Trust deficit between developers and home buyers has been a pressing concern in most cities. Also, there have been several instances of failure to deliver on promises made to home buyers or excessive delays. This resulted in a demand for legislation to protect the interests of the buyer. Thus, to create a single sectoral regulator to regulate the real estate sector, the Real Estate (Regulation and Development) Act (RERA), 2016 was passed by the Indian parliament on 1 May 2016, notifying 56 sections of the Act. However, effective implementation of RERA began only in 2017, with the remaining 32 sections coming into force with effect on 1 May 2017.

Using available data on the Ministry of Housing and Urban Affairs (MoHUA) website, this article provides insights on the projects registered and complaints resolved, as well as points to some of the challenges associated with the current tracking system.

Snapshot of the RERA Act

Since the enactment of the legislation, various states have set up prescribed regulatory frameworks of the RERA Authority and the corresponding appellate tribunal, as stated in the RERA Act and also framed state-specific RERA rules. Out of the total 36 states and UTs, all except Nagaland have notified rules under RERA, 31 have set up RERAs and 28 have set up Real Estate Appellate Tribunals (REATs). Further, 27 RERAs have operationalised their individual websites under the provisions of the RERA Act.

Read more: How a bunch of Bangaloreans helped the Real Estate Bill get passed

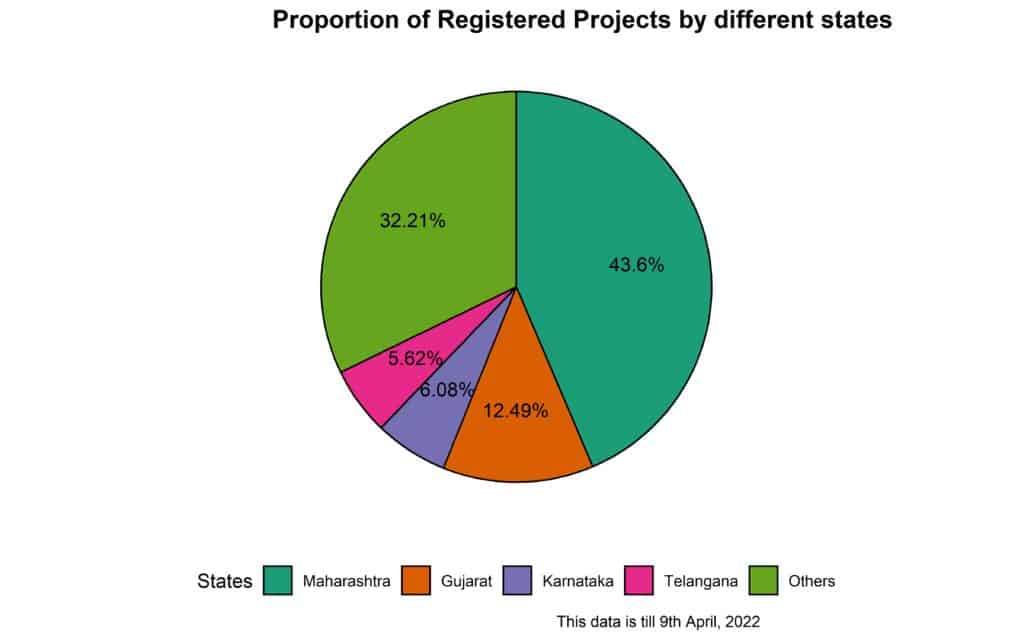

As per MoHUA, a total of 78,494 real estate projects have been registered and 88,864 complaints have been disposed of across the country till April 9, 2022.

