During the recently concluded monsoon session of the Karnataka state assembly two audit reports by the CAG of India were tabled.

Report No 1 of 2020 – tabled on 22nd September – pertains to State Finances of Karnataka Government for the year 2018-19.

Report No 2 of 2020 – tabled on 23rd September – presents the Performance Audit on Implementation of the 74th Constitutional Amendment Act.

On September 23rd, CAG of India’s Audit Report on Union Government (Finance Accounts) for the year 2018-19 got tabled in parliament. This showed a savings of Rs 5000 crore or more by way of non-disbursal of grants, which included savings worth Rs 15,669.92 crores due to lower payments by way of ‘Grants for Local Bodies’.

When this was pointed out by the national auditor to the department responsible for these disbursements to state governments, it stated:

“(These savings) were attributed by the Department to non-fulfillment of prescribed terms and conditions for release of grants by some State Governments.”

Why are these grants important?

The 74th Constitutional Amendment has paved the way for decentralised planning and governance with devolution of several functions to local governments. However, these devolved functions can be carried out effectively by Panchayati Raj Institutions and Urban Local Governance Institutions only when they have sufficient funds.

How do these local institutions secure funds? That, according to the CAG of India’s performance audit report on Implementation of the 74th Constitutional Amendment Act in Karnataka, can happen if and only if “predictable fiscal transfers are ensured through a robust State Finance Commission mechanism and compliance with State and Central Finance Commission recommendations.”

Some may argue that the 74th Constitutional Amendment also provides for empowering ULBs to raise their own revenue, but as this performance audit has shown, about 63% of the revenue of ULBs in Karnataka during the period under review was from intergovernmental fiscal transfers.

In an article titled, ‘India’s cities drive economic growth but are short on resources, how can the gap be bridged’, Meera Mehta, Dinesh Mehta and Dhruv Bhavsar states:

When compared to the global experience, municipal corporations in India lag far behind in, both, the extent of inter-governmental transfers that they receive as well as in their own revenues. In India, the share of such transfers to municipal governments is estimated to be 0.45% of the GDP. In Brazil, Indonesia, the Philippines and Mexico, such transfers accounted for 5.1%, 5.4%, 2.5% and 1.6% of their GDPs respectively. In some European countries, it was as high as 6 to 10% of GDP.

The B S Patil Committee report has also pronounced a similar opinion stating, “Low degree of fiscal decentralisation renders civic institutions heavily dependent on the state government, and partially incapable of financial self-sufficiency and independent decision making.”

CAG of India’s Audit Report on Karnataka (State Finances) for the year ended 31st March 2019 underlines that “performance grants to PRIs (Rs 234.08 crores) and ULBs (295.20 crores) for 2018-19 were not released by the Union Government till the end of March 2019”.

Not only were PRIs and Urban Local Governance Institutions deprived of the performance grants, authorities in Karnataka government also failed to get these grants released from the Centre, as of November 2019, as their replies to the CAG auditors suggest:

| Rural and Panchayati Raj Department (Reply dated September 2019) | – Claim for 2018-19 Performance Grants pertaining to PRIs forwarded to GoI – Grant was not released |

Municipal Administration Department (Reply dated November 2019) | – State Government had submitted its claim for release of performance grants for 2018-19 online in the Central Government’s SMARTNET portal – Same had also been submitted through letter dated December 2018 – Ministry of Housing and Urban Affairs evaluated the state’s claim and recommended to the Ministry of Finance for release of allocated Performance Grants – Proposal is pending with the Ministry of Finance, GoI |

During the year 2018-19, Karnataka state government was supposed to get Rs 3,425.57 crores from GoI as per XIV Finance Commission recommendation. The table below – reproduced from the CAG of India’s Audit Report on Karnataka (State Finance) – has details.

| Transfers | Recommended Amount (Rs in Crore) | Actual Release by GoI (Rs in crore) | Shortfall(Rs in Crore) |

|---|---|---|---|

| Basic Grants to PRIs | 1,856.02 | 1,841.53 | 14.48 |

| Performance Grants to PRIs | 234.08 | 0 | 234.08 |

| Basic Grants to ULBs | 1,040.27 | 1,040.27 | 0 |

| Performance Grants to ULBs | 295.20 | 0 | 295.20 |

| Total | 3,425.57 | 2,881.81 | 543.76 |

Grants recommended by State Finance Commission

If you are wondering whether similar short releases were seen in terms of transfer of grants to ULBs by Government of Karnataka as per the recommendations of the State Finance Commission (SFC), here is what the performance audit revealed:

“As against Rs 44,691 crore to be released to ULBs as per SFC recommendation, only Rs 17,119 crore was released during the period 2014-15 to 2018-19.”

The audit further observed that a substantially high portion of the grants released (51 percent in 2015-16 and 81 percent in 2018-19) were in the form of tied grants for payment of salaries and power sector payments and the untied grants ranged between 19 and 49 percent.

