BBMP, Bengaluru’s city government has never met its property tax targets in all these years. It wants to change that in 2021 – by revising the calculation, increasing the tax net, and verifying property data.

In its yearly budget, Bruhat Bengaluru Mahanagara Palike (BBMP) fixed 2,800 crores as its property tax target for 2021-2022. This is lesser than the target of 3,500 cr. of last year, perhaps because BBMP was only able to meet 57% of that target (around 2000 cr.).

The budget also proposed changing the tax calculation basis from the Unit Area Value System to Capital Value System. This means that properties will not be taxed based on the per-unit price of the built-up area of the property but instead the total capital value of their property based on the published guidance value. Once this system is approved, another 6 months will go into generating awareness about the new system among Bengalureans.

Read More: What BBMP’s budget holds for the ordinary Bengalurean

While BBMP Revenue Department wanted to raise the tax rates, this proposal was not approved. The Karnataka Municipal Corporation Act mandates periodic raise, but the current rates have not been revised from 2016-17. In 2016, there was a tariff hike in parallel with a zonal reclassification, which also resulted in an increase in the tax amounts. In certain cases, the net increase was more than 100% leading to huge opposition from citizens. BBMP then rolled back the increase due to zonal classification.

Property tax contributes around 25% of BBMP’s revenues and forms the single biggest chunk. The Report of the Fourth State Finance Commission, Karnataka from May, 2018 clearly states that an 80-85% improvement in BBMP’s collection efficiency would lead to revenues increasing by at least 4-5 times. The number of properties in the tax net of BBMP was less than 50% of the number on the ground, as per the report.

BBMP Chief Commissioner Gaurav Gupta recently instructed officials to expand the tax base and bring untaxed assets into the tax net. Former BBMP Commissioner N Manjunatha Prasad had announced during the budget presentation that BBMP has already issued notices to over 78,000 under-assessed properties and this was done with the help of GIS Tools.

BBMP has been trying to increase property tax collections: There have been SMS Reminders to pay property tax, verifications and tracking of defaulters, and internal dashboards to track targets.

BBMP has also been sending demands with penalties and interest for short claims, when owners are suspected of short calculating the property tax payable amount. D R Prakash, a citizen activist and expert on property tax, says, “BBMP has (now) started sending notices of wrong submission of returns since 2016 demanding the differential of tax with a penalty of 100% and a whopping interest of 24% per annum”.

