As per a recent report, it was estimated that in 2021-22, only 3% of the population of India pays up to 10 lakh in taxes, alluding that the rest are dependent on this. This begs the following questions:

- Are you employed?

- Do you have a regular source of income?

- Do you pay income tax?

- Do you purchase provisions, clothing, household goods, eyewear, footwear, fashion accessories, vehicles, furniture, or services such as haircuts, or pay rent and EMIs?

If you do any of the above, do you notice the GST charges on your purchases, along with other taxes like tolls, fuel cess, duties, and excise?

How much is a person’s actual contribution towards tax?

Consider a typical family of four. From tea leaves and coffee powder, toothpaste and brush, shaving blade, shampoo, hair oil, detergents, cleaning liquids, branded grains and atta, pulses, towels, bedsheets, mattresses, domestic LPG, edible oil, spices, butter, ghee, mobile phones, computers, printers, furniture, cars and bikes, fridge, TV, air conditioner, every purchase incurs GST ranging 5% to 28%. Even lifesaving drugs incur a 5% GST along with health insurance premium at a whopping 18%! Your electricity bills have a 9% fuel surcharge added in.

Taxation structure

I have performed actual calculations based on the average consumption and expenditure of a typical family, applying a weighted average, depending on the amount spent on each item. Hence, I can safely take 18% as the average tax paid on each and every payment that one makes in a month.

Many people have done an exercise after reading the report and confirmed that almost 65% to 67% of the money that they earn is taken away by the Government in various tax, cess, duties etc.

In India, citizens contribute taxes under various categories. These include:

- Income Tax (IT): Paid by all salaried employees

- Goods and Services Tax (GST): Paid on goods and services consumed

- Non-GST expenses: Items notified under Schedule III of the CGST Act

One of the high non-GST expenses at home, after school and college fee and healthcare expenses, include the petrol and diesel used in your vehicles.

If you own a vehicle, this is what you pay:

- In Karnataka, the base price for petrol is Rs 57.07 per litre, with an additional 0.20 paise added as freight charges, making the dealer’s cost to the oil company. The state imposes a uniform statewide tax of 25.9%, amounting to Rs 21.17.

- Furthermore, excise duty and road cess charged by the Union government add up to Rs 19.90 per litre.

- Additionally, the commission paid to petrol pump dealers is Rs 3.84 per litre.

- Therefore, when purchasing petrol at the cost of Rs 101.94 per litre in Bengaluru, the taxes and duties component amount to Rs 44.67.

If a family uses around 50 litres of petrol in a month, in addition to the GST paid for other purchases, they additionally pay Rs 2,233 every month for vehicle fuel alone.

Then, of course, there is the property tax that you pay every year. Stamp duty charges on important transactions; service charges on all your loans are taxed at 18%. (BBMP has proposed a shift from Zone based calculation to guidance value, which is likely to increase property tax by 50%).

Read more: Editorial: Inflation statistics don’t lie, they are merely economical with the truth

Additionally, individuals also pay a health and education cess at 4% on their income tax. Apart from this, there is the GST compensation cess, national calamity contingent duty on tobacco and tobacco products, building and other construction welfare cess, road and infrastructure cess, cess on crude oil, cess on exports, etc. that goes to the Centre, and not shared with the states. These taxes are levied on the tax liability, including surcharges.

Read more: Bengaluru, here is where all the taxes you pay end up

The hidden tax

- Travel: When individuals use expressways or highways, they pay toll tax. For economy class air tickets, one has to pay 5% GST. For business class and international travel, it is 12%. When travelling by train, the GST on first class and AC compartments is 5%. When one takes a ride on Ola or Uber in India, GST is charged at 5%.

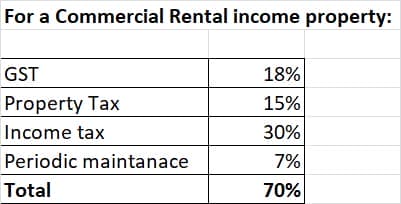

- Property: Rents on building properties for commercial purposes is 18%.

- Convenience: For services availed from food delivery platforms, such as Swiggy and Zomato, 5% GST is charged.

- Essentials: The cost of medicines includes an additional 18% on top of GST.

If I share the duty collected on alcohol and tobacco can depress the user to terrible levels. Let me skip that.

The 3 percent(ers) tax!

Income tax: depending on your income slab, the income tax varies.

- Up to Rs 3,00,000 – NIL

- Rs 300,000 to Rs 6,00,000 – 5% on income which exceeds Rs 3,00,000

- Rs 6,00,000 to Rs 900,000 – Rs 15,000 + 10% on income more than

- Rs 6,00,000/ Rs 9,00,000 to Rs 12,00,000 – Rs 45,000 + 15% on income more than Rs 9,00,000

- Rs 12,00,000 to Rs 15,00,000 – Rs 90,000 + 20% on income more than Rs 12,00,000

- Above Rs 15,00,000 – Rs 150,000 + 30% on income more than Rs 15,00,000]

If you are a businessperson, it is quite possible to allocate most of your personal expenditures as company expenses and offset all the GST amounts paid against your own liabilities. Depending on how crooked their chartered accountant is, the business will ensure that the accounting books are written in a manner that minimises the amount of income tax owed.

But then, if you are a salaried middle-class family, sorry my friend, bad luck. You have to pay all taxes with absolutely zero provision to pass it on anywhere else. Every single rupee that you pay as tax, cess, duty, surcharge, etc. goes to the government. Cheer up, you are very precious to the government.

Do this exercise at home

For the next three months, retain every single invoice for the goods and services that you consume. Total up the taxes, surcharges, cess, excise and customs duty, etc. that you pay, add the proportion of income tax and cess/surcharges for the three months in consideration, add the taxes and cess on fuel, restaurant, pubs, in everything that you pay.

| Item Category | Inv No. & Date | Invoice Amount | CGST Amount | SGST Amount | Surcharges | Excise Duty | Cess |

| TOTAL | |||||||

| Percentage | InvAmt | As a %age of InvAmt | As a %age of InvAmt | As a %age of InvAmt | As a %age of InvAmt | As a %age of InvAmt |

Now, calculate the percentage amount that you shelve out to the government out of your total income in the same period. You might surprise yourself with the results.

Do the same exercise in the same period every year. That will give you a good idea of how price rises, or inflation, are impacting you. And if your income has not correspondingly increased during the year, then you will know how much poorer you have become at the end of the year.

Having done that, take a look into the government programmes, projects and expenditure. It is your money that they are using. Also, the money saved in your banks is often used to provide loans to industries and the business community, in accordance with government policies. The fate of the money invested in equity, bonds, mutual funds, too, depends on the government’s economic and fiscal policies.

The value of the rupee is also influenced by the balance of exports and imports. India’s trade relationships with other countries play a significant role in this regard. Furthermore, domestic policies affecting the income growth of individuals in the lower economic strata can impact government revenue growth and the reduction of subsidies.

[This article was first published in The Wire and has been republished with permission, with some edits. The original article can be read here]

Talking of Income Tax, Bangaloreans would be interested to know that their RS MP’s burden is only Rs 580/- – check @ https://m.thewire.in/article/politics/rajeev-chandrasekhar-election-affidavit-congress?s=08