State governments were required to set up SFCs within one year from the commencement of the 74th Constitutional Amendment Act, 1992 and thereafter at the expiry of every fifth year. Thus, as per these constitutional provisions, setting up of the fifth SFC became due in the year 2014-15 for all the states. However, a Study Report on State Finance Commission Reports by National Institute of Public Finance and Policy (NIPFP), which was published in October 2018 found that:

“… only thirteen states have constituted their 5th SFCs till date. Five states have constituted their 4th SFCs and there are several states that are still in their 3rd and 2nd SFCs. Jammu and Kashmir has not yet constituted its 2nd SFC. In other words, there is considerable divergence between the constitutional provision regarding setting up of SFCs by states and the working of SFCs on (the) ground.”

The NIPFP study also calculated the average time taken by the first three generations of SFCs to submit their reports, which turned out to be 27 months. However, when it comes to the average time taken by the fourth and fifth generation of SFCs, the study found it to be higher at about 33 months.

To see how different states performed in terms of time taken to submit SFC reports (as per the study by NIPFP researchers) click here.

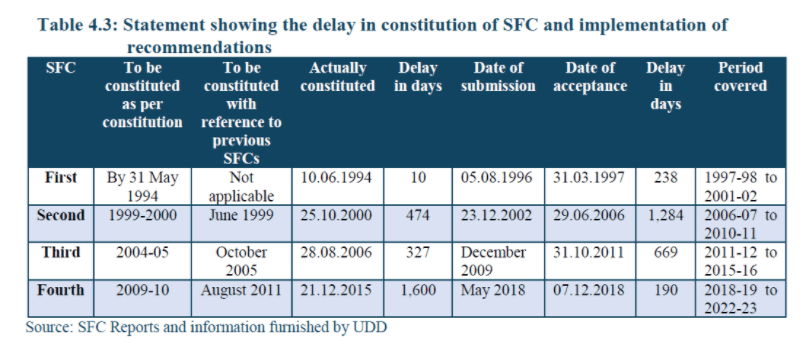

Karnataka also recorded considerable delays in the constitution of State Finance Commissions (ranging between 10 to 1600 days against the norm) as well as in the implementation of SFC recommendations (ranging between 190 to 1284 days).

The report also compared Karnataka on this aspect with other states and observed, “In comparison, while Bihar and Tamil Nadu have constituted 6th State Finance Corporation, Himachal Pradesh, Madhya Pradesh, Maharashtra, Punjab, Rajasthan and Uttar Pradesh have constituted 5th State Finance Commission and in Delhi and Kerala, SFCs have submitted the 5th Report”.

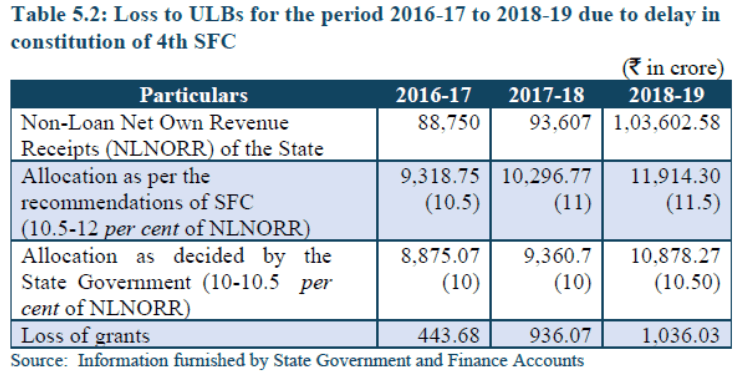

The loss to ULBs due to delayed constitution and submission of report of the 4th SFC alone for the period 2016-17 to 2018-19 is given in the table below:

Audit scrutiny had also revealed that the funds released to ULBs in 2017-18 was 20% less than what was mandated. In 2014-15, this shortfall was as high as 53%.

Performance Audit has also brought under scanner the way the State Government has been accounting the debt servicing obligations of parastatals on behalf of ULBs, despite an unambiguous recommendation given by 3rd and 4th State Finance Commission in this regard.

CAG auditors have found it strange that the state government went ahead with its practice of distributing the debt servicing obligations to all ULBs irrespective of whether they had availed any loan or not.

Auditors found that by indulging in such practice, the state government had deprived those ULBs that had not availed any loan of their complete share of SFC grant.

In its reply dated November 2019, the state government argued that

“There were no short releases to ULBs, as the releases to state-owned projects, state share against GoI releases, externally aided projects, parastatal agencies and Central Finance Commission grants were also to be considered as share of ULBs for computing the percentage of Non-Loan Net Own Revenue Receipts (NLNORR). Accordingly, the state government had released 11.64 percent, 14.15 percent, 15.12 percent and 12.86 percent (of the NLNORR) during the years 2014-15, 2015-16, 2016-17 and 2017-18 respectively.”

Having recorded this reply, the CAG of India auditors pronounced their judgment thus:

“The reply of the Government was not tenable as State Finance Commission grants was a package of devolution recommended as a share of NLNORR and doesn’t include amounts released for implementation of state/ central schemes and CFC grants. The 2nd, 3rd and 4th SFCs had also recommended that CFC grants should not be considered as devolution as it was not part of NLNORR.”

The Performance Audit revealed that ULBs were able to generate their own resources to the extent of only 56% of revenue expenditure and had utilized about 69% of the available funds on average.

The performance audit also identified a few expenditure constraints such as limited financial and administrative powers to ULBs, rigid guidelines for allocation and utilization of CFC grants by the state governments and large number of vacancies.