though newspaper reports (as displayed at the police station) indicate that this is not required, the policeman at the police station revealed that they have recently come up with a new form, which can be found here. (The form was not available with the policeman. He asked me to pick it up from the photocopy shop across the road.)

There is no need to enclose a copy of the rental agreement. The form asks for information about the owner, tenant and agent, and needs to be accompanied by a photo of the tenant, ID proof (Driving Licence/Aadhaar card/ Voter ID, etc.), details of place of work, letter from employer. These need to be submitted to the police station. Take a photocopy of the form. This will be stamped and signed by the policeman in acknowledgement of receipt and can be used for building society purposes.

8. Building society formalities

Apart from the police verification, building societies will have certain formalities before allowing a new tenant to occupy a house. They may ask for Form 11 and Form 29. Formats can be found here. The society may also charge the tenant a fee for moving in. Societies are so used to agents doing everything that they may find it strange to respond to your queries, but don’t hesitate to ask for the move-in procedure.

Now you are all set to move into your new home. Good luck!

A part of this article first appeared on the writer’s blog here and has been modified to reflect current practices.