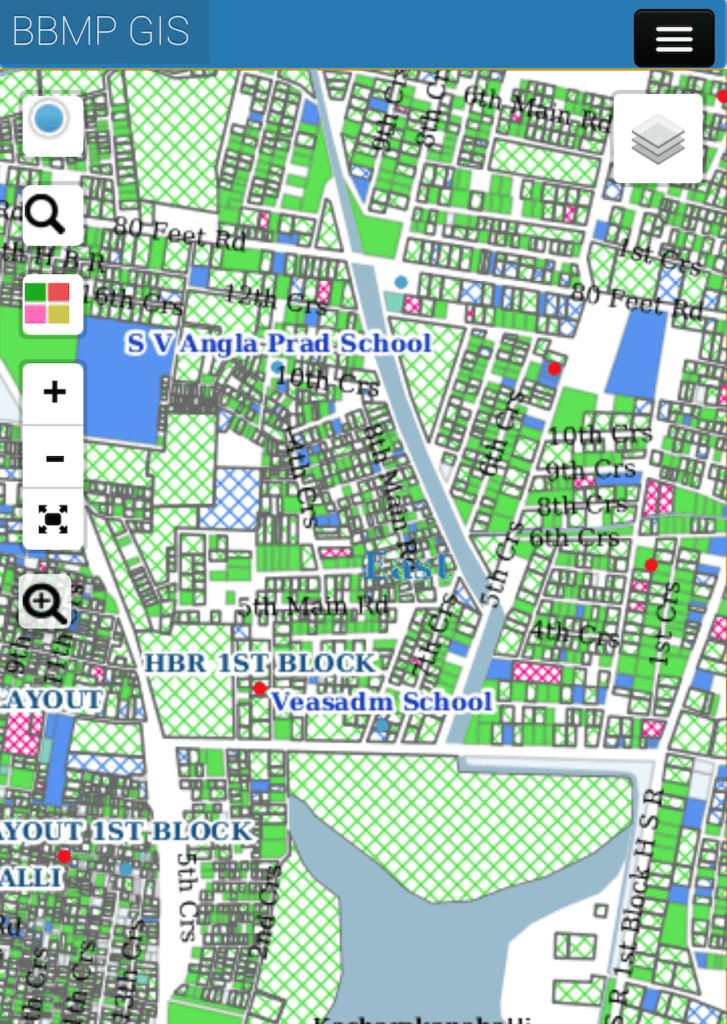

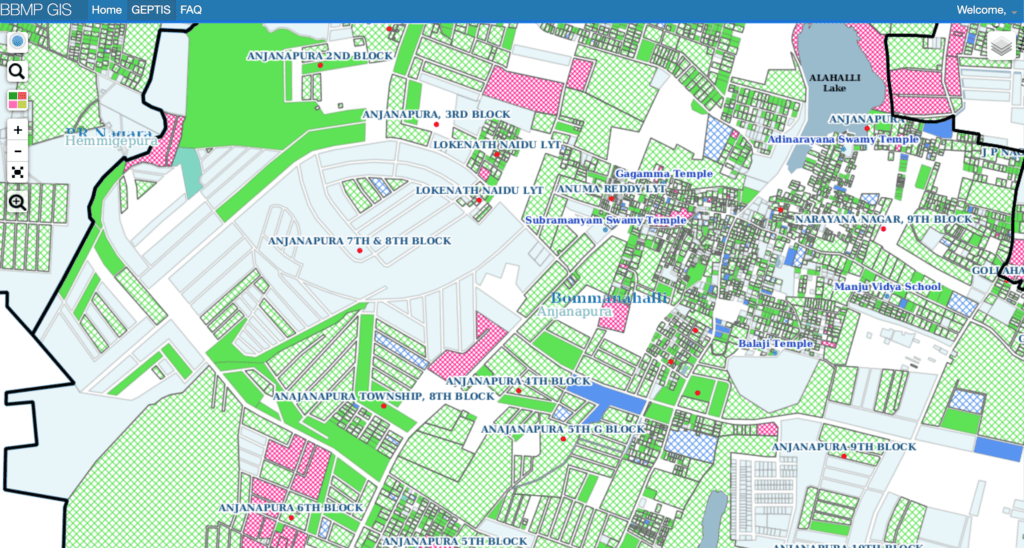

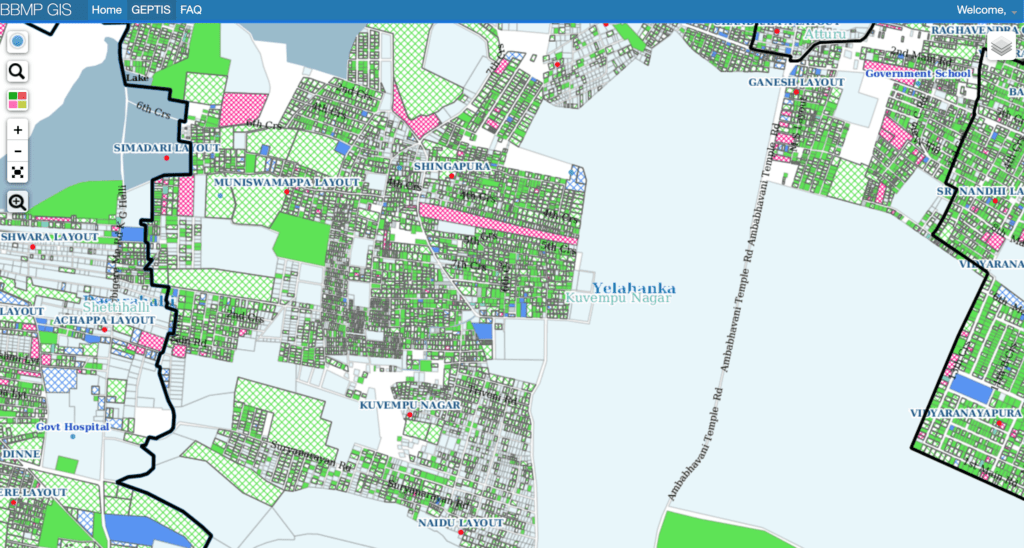

BBMP has started using GIS Enabled Property Tax Information System (GEPTIS) to track each property’s tax status.

