“A house is just an emotion,” says Rajesh Kumar. “Investing in mutual funds or stocks and getting your finances right should be the priority instead of being crushed under loans,” says the 34-year-old senior consultant working for an IT company in Goregaon. He has been against the idea of homeownership due to the surging EMI burden to realise the dream of buying a house in Mumbai, the most expensive city in India for real estate.

His concerns are not unfounded. Earlier this month, a report by real estate consultant company, Anarock, revealed that affordable home buyers in India have been hit hard by a sharp rise in their EMIs over the last two years. Floating interest rates for home loans up to Rs 30 lakh have surged from 6.7% in mid-2021 to a substantial 9.15% this month, says the report. This shift is sending ripples across the real estate industry, with serious implications for prospective homeowners.

Reality of real estate

According to the report, the surge in EMI has resulted in the share of affordable housing in overall sales in H1 2023 shrinking to around 20%, an 11% decrease against the corresponding period in 2022.

Prashant Thakur, regional director and head of research, Anarock group, says, “Home loan borrowers who were paying an EMI of approximately Rs 22,700 in July 2021 are paying around Rs 27,300 today, an increase of Rs 4,600 per month. This 20% increase in the EMI has resulted in a jump of almost Rs 11 lakh in the overall interest component, from around Rs 24.5 lakh interest payable in 2021 to Rs 35.5 lakh today.”

When home loan interest rates hover at around 9.15%, for the buyer who has taken a loan of 30 lakhs for 20 years, the total repayment to the bank at this rate is now about Rs 65.5 lakh, of which the interest component will be approx. Rs 35.5 lakh – more than the total principal amount, Prashant explained.

According to Knight Frank’s report, another real estate consulting firm, affordable housing sales have gone down. The share of homes under Rs 50 lakh has been slowly decreasing since 2018. In the first half of 2018, these homes made up 76% of sales, but by the first half of 2022, it had dropped to 62%, and it further dropped to 54% this year.

Renting as a viable choice

Many young professionals choose to step away from the conventional route of homeownership and prefer to rent, to avoid the long term financial burden of home loans.

When a person buys a house, they spend most of their younger years paying huge amounts of loans and working non-stop for it. Moreover, there are other factors such as monthly maintenance too, says Rajesh. “Additionally, home renovations, including painting and decor, occur multiple times over a 20-year span. After 20 years, when finally the house is yours, it’s already a 20+ years old building structure with a lower resale value,” he points out.

Even if the real estate prices rise over a period of time, many young Mumbaikars wonder if they will be able to reap proportionate benefits after putting in so much struggle for most of their working life.

On the contrary, when you live on rent, you don’t have to pay for maintenance, and if the house feels small, old, or any other need arises, I can simply move to a better place, he says. “However, this scenario holds true only if a comparable sum to the EMI amount is consistently invested in funds, encompassing the rent.” He further explained, “This money will grow and offer accessible funds instead of being tied down by real estate liabilities.”

This paradigm shift underscores the evolving inclination of some individuals towards financial flexibility and personal freedom.

Read more: How luxury housing is changing Mumbai’s housing landscape

Dream of homeownership

While some lean towards financial flexibility, many people still associate owning a home with security.

“I think having a place of your own which you can call ‘home’ is very important. I would feel proud to buy a house with my own hard-earned money,” says Pradeep Choudhary, an associate manager working for a firm in Andheri. He plans to buy a one-crore house in Powai with the help of a home loan and other savings. “I am planning to work in Mumbai for a few years and then shift abroad to earn more money to pay off the loan faster,” he said.

Purchasing a house brings with it a distinct set of advantages. There are no landlord-related hassles or uncertainties in tenant agreements. The property becomes entirely yours, affording you the freedom to make decisions and modifications at your discretion, he says. “Furthermore, a significant aspect is an emotional security that comes with homeownership, as your home becomes a special place filled with personal meaning,” added Pradeep.

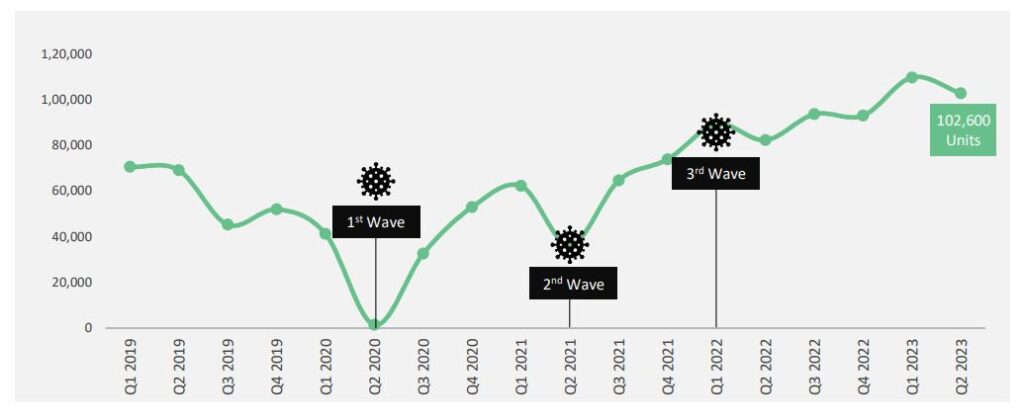

The year 2021 proved to be a favourable year for homebuyers, driven by the aftermath of the second wave of the Covid-19 pandemic, say reports. Lockdowns led to a surge in demand, with many seeking larger homes due to work-from-home arrangements.

Low home loan rates, government incentives, and stable prices further enticed buyers to invest.

But these good times didn’t last long for the homebuyers and real estate developers. Since 2023, things have changed. The special concessions from governments have ended. Home loan interest rates are going up, and developers are raising home prices because it costs more to build, say reports.

Cultural pressure to ‘own’

“Homeownership is engraved in Indian culture,” says Sheetal Dubey, a homemaker from Malad. Owning a house is often seen as a symbol of financial success and stability. “When it comes to marriage proposals, some parents may reject potential matches, if the man doesn’t own a house, even if he has a stable career and no debt, while living on rent,” she says. A large number of people connect owning a house to providing security to family.

This is a classic indicator of societal pressure to tick the check boxes that symbolise security and success. Not surprisingly, many working professionals, despite all hurdles, prioritise homeownership. The demand for affordable housing remains high, with many buyers relying on bank loans.

However, the rising EMI interest rates may show long-term effects on affordable homeownership. “It is not a good sign for either individual borrowers or the broader housing market, if the interest on home loans exceeds the principal amount. This should be addressed in the next Union Budget or even earlier via a focused policy intervention, so that the affordable housing segment is not derailed further,” says the Anarock study.

Urban planners and working professionals, who belong to the middle income category, unequivocally point to the need to construct a higher number of affordable units of houses over luxury houses and provision of public facilities such as parks and grounds for recreation. Given the current market trends, in a city, where every inch costs a premium, nudging the industry towards making this shift, will not be easy.