Source: MoHUA RERA Tracker

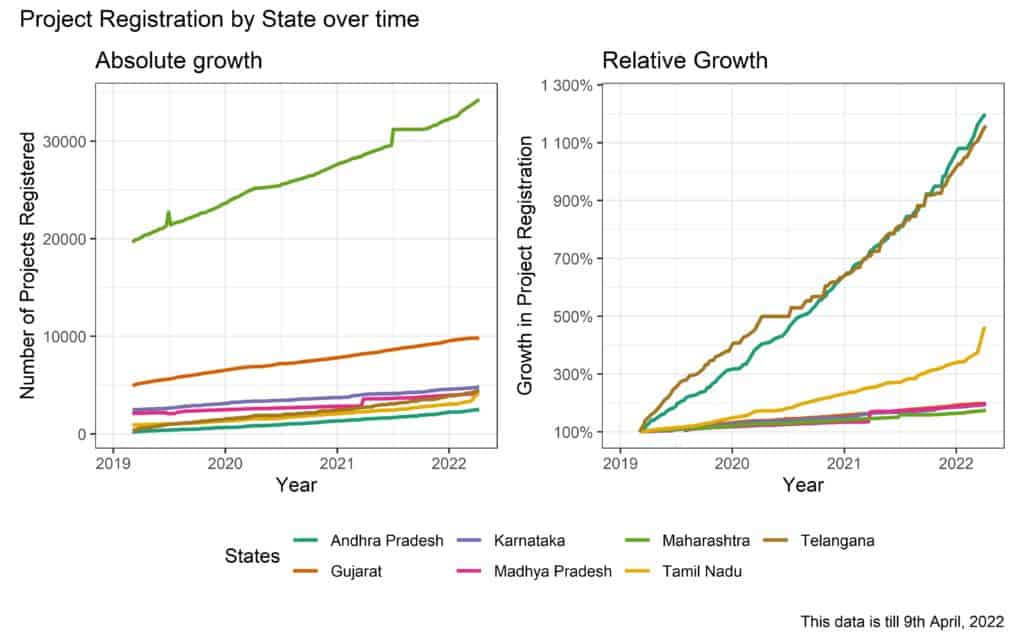

In Figure 2 above, the first plot captures the shift in the number of projects registered (i.e. projects registered at a given date). This shows the states that have had the highest volume of projects registered over time. The second plot on the right captures the growth rate compared to the initial number of projects registered (Growth = Projects registered at a given date/Projects registered initially), and this plot captures which states have the highest growth rate in projects registration over time.

Since its inception, the highest number of projects have been registered by Maharashtra RERA with 34,280 projects accounting for 43.6% of all projects registered in the country, followed by Gujarat with 9,822 projects (12.49%), and Karnataka with 4,783 projects (6.08%). However, the fastest growth is seen in Andhra Pradesh and Telangana with an approximately 1200% increase in project registration. A plausible reason for the high relative growth of projects registered in states such as Andhra Pradesh and Telangana can be that RERAs in the initial years did not perform well, and project registration was low.

While other States/UTs such as Puducherry, Jharkhand, etc. have also experienced a high rate of registration, for the purpose of this analysis we are only considering RERAs with more than 2000 registered projects to date.