How can GEPTIS help?

GEPTIS, developed with the support of ISRO, aims to provide a comprehensive mapping of all properties within BBMP jurisdiction. Over the last few years, BBMP has digitised data of more than 20 lakh properties. It has a colour-coded map with the granular data of each and every property in Bangalore with information about its land use and property tax status. Each property has been marked with a Property Identifier (PID) and the citizens will be able to log in with their mobile number (registered with BBMP) to assess their property tax status.

You can go on to the Beta version of GEPTIS and zoom in to your area to see how your property has been labelled.

If you are certain that you have paid your property tax but GEPTIS has not identified it as paid, do not worry. GEPTIS data updates and validation are still in progress. A senior officer from the revenue department of BBMP explains, “Polygons drawn on GIS map indicating properties that have Unique PID numbers and wards are mapped with property tax base application number. These are yet to be validated, as some properties are mapped with wrong property tax base application number and some are yet to be mapped.”

For that, an on-ground comprehensive survey is required to further update and document this information. This survey procedure is being formulated by BBMP right now. But, just looking at the beta version tells us of the potential of the application in smoothening property tax collection process.

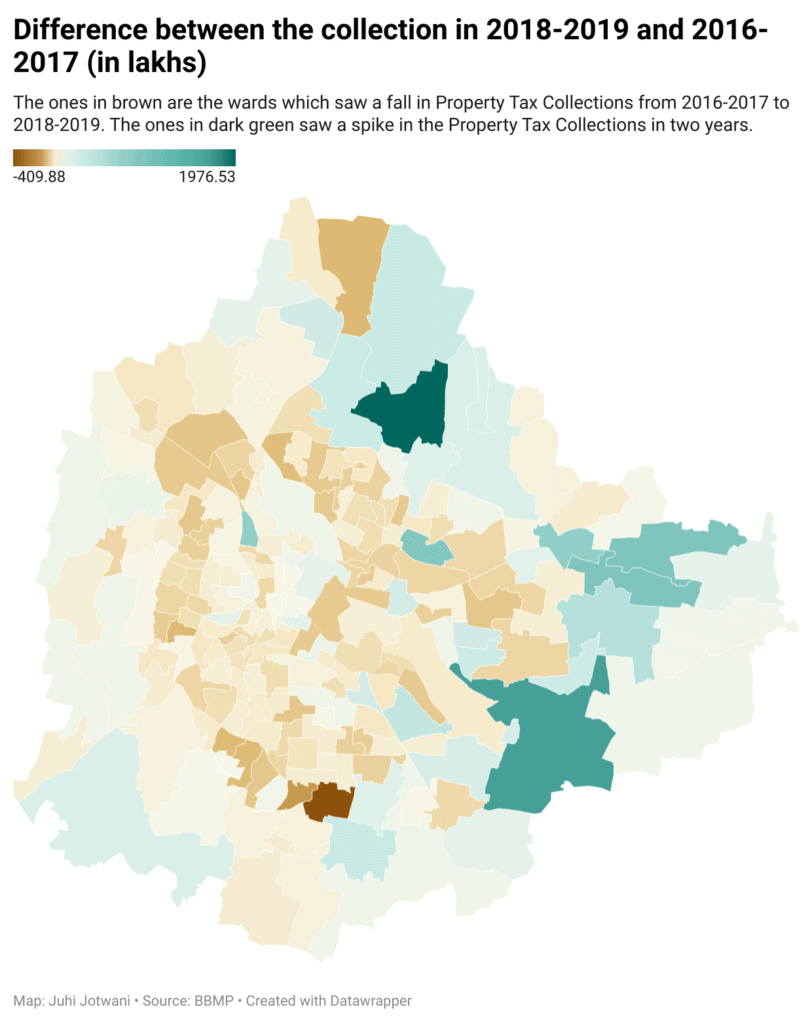

Comparing 2018-2019 Property Tax Collection with 2016-2017

The property tax collections should go up every year, considering their linkage with BBMP’s finances. But, this is not the case with many wards where property tax collections have been going down.

