This article is supported by SVP Cities of India Fellowship |

Sameer runs an independent self service store in JP Nagar 4th phase, Bengaluru, which sells a wide range of products catering to people’s grocery demands. He has four Point of Sale (POS) machines, offers free delivery within a 5 km radius; and has no minimum purchase quantity requirement. There are usually around 25 company salesmen who visit him regularly to check the stock and take orders.

Manjunath runs SLV stores, a general store or kirana, in JP Nagar 3rd phase, Bengaluru. He primarily sells Fast Moving Consumer Goods (FMCG). He gets his stocks replenished from the distributor every week.

There is a well-oiled distribution system in big metros. However in smaller towns and rural areas, it is not as efficient. For example, Krishnamurthy who runs a small store in Kakinada rural district of Andhra Pradesh finds companies don’t regularly visit his store, and therefore he is forced to visit the local wholesale dealer. This is a challenge as he looks to grow the business and increase the range of products he offers to his customers.

So how does your favorite biscuit brand reach your friendly neighborhood angadi, kirana or the larger chain stores such as Reliance Fresh, More, Big Bazaar etc? How do so many of these products in different shapes and sizes get to these thousands of stores ?

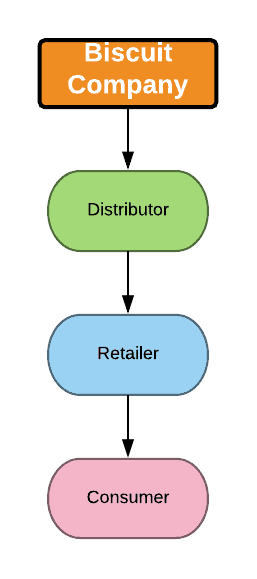

The answer is through the system known as distribution. Here is the simplest form of distribution:

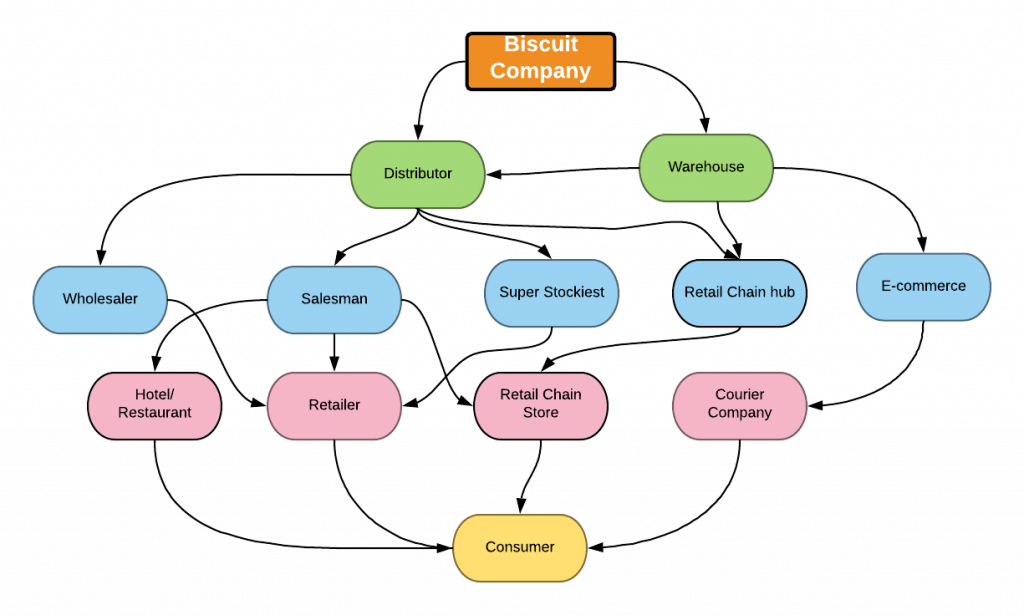

The distribution gets complex as companies try to reach out to different types of retailers located in different parts of the country. India is known to be one of the most complex markets in the world. Here we find various types of retail stores; each one thriving in their own space.