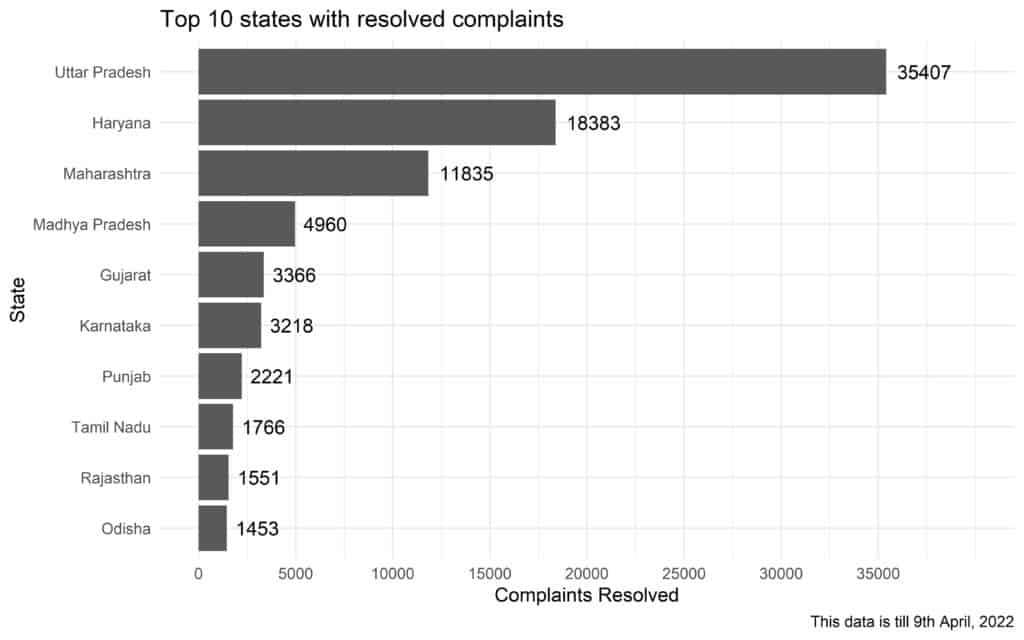

Figure 3 shows the number of complaints disposed of in five years. Uttar Pradesh (40%), Haryana (20%) and Maharashtra (13%) account for 73% of all complaints resolved in the country, which partially represents the two largest real estate markets in the country, Maharashtra and NCR of Delhi.

Read more: State of RERA implementation: Are home buyers really safe?

Analysis of registered projects

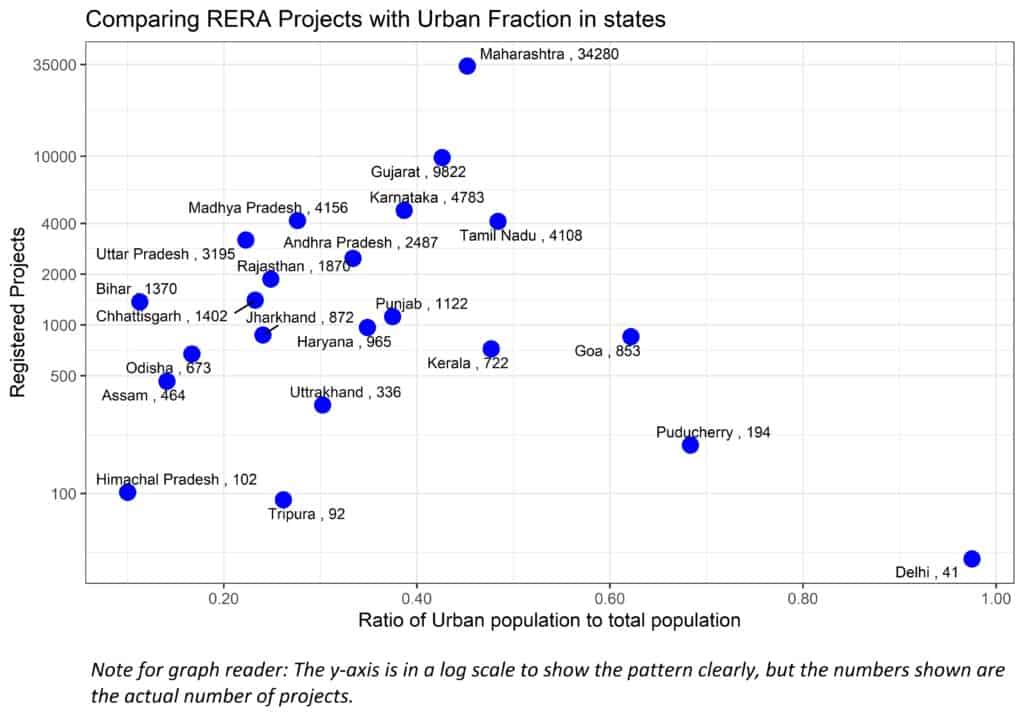

Since RERA provides information on growth in real estate projects, it is useful to also compare the real estate dynamics within Indian states. While real estate markets are heavily dependent on local market conditions, Urbanisation and Economic Performance are important factors for real estate demand at a macro level. We compare RERA data with Urban Fraction of States (Ratio of Urban to Total Population) and Gross State Domestic Product (GSDP) below:

RERA projects and urbanisation

Source: MoHUA RERA Tracker; Census of India, 2011

In the graph above, we see a positive relationship between the number of projects and the urban fraction barring a few exceptions. The States/UTs with high urbanisation show a higher number of projects.