This map can be used to see if your ward’s property tax collections have gone down or up from 2016-2017 to 2018-2019.

The ones with negative values are the wards where collections have gone down. This is the case for more than 50 wards in Bangalore which are mostly located in central Bangalore. Puttenahalli in Bommanahalli zone has seen a fall of almost 410 lakhs in this period. Thanisandra in the Yelahanka zone, on the other hand, has seen a rise of around 2,000 lakhs in the same period in its property tax collections. Same goes for Bellandur, Garudacharpalya, and Hoodi in Mahadevapura Zone which have seen huge spikes in their collections.

The 2019-20 data is not yet available for analysis.

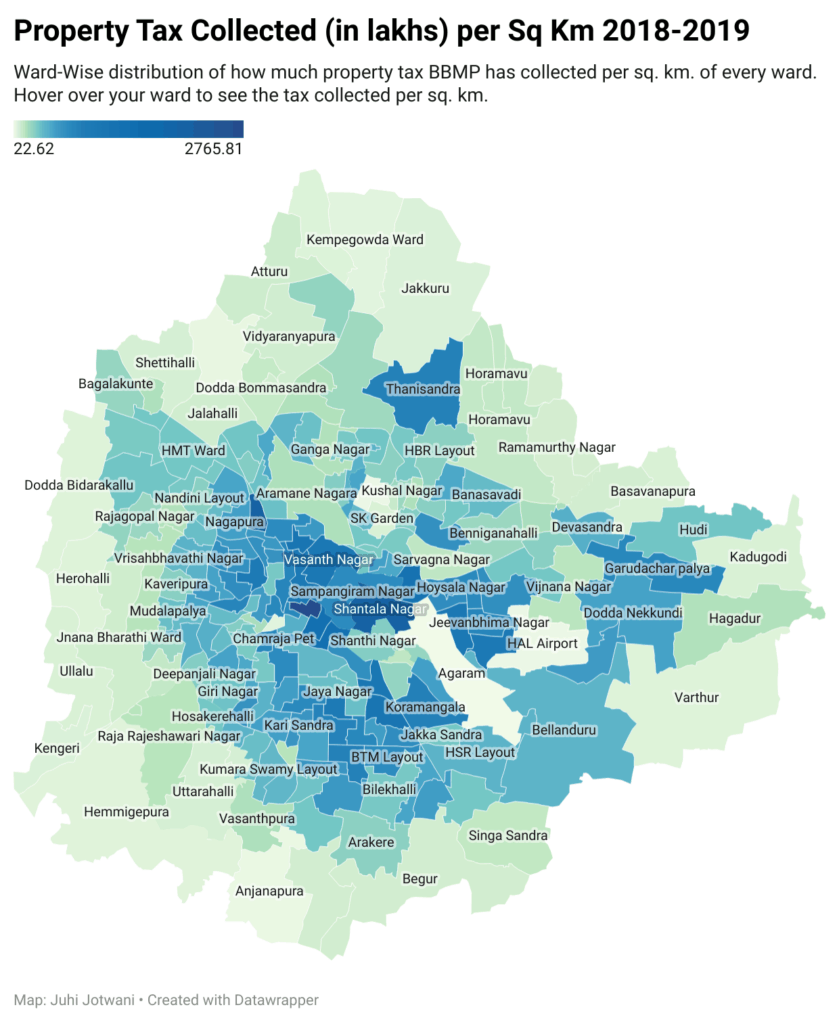

Ward-wise analysis of Property Tax collected per square kilometre

Data is available on the number of applications and property tax collections from every ward in Bengaluru (till FY 2018-19). But, absolute numbers cannot give an accurate picture because wards in Bengaluru are not homogenous in terms of their sizes at all. We have many wards as small as one square kilometre in size in the East and West Zones and wards stretching to 25 square kilometres, in Mahadevapura and Yelahanka zones.

