There has been confusion over the past few years on BBMP’s issue of khatas, especially for properties awaiting ‘regularisation’ under Akrama/Sakrama. This guide presents the latest information on getting your khata.

Republication of this guide without express permission from Citizen Matters is prohibited. See here for requesting permissions.

If you own a property in Bengaluru – vacant site, indepedent house or an apartment – and are looking to apply for a khata, here’s what you need to do register for one.

To begin with, one needs to know what a khata is and why you need to register for it. A khata is not a proof of one’s ownership to a particular property. It is merely a recording of one’s property, assessing the property for payment of property tax.

A khata is required in case you apply for a building license, trade license or a home loan. Anyone who owns a property is eligible to register for a khata.

If your property is within BBMP limits, you can apply for khata registration at your local BBMP office. The officers of the revenue department are in-charge of this process. There are at least two BBMP revenue offices in every assembly constituency.

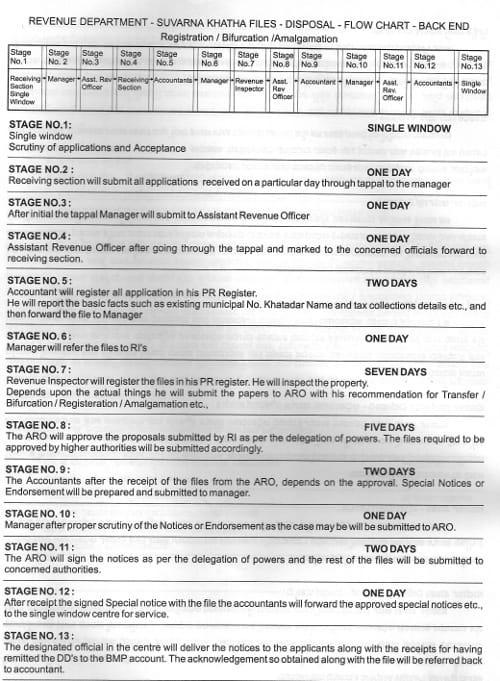

(Click image to enlarge) The BBMP has a Single Window system for accepting khata application forms. Even as this system exists, the procedure is known to be long-drawn and involves payment of ‘extra’s money to get the job done faster.

The following are the documents required to be submitted for khata registration, along with the khata registration form. This form can be downloaded here or purchased from a BBMP office at a cost of Rs 10.

How to get your Khata – documents needed

For BDA/Karnataka Housing Board (KHB) Layouts

• Notarised copy of sale deed

• Copy of property tax-paid receipts

• Sketch of BBMP-approved plan

• Possession certificate

For Revenue layouts and high-rise buildings (apartment complexes and commercial complexes)

• Notarised copy of sale deed

• Copy of property-tax paid receipts

• Proof of betterment charges paid

• Copy of BBMP-approved plan

• Encumberance certificate

In the case of apartment complexes, a copy of the khata of the entire property and the approved plan can be obtained from the builder.

An encumberance certificate can be obtained from the sub registrar’s office. The certificate shows that in a given period of time from when the property was bought/sold has there been any transaction or mortgaging. Buyers/sellers ask for this certificate for when a new transfer (sale) is taking place, so that the buyer knows all the transactions have happened. The sub-registrar’s office is directly under the control of the Inspector of Registration of Properties, operated by the state government.

Submit the above relevant documents along with the khata registration form at the BBMP office whose jurisdiction your property falls under.

No ‘extra’ money needed for khatas

The BBMP has instituted a Single Window system where scrutiny and acceptance of applications is done at a ‘single window’. At this stage you will not be required to pay any money apart from the administration fee. The administration fee is two per cent on the stamp paper value. Most people confuse this to be two per cent of the property value mentioned in the sale deed, which is not the case. This fee can be paid through demand draft (DD) or cheque.

In case any BBMP official demands money apart from the khata registration fee and cost of application form, you can lodge a complaint with the concerned Revenue Officer. Do not involve middle men for khata registration. If the RP does not act on your complaint, you will have to approach the zonal deputy commissioner.

What happens after submitting khata form

After receiving your application, an accountant will enter your property details into an online register. The file will then be forwarded to a Manager who will then refer it to a Revenue Inspector (RI) or Assessor.

This official will then inspect your property. He will then submit a report to the Assistant Revenue Officer (ARO) with his recommendations. For properties below 4000 sq ft, the ARO will approve/reject the proposals submitted. For properties above 4000 sq ft, papers will be sent to the zonal Joint Commissioner or Additional Commissioner.

Depending on approval or rejection, the accountant will prepare a notice or an endorsement and submit it to the manager. An endorsement will be sent in case any documents are required from the applicant. If the khata is registered, a notice will be sent to the applicant, mentioning the property tax amount to be paid.

The manager will scrutinise this and send it to the ARO for his signature. The designated official at the centre will then deliver the notices to the applicant.

This means your property has been officially registered under BBMP records.

Deadlines – in how many days should I get my khata in as per norms?

In the case of BDA and KHB properties, the khata can be registered in seven working days.

In the case of revenue layouts, it takes upto 15 working days. (See separate section for revenue layouts)

Citizen Matters spoke to several residents (June 2010) across Bengaluru who narrated their experience while applying for a khata. Almost all of them say that it takes at least a few months to get a khata.

Moreover, citizens are also asked for ‘extra’ money to get the job done faster. Many residents have paid anywhere between Rs 3000 to Rs 10,000.