For others with high urbanisation but low number of projects such as Delhi, Puducherry and Goa, this could be for a number of reasons: market dynamics like limited space for new developments or exemption of smaller plots from registration; size of states, where larger states show a high correlation mainly because of the high volume of area and population in these states.

For example, in the case of Delhi, a majority of new projects are coming up in surrounding cities of Noida (U.P.), Gurgaon (Haryana), etc. due to very high land prices in Delhi-NCT region. Developers in Delhi also avoid registration by subdividing large projects under different project names to be eligible for registration exemptions as per the act.

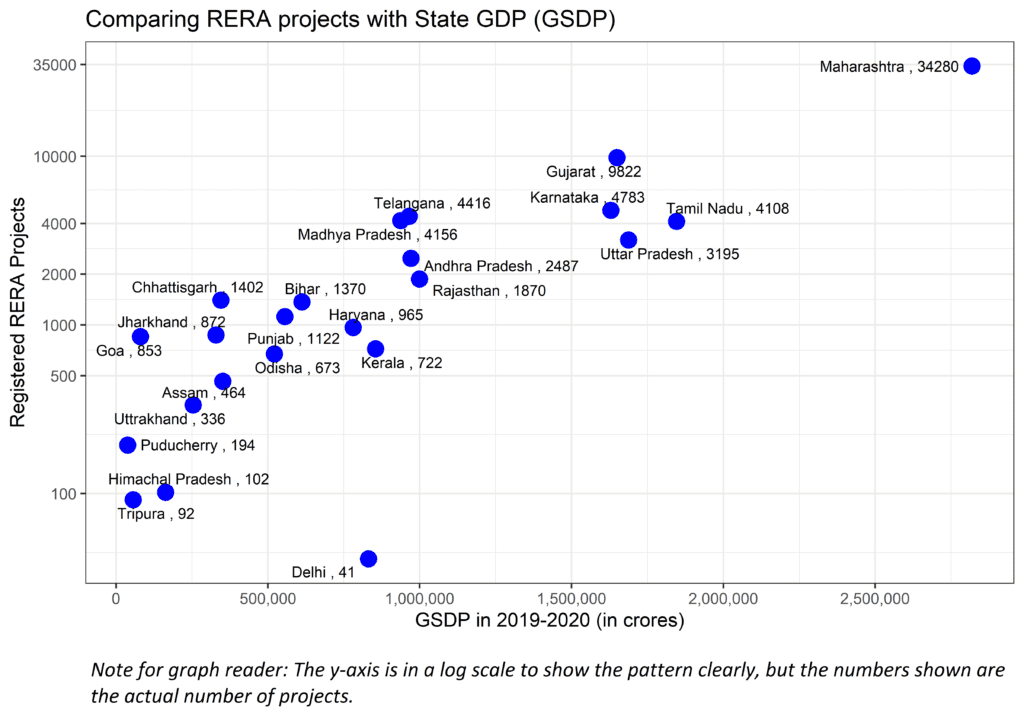

RERA Projects and Gross State Domestic Product

Source: MoHUA RERA Tracker; MOSPI (2020)

Similar to the previous graph, there is a positive relationship between the number of projects and the GSDP. Maharashtra has the highest GSDP as well as the number of projects, followed by Tamil Nadu, Gujarat and Karnataka.

Although Uttar Pradesh ranks third in terms of GSDP, the number of projects registered is comparatively low compared to states like Telangana and Madhya Pradesh, which have more projects for significantly lower GSDP. Cities like Noida and Lucknow (the primary demand locations within the state of UP) have only around 800 projects registered in each, compared to cities like Bhopal and Indore in Madhya Pradesh which have more than 1000 projects each.

However, the number of projects registered alone cannot necessarily be used to identify the precise trends in terms of consumer demand. Most projects registered in Noida and Greater Noida of Uttar Pradesh involve high-rise buildings, which provide substantially higher number of dwelling units as compared to the kind of projects registered in Madhya Pradesh. But this is useful to understand that Telangana and Madhya Pradesh have a higher number of projects as compared to other states with similar GSDP, which can be an indicator that real estate development is booming in these states. That, in turn, may reflect in their GSDP in the coming years.

