“I had sleepless nights for months, even now when I recall those days, I feel uneasy,” says Neelam Lilaramani, a senior citizen residing in Goregaon – a suburb of Mumbai. Last year, as she was scrolling through her Facebook app, she stumbled upon an advertisement for a dress that she liked. She added her address, checked for payment details, and chose the ‘cash on delivery’ option to avoid any unwanted online scams – and then clicked ‘buy’.

A few days later, when the parcel arrived, she wasn’t at home. On his third attempt, the delivery person handed the parcel, Neelam paid him Rs 2000 for the dress. When she opened the package, to her shock she found a toddler’s knickers in it instead of her dress. She immediately called the helpline number on the shopping website and informed them.

They apologised and promised to refund the money for which they told her to click a link and check if she received one rupee from them to verify her google pay account. Trusting the person on the other end of the phone, Neelam clicked the link and informed him that she did receive one rupee, after which he assured her that he will soon refund her 2000 rupees.

To her horror, a few minutes later, Neelam received a message of Rs 900 being deducted, and after a few more minutes another Rs 10,000 and so on. More than 20,000 rupees were wiped out within minutes from her account. “We rushed to the bank, and then to the police station. A case was registered but nothing happened, it’s been over a year now,” she said.

“My husband was terminally ill at that time, while I and my son had to additionally make rounds of the banks and police station. More than the money, the amount of mental trauma that we went through can never be forgotten,” she said.

When it comes to cybercrime, senior citizens fall prey most easily due to two main reasons – the lack of digital training and the tendency to trust online scamsters easily. Many of them have lost huge amounts of their hard-earned retirement savings. The worst part is – the accused usually do not get caught and the money is completely lost.

Alarming rise in cases

In the last four years, cyber fraud has rapidly risen. Compared to other crimes in Mumbai last year, cybercrime has seen the highest number of cases. According to Mumbai police data, the number of cyber crimes registered by Mumbai police in 2022 stood at 4,286 as against 2,883 such offences in 2021. That’s a rise of 49%.

Among these, senior citizens have been the main target. The police say that criminals are targeting older people as they lack digital knowledge, they have savings and they hesitate to report the crime to authorities.

A low-risk, high-reward crime

According to cops, cybercrime is an organised racket that comes with less risk of getting caught while escaping with large amounts of money. “The detection and recovery rate in these cases is low. Even if the criminal is caught, the evidence is not enough to prove the accused guilty in court. This emboldens the criminals to commit such crimes,” said a police officer, requesting anonymity.

In many cases, after the cyber fraud takes place, complaints don’t even get registered as an FIR. Only 0.8% of the 1,95,409 complaints filed from Maharashtra on the National Cybercrime Reporting Portal from January 2022 to May 2023 resulted in an FIR. According to RTI activist Jeetendra Ghadge, the Cybercrime portal makes it easy for citizens across the country to register complaints. But the lack of FIR registrations by states limits its effectiveness.

Impact on mental health

Cybercrime, which wipes out massive amounts of savings of senior citizens, leaves a major mental impact. In most cases, the money they lose is an emergency fund for medical treatments and survival after retirement.

According to Rajesh Phadke, 68, a cybercrime victim from Jogeshwari, said that most of the elderly begin to feel lonely and isolated as they grow older. It makes them trust strangers easily as they feel good to talk to someone, who is ready to listen to them and give them company. “Our children grow up and become busy with their lives. In case there is no one else to talk to and if you are digitally illiterate, then it becomes very easy to fall for cyber frauds,” he says.

Many times the senior citizen victims are not taken seriously by authorities. “In fact the police should understand that such crime can be much more overwhelming for older victims, because they cannot retrieve their losses by going back to work like younger adults,” adds Rajesh.

Spreading awareness

The cybercrime police have begun to take digital frauds more seriously even as NGOs such as HelpAge, have come forward for digital literacy among senior citizens.