Vinaya Kumar Thimmappa, a resident of Basavanagudi says, “I wanted to get khata for my house. After filling the form and submitting it (3 months) nothing happened. My father then went around the office and was told that the person who was supposed to visit my house for inspection was transferred. Then new person asked for Rs 3000 and everything will be done in one week. (Thimmappa paid the official) This person came to my house, collected all documents and got it done in one week.”

K K Eranna, Revenue Officer, C V Ramannagar assembly constituency (he is in charge of eight wards and two AROs), says that obtaining a khata is very simple and easy. But over the years, the process itself has become long-drawn because of the involvement of middlemen and junior-level staff. Even as this single-window system exists, very often junior-level staff, builders or middlemen demand more money to get the work done ‘faster’.

Citizen Matters has also spoken to residents who have taken the ‘clean’ route and obtained khatas without paying any bribe to BBMP officials. Even though it has taken much longer, the effort has proven to be fruitful.

After registering your property, there are two different khata-related documents you can obtain from the BBMP.

1. Khata certificate – This is a document which states the name of the property owner, the area in which the property is located and the property number. To obtain this certificate, the property owner or the khatedar (in whose name a khata has been registered) will have to submit a written request to the concerned BBMP office. On payment of Rs 25, you will receive this immediately. This certificate can only be obtained by the property owner and no one else.

2. Khata extract – This document will state the name of the property owner, details of the property like plot size, built-up area and so on. This is a public document and can be obtained by anyone and not just the property owner. On payment of Rs 100 and a requisition letter to the BBMP office, one can immediately receive this document.

Revenue layouts and BBMP’s so-called B-register

Any land that has not been authorised for residential or commercial use by the state government is referred to as ‘revenue’ land. In these cases private builders buy land from individuals and develop them. The BDA, KHB or gram panchayats will not have officially authorised these properties for residential or commercial purposes. The proposed Akrama Sakrama scheme is aimed at regularising such properties. Land that is converted by the Deputy Commissioner is not revenue land.

According to Section 108(a) of the Karnataka Municipal Corporations (KMC) Act, the BBMP can collect property tax

“from every building, vacant land or both including a building constructed in violation of the provisions of building byelaw or in an unauthorised layout or in a revenue land or from a building occupied without issuance of occupancy or completion certificate except the building constructed illegally in Government land, land belonging to any local body, any statutory body or an organization owned or controlled by the Government.”

The property tax collected from such a building should be maintained in a separate register.

The BBMP registers such property under what is called a B register. However, a property owner will not be able to obtain a khata certificate if his/her property is on revenue land. A khata extract can be obtained at a cost of Rs 100.

BBMP Revenue Officer K K Eranna says that owners of these properties can obtain a khata certificate only after they are regularised through the Akrama Sakrama scheme.

Khata transfer

In case a property owner wants to sell his property or an individual has recently bought a property, he will be required to transfer the khata (in case of an already existing khata) to the current owner’s name. A khata transfer may also be done in case of death of the khatedar. This process is almost like applying for a fresh khata.

The application form for this is the same as the one used for registration. You will only be required to mark the relevant box to indicate whether you want register, transfer or bifurcate a khata.

The documents required for khata transfer include:

• Notarised copy of sale deed

• Property tax paid receipt

• Death certificate (in case transfer is happening due to death of the original property owner)

• Affidavit declaring that applicant is legal heir of the deceased khatedar

• Betterment charges paid receipt

Khata transfer will take seven days.

Khata amalgamation

Along with the application form, the documents required are

• Notarised copy of sale deed

• Property tax paid receipts

• Sketch showing amalgamation of property and measurements

• Affidavit regarding proof of blood relationship

• No Objection Certificate from BDA if property is located in BDA layout (in case of for vacant land)

This will take 30 working days.

Khata bifurcation

Along with the application form, the following documents are required.

• Notarised copy of sale deed

• Property tax paid receipt

• Sketch showing the bifurcation of property and measurements

• No Objection Certificate from BDA if property is located in BDA layout (in case of for vacant land)

This will take 30 working days. ⊕

References

Information for this guide has been provided by K K Eranna, Revenue Officer, C V Raman Nagar Assembly Constituency.

Nice article very helpful. I am in process of getting khata.. one point to note is they don’t accept the application submitted from website.They provide u some colored official copy which also has acknowledgment

i purchased a property in Bangalore (in Singapura, near to kaveri project) around 4 1/2 years back. But i didn’t have the khatha certificate. The owner is telling that the govt is not accepting applications for khatha. Till now he is saying the same thing. we are so much worried about this issue and we didn’t pay the tax also. Wheather the govt is accepting the application for khatha? He is now telling that govt is taking tax for BDA properties only. Can you please help me?. If some body is there to help me, i’m ready to give other details. Thank you..

very comprehensive and informative.good work, Vaishnavi!

Just adding that, yes, several of us got our khathas done in the Konanakunte jurisdictional area with absolutely no bribes, either to get the encumberance certificate or to get the khathas. number of visits varied between 3 to 5 for each of us.

My father in law is expired and his property has to be transferred to my mother in law. My question is it possible for a transfer if somebody has taken a stay on the property. Kindly help me because we want to dispose of the land. The land is located in guniagrahara, yesaragatta obli, Yelanka taluk.

Can someone post a sample khata copy.