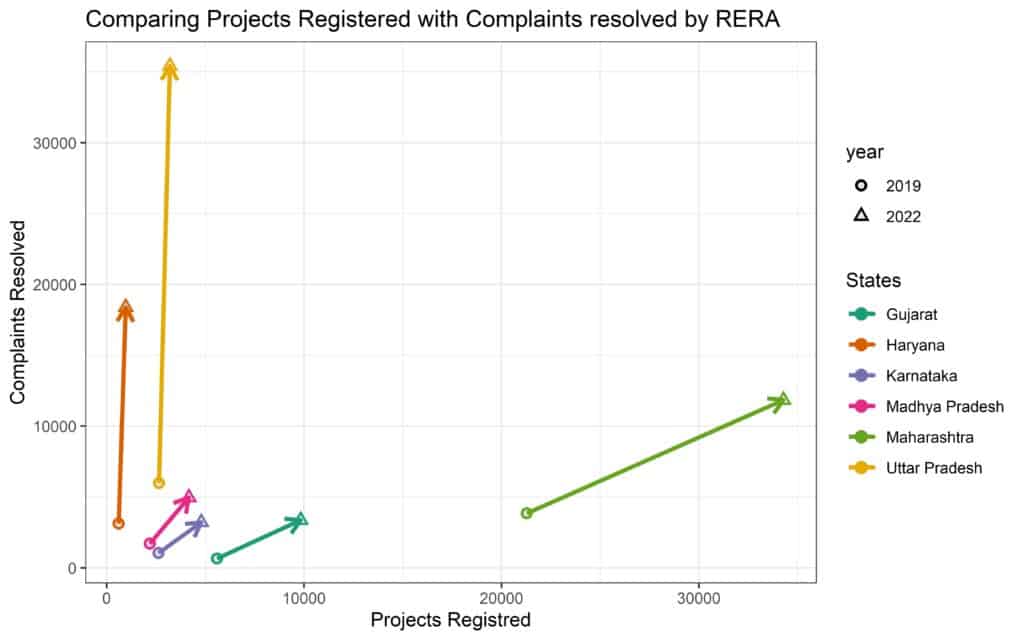

Project registration versus complaints resolved

As seen in the graph above, most states except Uttar Pradesh and Haryana have a balance between the growth of the number of projects registered and the number of complaints resolved.

While there are known cases of huge complaints in cities such as Noida (Uttar Pradesh) and Gurgaon (Haryana), and high real estate demand in Mumbai Metropolitan Region (MMR), this trend is not completely displayed in the RERA performances, because of certain data gaps. These include ratio of complaints received to resolved and the nature of resolution itself.

Existing data gaps and the way forward

RERA has a significant institutional role in making the real estate sector transparent and bringing information into the public domain. However, there are certain gaps in the RERA data available in MoHUA for it to be used to understand the true impact of the legislation on the real estate sector. Projects registered under RERA aren’t representative of the overall real estate sector, as many projects are exempted from registration. Another constraint is the lack of data on complaints received by RERA bodies, as MoHUA only releases processed data and not pending data.

Lastly, RERA seeks for the registration of projects located in planning areas, which is geographically closer to urban areas in most cities. However, it can also expand to rural areas. Therefore, it would also be useful to get an urban-rural split at the state level to better understand the varying real estate dynamics in different states.

Going forward, the information captured and released by RERA and MoHUA could offer the opportunity to make data about the sector accessible in the public domain, which was previously only done by private agencies which served the sector. How this data is used and interpreted, however, depends on how the institution addresses the gaps in data released in the public domain at present.

Also read:

- Home buyers demand stronger RERA for Karnataka

- Explained: What the Model Tenancy Act 2021 could mean for landlords and tenants

Maha reras redressal by complainant is riddled with outright favouritism to builders outrageous goondagiri especially by member mr.vijay satbir singh who does not follow his own judgements and higher forums. Lack of complete judicious mind .approach is abysmal and black spot on rera

For all deviations structures any loan funded by financial institutions should be taken to task and heavy exemplary penalties should be levied on such institutions to maintain Rera act norms in letter and spirit.