In July 2021, the State Minister for Human Resources and Finances, PTR Palanivel Thiaga Rajan presented a white paper that indicates that Chennaiites may soon see an upward revision of water charges. The document draws attention to the mounting losses incurred by Chennai Metropolitan Water Supply & Sewerage Board (CMWSSB) which stood at Rs 2581.77 crores as on March 31, 2021, and identifies “the gross under-recovery of the operational costs” as one of the main contributing factors.

It also points to the irrationality of the flat rates at which water is charged in Chennai; to quote from the white paper:

“The bulk of the receipts of CMWSSB are from Water and Sewerage Tax and flat charges for domestic connections. This is an inherently unfair and regressive system which favours those who live in large houses and bungalows and pay a flat fee without a meter, as opposed to the middle class who live in apartments and pay on the basis of bulk water metering, let alone the poor who use much less water per-capita independent of metering.“

The white paper argues for a revision in property tax on the grounds that it would greatly help Urban Local Bodies and make them more self-reliant. At the press meet where the white paper was released, the minister also stressed on the need to revise taxes. Since a portion of the overall tax on property accrues to the CMWSSB, this has been construed by many as a precursor to an overall revision of water charges, both in tariff and taxes.

The prospect of an increase in water taxes, however, has not gone down well with residents, especially in certain pockets of the city, where they feel that a blanket hike in charges would be unfair and unjustified. To understand why, let us first look at how water is billed and taxed in Chennai.

Read more: Why more Chennai homes should opt for water meters

How are water charges calculated?

The Chennai Metropolitan Water Supply And Sewerage Act, 1978, calls for the installation of water meters. The Act notes that water meters would enable the Board to determine the amount payable by the owner for the consumption of water on the basis of actual consumption, as noted from readings recorded by the meter installed in the premises. However, water meter installation has been successful only in the commercial circuit.

Every household (individual houses, bungalows and apartments with less than 50 units) that gets its water supply through pipelines from the Metrowater agency pays a flat monthly sum of Rs 80 as water charges, irrespective of the quantity of water they use.

For apartments that have above 50 units, the Metrowater agency charges an amount based on bulk water metering installed in the premises. The charges, subject to a minimum of Rs 80 per month, are as follows:

| Quantity consumed in total | Rate per kilolitre (in Rs) |

| Upto 10 kilolitre | Rs 4.00 |

| 11 to 15KL | Rs 16.00 |

| 16 to 25 KL | Rs 24.00 |

| Above 25 KL | Rs 40.00 |

However, many areas in the city do not receive piped water supply and residents have to fall back on CMWSSB tankers** (apart from other sources such as borewell, private tankers etc) that supply water at the following rates:

| Capacity of lorry | Payment Tariff for domestic purposes (in ₹) | Rate per kilolitre (in ₹) |

| 6 KL | 475 | 79.17 |

| 9 KL | 700 | 77.77 |

| 16 KL | 1200 | 75 |

The white paper terms the existing Metrowater scheme as unfair and regressive, because it charges at a flat rate for domestic connections, thereby favouring those who live in large houses and have huge water consumption, and yet pay the same tariff as people belonging to the lower or mid-economic strata, who use much less water per-capita.

Sewer collection tariff for domestic households is billed at Rs 40 per month. Residents in areas who are not connected to the sewerage network can book sewer lorries to clear their septic tanks through CMWSSB at a cost of Rs 650 per 6000 litres.

Revision of tariff

The white paper notes that the water tariff for domestic and partly commercial consumers was last revised during May 2018 with an annual increase of 5%. Further, tariffs for commercial and institutional consumers were revised in October 2017 with an annual increase of 10%. However, the annual tariff revision was not implemented in May 2019 for domestic and partly commercial consumers, due to the prevailing drought situation then while the annual tariff revision was again suspended in 2020 due to the COVID-19 pandemic situation.

How is water tax calculated in Chennai?