Read more: Bellandur singlehandedly contributes 103 Cr to BBMP’s 1926 Cr property tax collection

In the map below, the wards are colour-coded according to the amount of tax that is collected per sq km from them. This clearly shows that the central wards are able to collect more tax from each sq km of their ward as compared to the peripheral wards. The peripheral wards may be generating more absolute tax revenue, but they leave a lot to be desired when it comes to tax coverage.

Note: Agaram ward in East Zone and HAL Airport Ward in Mahadevapura are exceptions due to the non revenue generating green spaces or airport ground present in the ward.

In the case of Anjanapura, Kempegowda, Kuvempu Nagar, and Chalavadipalya, the reason for lower tax generated per sq. km is that a lot of the properties in these wards are not yet under the tax net. Up till now, it has been the taxpayer’s responsibility to approach the BBMP to pay the tax (if they are paying it for the first time).

The Revenue Department of BBMP claims that a lot of these properties have not become a part of the tax jurisdiction itself because the taxpayers have not shown up or they have undervalued their properties by wrongly classifying usage, zone, or category. It is these massive peripheral wards that hold the most potential for increasing the property tax revenue.

But, why are so many properties not under the tax net yet? Officers from Revenue Department explain, “Most of the properties in newly added areas are vacant plots whose owners are difficult to find”.

Dr. Sudeshna Mitra, faculty at Indian Institute for Human Settlements (IIHS) and a scholar on political economy of land and real estate, says “It is the state of property records and their state of updation, not only in Bangalore, but all cities in India, that is a crucial barrier to improving property tax collections. Bangalore is better than many other cities, in terms of its urban property records, but there is still a significant gap, and records are fragmented across multiple government institutions, including the Stamps and Registration department, the revenue department, the property tax register, etc.”

Read More: BBMP is dead; Long live BBMP

What does BBMP plan to do about it this year?

An important project in the BBMP’s pipeline is the Comprehensive Survey, the procedure of which is being formulated right now. A comprehensive survey modality is being drawn, where all the properties will be surveyed street-wise for the following scenarios:

- Mapping the correct base application numbers for wrongly mapped properties.

- Mapping correct base application numbers for unmapped properties.

- Identifying the actual TNA (Tax Not Applicable) properties i.e., Worship places, BBMP properties, Parks, Grounds and etc.

- Verifying the property tax returns filed for tax evasion or undervalued taxes.

- And also capturing as many as attributes as necessary, including photos

This validation will concretize the GEPTIS and once that is done, GEPTIS will officially be available for public view, and citizens can give their feedback after logging into the portal. This is in line with one of the recommendations of Karnataka’s Fourth State Finance Commission which suggests that the reality of the actual built-up area should be ascertained on the ground.

Dr. Sudeshna points out, “Property record updations are severely affected by the significant load of pending land and property dispute cases in court, as well as the financial incentives associated with hiding, misrepresenting and misreporting details of property ownership.”

Senior officers from BBMP’s Revenue Department also say that they are planning to prepare a module for those whose properties are not in the tax net. Once the module is in place, Bengalureans could add their own properties to the tax net if they are not already registered.

Dr. Sudeshna suggests, “Property tax collections would gain significantly if non-residential properties were better represented in the property tax register because these are productive properties where much of the city’s GDP is being generated. It would be useful to link valuations to income generated from these properties, rather than proxies such as location and building materials.” BBMP Act, 2020 allows BBMP to not only auction the movable property but also seize the property owner’s bank account as well as immovable property in case of non-payment of property tax after 2 months of sending a notice.