Channels of Distribution

The complexity of the distribution is managed by segregating the various types of retailers into channels.

For example, a channel termed as Traditional Trade refers to our neighborhood kirana store where we buy groceries for the week or the month, the small angadi (convenience store) in the corner where we buy items for immediate consumption, hotels, cafeterias, independent self service stores, restaurants, pharmacies, paint and hardware stores etc.

Modern Trade channel refers to the branded retail chain stores (More, Big Bazaar, Reliance Fresh etc), where one walks through the store, picks up products of their choice and checks out at the billing counter. And more recently the latest addition, Online or e-commerce channel which has been gaining immense popularity especially among affluent urban dwellers.

While Modern Trade channels and E-commerce channels have come up in the recent past and seem to be booming, it caters to just 10 percent of the demographic and it hasn’t largely affected the traditional channels such as the kirana store. The kirana store and traditional channels in general are not just surviving but are thriving. The reason being that service provided by the kirana stores is unparalleled! They provide home deliveries without a minimum requirement; they allow you to clear your accounts later in the month. And usually there is that special inexplicable connection that one has with the kirana store owner that isn’t present when one shops online or through retail stores.

In addition, many households don’t have refrigerators to store grocery items; and therefore need to shop every few days, and the kirana stores are the model that cater to the needs of the large majority who have a purchase cap of anywhere between Rs 50 and Rs 500 per visit.

Bengaluru is estimated to have about 28,000 kirana stores and convenience stores.

Setting up a kirana store doesn’t involve a lot of capital, especially if the store is part of one’s house; which is usually the case. There is the initial investment for the first set of stocks. Depending on the size of the store the store would at any point have on average stock worth 2 to 3 lakhs; out of which 1 lakh would be the proprietors investment, and the rest would be credit from the distributor.

Pic: Thanmaya B P

In running the store, there is a need for the proprietor to be hands on; and usually the entrepreneur takes the help of the family.

The intricate distribution system

Companies package and sell products differently, depending on which channel the product is sold through. In the kirana shop, you will find products with larger packaging, biscuit packets which are priced at Rs 25 or more, shampoos in bottle containers. However, in the small angadis, we find shampoo sachets priced at Rs.2, biscuit packets at Rs.5.

Companies decide which products or brands to sell in which channel. A popular cosmetic company sells its premium wrinkle-remover face cream only in a Modern Trade store. Fresh milk is almost sold only in Traditional Trade stores. In the Modern Trade stores one would find the tetra-pack milk.

Modern Trade stores generally do not stock a desi-brand, masala cola drink as they prefer to have hipper, popular brands on their rack, than a dull looking cola with an Indian name. When you look at beverages, all the beverages packaging found in a modern trade store are 500ml, 1L or the larger fridge sized 2L. These are for consumption off-the-premise. In a traditional trade store, you are likely to find the smaller bottles of soft-drinks, tetra-packs of drinks and more recently the cans. These are often purchased singly and possibly consumed at the store itself.

In a Traditional Trade store you are more likely to find home-made products like pickles, fry-ups, chutney podis etc. The kirana store owner either makes it himself or sources these from the neighbourhood homes.

Each distributor usually provides to a specific geographic area. Companies make the determination based on the population density. In a metropolitan city such as Bengaluru, companies will typically have distributors than can cover and provide to 5000 stores; visiting and replenishing stock twice in a month. Companies prefer having fewer distributors, if they have a large team and are able to handle larger territories.

Super Stockists and Wholesalers cater to the retailers not serviced by a company’s distributor. The difference though is, a Super Stockist is in the company’s radar and the company ensures proper supplies to the Super Stockist. The Super Stockist works mostly in the rural areas. A wholesaler is in the Urban/ sub-urban areas. Wholesaler has no brand loyalty and will sell anything with a good margin.

On a given day, If you find the product that you were looking for or if you didn’t, it means that the cogs of the distribution had worked or hadn’t.

| This article is supported by SVP Cities of India Fellowship. This article is a part of The Food on Your Plate series, that explores food options, availability and food safety in Bengaluru. |