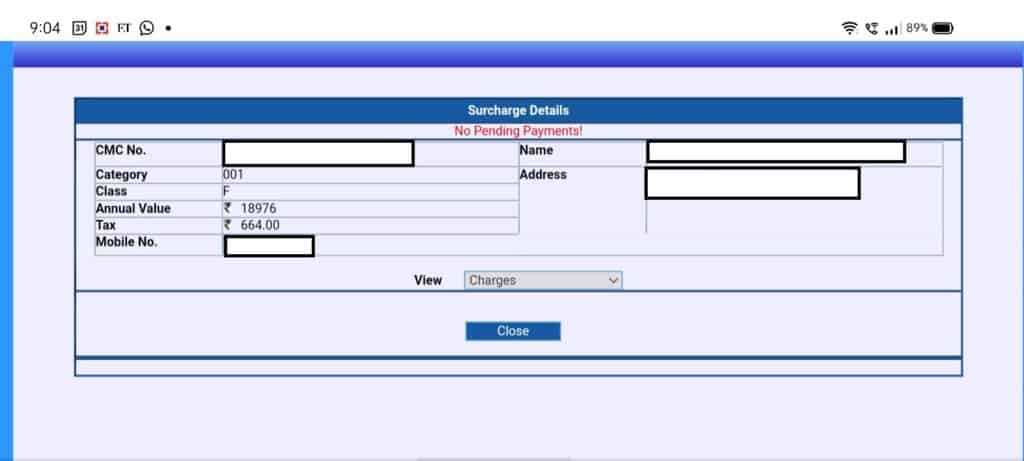

Property owners in Chennai are mandated to pay 30% of the ascertained value of a property as tax to the Greater Chennai Corporation and water utility. Of the 30%, 23 per cent is collected as property tax by the civic body and 7% is collected by CMWSSB. This is paid in two half-yearly instalments.

Thus the half-yearly tax rate of a property is calculated at Annual Rental Value (ARV) of the property (that falls under Corporation of Chennai) * 3.5%.

The Greater Chennai Corporation adopts a reasonable letting value (RLV) to arrive at the ARV. The monthly RLV is calculated with the following formula: Monthly rental value = Plinth area X Basic rate per sq ft.

The plinth area is calculated by adding the carpet area of the building, area of the balcony and areas of the walls. The basic rate is calculated by the civic body and depends on the location of the property. For residential properties (that includes both independent houses and apartments), it ranges between Rs 0.60 per sq ft and Rs 2.40 per sq ft.

Read more: Why does actor Rajinikanth pay less tax than Nagarajan of Nanganallur?

Water tax revisions

In 2018, the civic body had hiked the property tax rate for residents living in the newly added areas (Tiruvottiyur, Manali, Madhavaram; Ambattur, Valasaravakkam, Alandur, Perungudi and Sholinganallur). Subsequently, a year later, the Metrowater agency increased the water and sewerage taxes with retrospective effect from the date when the revised property tax was implemented (April 2018). While property tax revision was withheld following protests from residents and a subsequent state government order, Metrowater continued to collect tax at the hiked rates, in a move that irked residents in these areas. In 2020, CMWSSB rolled back the rates.

However, given the mounting losses incurred by CMWSSB, a senior official stated that they have requested policy-level changes to enable them to revise the water and sewerage tax, in order to make their operations financially sustainable. The white paper also points out that the operational cost of Metrowater is higher than that of Tamil Nadu Water Supply & Drainage (TWAD) Board which is linked to the higher cost incurred on the purchase of water produced from seawater desalination plants and the higher distribution cost.

Read more: Increasing property tax can be a gamechanger for city: DC, Revenue & Finance

Why are residents unhappy?

Citing the Chennai City Municipal Corporation Act, 1919, a senior CMWSSB official said that property tax along with water and sewerage tax is mandatorily levied on all buildings and lands within the city. However, the same act also mentions exemptions made under this Act or any other law. Section 34 (3) of the Chennai Metropolitan Water Supply and Sewerage Act, 1978 states that the Board may exempt any locality of water and sewerage tax in whole or partially, if that locality does not benefit from the water supply or sewerage system. The law also states that the Board can remit a portion of such taxes, if the property has remained vacant.

While the laws provide such specific exemptions, in practice, residents are never exempted from paying taxes, even if they do not enjoy the benefits. Many localities that fall under the limits of the Corporation do not get water from CMWSSB, yet they pay water tax. Some of the areas are Thoraipakkam, Karapakkam, Sholinganallur, Ullagaram, Puzhuthivakkam, Pallikaranai, Kottivakkam, Perungudi and Mugalivakkam.

Harsha Koda, co-founder of Federation of OMR Residents Associations (FOMRRA), also points to the irrationality of water charges in general: “People on OMR shell out Rs 80/KL every time they buy water from tankers, while residents living in the core city pay a flat fee of Rs 80 per month, independent of the quantity of water they consume. Yet, we continue to pay the same taxes.”

Several areas rely entirely on water tankers for their everyday consumption as they do not have piped water supply. This is one of the main sources of revenue for the Metrowater Board. “I do not see people in the extended areas ever getting piped water supply, as the tankers are clearly a source of much higher income for the Board,” adds Harsha.

** Errata: The rates for the CMWSSB tankers initially quoted were the ones applicable to semi-commercial use. These have since been replaced by rates for domestic consumption. The error is regretted.