The Dahisar police staff conducts cyber crime awareness programs for the citizens under their jurisdiction. “Every day at least 5-6 cases are registered at the Dahisar police station itself, so we can imagine the fast growth of these crimes,” Senior Police Inspector Pravin Patil, Dahisar police station, adding that action within “golden hour” is crucial. “It’s an appeal to the citizens that in case such an incident takes place, they should come to the police in the golden hour (within one hour of the crime) because we can contact the bank and stop the fraudulent transaction. But if you delay it, the fraudster can transfer the amount to other accounts, which makes the cash retrieval difficult,” he says .

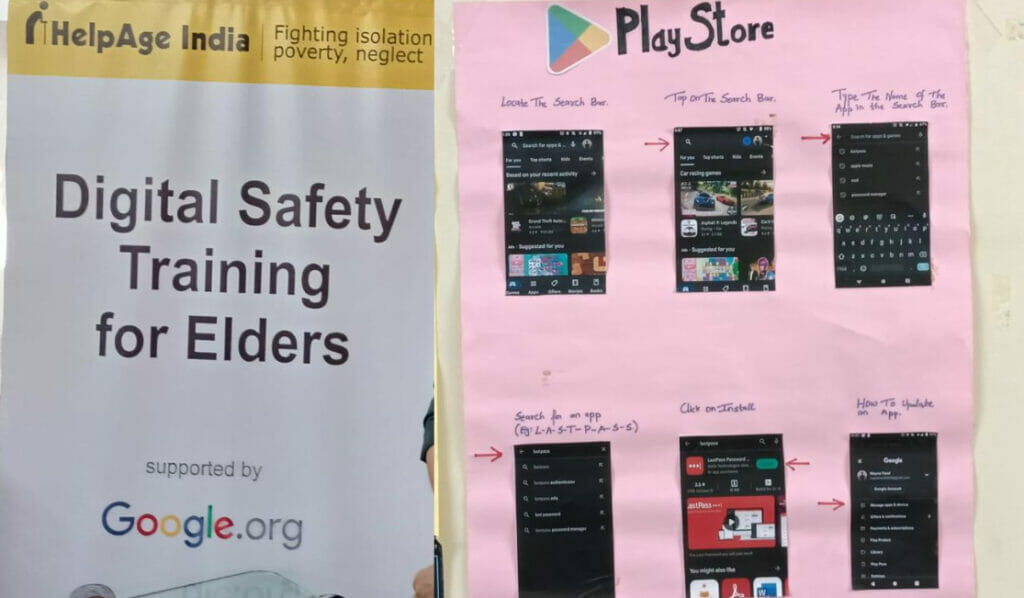

HelpAge India conducts digital safety training for senior citizens once a week at Andheri. During these sessions, they teach the attendees basics like – how to use a smartphone and then gradually familiarise them with preventive measures to avoid falling for cyber frauds.

“We have about 480 senior citizen members, who benefit from these training sessions. It also acts like a safe and interactive space for the elders to share their own experiences and grow,” says Prakash Nayak, one of the NGO members.

“The ever-growing online frauds make the elders worried about their savings. They hesitate to conduct online transactions and prefer going to the bank every time. The digital world is something truly new for many of them. Seniors especially above 70+ find it exceedingly difficult and most of them have said that their children have no time to teach them,” he says.

Read more: Cyber crime: A guide to understanding, prevention and redress

Do’s and Don’ts for Seniors

- Never click suspicious links or attachments received in email, text messages, or social media from an unknown person. Do not share your OTP with strangers.

- Cover your webcams: A web camera (default in laptops) if hacked/compromised can be leveraged as a medium to observe/watch and record day-to-day activities. It is recommended to cover the webcam when not in use.

- Be mindful of your appearance on video chat and video calls. Your video chats on social media sites can be recorded by the person on the other side.

- Beware of fake social media accounts and websites – Not all the accounts/websites are real and not all information provided on them is true.

- Install antivirus software on all your digital devices and keep them updated.

Helpline number: 1930

Register cyber crime at: cybercrime.gov.in

All time risk, all time alertness needed

Senior citizens are currently at an all-time high risk of cybercrime. This puts them in a compromised position, where they are at the risk of losing their life’s savings and undergo tremendous stress at an old age. This can be addressed by increasing data protection and making people more aware with constant digital training. The elderly should be provided with the skills and knowledge to take precautions while sharing their private information to avoid the traps set by cyber criminals.