For Bengalureans, BBMP’s Special Commissioner (Revenue) Basavaraju’s message is, “My humble request to all the citizens to pay their taxes properly and if they have wrongly declared zonal classification, usage, occupancy or category, I would request them to correct those by opting for Form V and make changes this year to avoid unnecessary penalties and interest.”

Considering the financial condition of urban local bodies, it is important the government adopt innovative mechanisms to improve property tax revenues. The coming year’s collection will tell us how these new attempts have fared.

Note: Pay your property tax on or before April 30, 2021 to be eligible for a 5% rebate.

Also Read:

BBMP should make it attractive by giving civic amenities to the pvt layouts, so that Taxes are paid well in time, we are diligently paying taxes from 19yrs but still no UGD / Kaveri water, we feel where do our taxes go?

Excellent work,a simple methodology is to woo tax payers simply by ensuring streamlined services such as garbage pickup,road sweeping, streetlights lit and surely taking surveys. Currently we pay in thousands only to be screamed by a bbmp garbage collectors for having complained on seva portal about roads not being swept. The workers threatened harshly and warned not to complaint online no matter No services rendered. How do you expect citizens to proactively handover haftas to them in the form of property taxes. Gory and sad.

Can BBMP do something to clean up all the BDA stray sites. It’s an eyesore and most people use them to throw their garbage. Such stray sites are infested with rats and even snakes. The owners are no where to be seen and they are not bothered.

Before raising taxes please think about cleanliness also.

Property rents are going down amid covid situation and property tax is increased. hope to retain the market value of the property. Better to sell the property if the latter decreases.

We request BBMP to note the demand against the property giving particulars of site constructed area, purpose of use etc while The property owner opens The website for online payment. Besides that each ward should notify by public notice the tax to be paid by each property in the ward.

We have a property in Chamarajapet (Zone-C), which was bifurcated in 2019-20. After bifurcation, the share in my name continued to have the same PID number and the other two could alter their details using Form-V. While paying annual tax for 2020-21, I could see my old application form number and my name but didn’t check the amount. I paid my tax for the entire property and this was repeated for 2021-22 also. This excess amount paid can in any way be reimbursed and rectified ?

Instead of unleashing their tax terrorism on homebuyers, BBMP should penalise and collect the property tax also from the builders for violation and deviation of building plan sanctioned by BBMP.

BBMP doesn’t describe how they are going to develop each area like bad odur, good roads, sewage, solve resident problems with builders, as you see the article all that they are interested in is tax collection budget only

Honest tax payers only pay property tax correctly.When sanction is accorded for two three or more floors, a good number of owners add one more floor and the illegally constructed floor is out of the tax net. Tax is paid for the sanctioned plan and illegal constructions are left out. The tax for the illegal portion cannot be paid unless it is regularised. This is happening with the knowledge of the area engineers. Secondly when a house is sold and the new owner demolishes and re-constructs a new house with a higher area, a good number of people do not reveal the fact and keep on paying the old tax. Further, under the self assessment system, a number of owners do not reveal the fact that a portion of full property is rented out, but pay the tax as owner occupied. The sad fact is that only honest tax payers are burdened with revised taxes or higher taxes periodically and the remaining non-tax payers are enjoying tax holidays. If the BBMP take corrective action by strictly verifying the tax details with the area constructed physically with the help of voluntary and honest citizens, the financial problems of BBMP can be solved easily.

It’s totally unfair to force the citizens to pay the penalty and interest charges for not paying the extra tax from 2016. BBMP was sleeping from 4 years and it can’t notify citizens to pay the penalty and interest charges now for the last 4 years. It’s their fault for not giving us a notification in the portal from 2017 and asking for penalty charges now. Penalty and interest charges must be waived off!

No basic amenities like

KAVERY water or other source. We are buying 4-5 tankers per month in Ward 198.

No proper roads connecting KANAKAPURA ROAD from layouts.

No drainage silt removal regularly.

Though we gave paid ‘000 of Rs.to BWSSB on demand srarted during 2019, and also sanitary connection charges, no kavery water is supplied. I think the money we deposited might be looted by departments for selfish thirst.