When the Centre refused to allow the state government to procure rice from the Food Corporation of India, the Anna Bhagya scheme appeared to be in danger. As a solution, the Congress-led state government reduced the amount of food grains supplied through ration shops and initiated cash transfers in lieu of the remaining rice.

As per the revamped Anna Bhagya scheme, recipients would now get 3 kgs of rice, 2 kgs of ragi and Rs 170 per person on the ration card. Each household can now get a maximum of 21 kgs of rice and 9 kgs of ragi.

In Part 1, we looked at the issues with reduction in the quantity of rice provided through the scheme. In part 2, we will look at issues with the cash transfer process.

Read more: Missing: ‘Anna’ in Anna Bhagya scheme

Cash transfer process

Currently, cash transfer in the Anna Bhagya scheme is done through the Aadhar Payment Bridge System (APBS), explains Preethi Chandrasekhar Doddamani, Deputy Director of the Food and Civil Supplies Department, Bengaluru.

APBS is a payment system where cash-based benefits, such as pension or LPG subsidies, are transferred to a beneficiary’s bank account. Money is transferred to an Aadhar Enabled Bank Account, i.e. a bank account that is linked to the beneficiary’s Aadhar card.

Cash transfers for the Anna Bhagya scheme are done to Aadhar Enabled Bank Accounts of the head of the household as listed on the ration cards.

However, in reality, the process is not so smooth. Many beneficiaries-including domestic workers such as Priya* from Kodigehalli, Lakshmi from South Bengaluru, and Laxmi from BTM Layout, featured in Part 1- had not yet received cash transfers.

Unfamiliarity with the banking process

When I spoke with Jansi Rani, a social worker, in the first week of August, she was knee-deep in the Food and Civil Supplies database trying to understand which beneficiaries had received cash transfers under the Anna Bhagya scheme. Jansi, who works with ActionAid Association (India), helps low-income communities access various government benefits and schemes.

She noted that many beneficiaries from low-income communities had limited literacy and understanding of the banking process, which hindered progress.

Preethi has a similar outlook. “It is essential to remember that cash transfers are given to the bank accounts of the head of the household as listed on ration cards. But in many cases, we have observed that the head of the household does not have a bank account. So, this is the first step. Everyone must get a bank account,” says Preethi.

However, Jansi believes many people do have bank accounts, especially after the Jan Dhan Yojana was introduced in 2014. However, she observes that most low-income communities still depend on cash transactions for their livelihood and expenses. “So, very few of these bank accounts are used regularly,” she says.

When bank accounts are unused for a long time, banks designate them as inoperative. In such cases, people sometimes open a second bank account when they need to access some other scheme. This leads to multiple bank accounts that people who are unfamiliar with the banking system cannot track.

“We have several beneficiaries who have no idea which bank account is operational and where the funds may have gone,” says Jansi. On the advice of the Food and Civil Supplies Department, she is now checking the status of cash transfers for each person who came to her for help via the Food Department website.

Read more: Interview Amit Basole: “PDS the most effective safety net, cash transfers the worst”

Linking Aadhar to bank accounts

Another issue Jansi noted was that very few beneficiaries had linked their bank accounts to their Aadhar cards. “These people do not use their bank accounts regularly and do not know that they need to link Aadhar cards to their bank accounts,” she says.

Linking Aadhar and bank accounts is also no easy feat for many urban poor. Priya* had a bank account with the Indian Bank since 2015 but she had not linked the account to her Aadhar. She recently attempted to link her bank account and Aadhar so that she would receive the cash benefits from the Anna Bhagya scheme.

The only glitch-her bank branch requires an OTP (one time password) sent by UIDAI to her phone number registered with Aadhar. The phone number, belonging to her husband, is inoperative. Her bank is unable to use the much-touted biometrics feature to complete the linking process.

Priya now has to take time off work, change her registered number at the nearest UIDAI centre, and then complete the linking process.

She is tempted to forgo the cash because the entire process is intimidating to her. “It is very complicated for me to understand. And people at the bank and Aadhar centre get irritated if I ask for help.” But she is due to receive Rs 550 per month. “It is not a small amount. So, I need to get it done.”

Complex procedures

Moreover, according to the National Payments Corporation of India (NPCI), the organisation in charge of the Aadhar Payments Bridge System, only one bank account of the beneficiary can be linked to Aadhar at any point. If a beneficiary links more than one bank account to Aadhar, NPCI will automatically take the latest bank account linked to Aadhar.

Meanwhile, other domestic workers I spoke with say their bank accounts are linked to Aadhar, but they have not yet received the cash benefits. Some have tried approaching their local ration shops for clarity. “I tried asking at the ration store but they also don’t seem to know,” says Lakshmi, a domestic worker from South Bengaluru, who has dutifully linked her Aadhar to her bank account at Canara Bank, but has not received any subsidies so far.

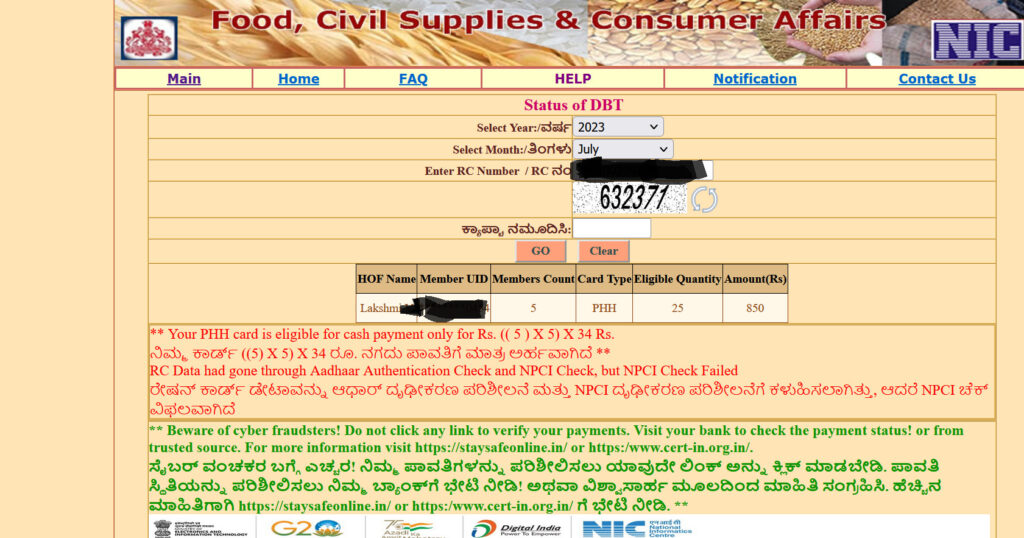

The Aahaar website shows that she is entitled to Rs 850 in cash transfer but has not received it in July or August.

The website shows that the payment had not gone through because the NPCI Check failed. “I don’t understand this message,” says Lakshmi. “My bank says my account is linked to Aadhar. What else should I do?”

When I asked Preethi about Lakshmi’s situation, she suggested that beneficiaries need to first ascertain the cause of transaction failure. “One, they should check if they have completed their eKYC process, i.e., the process of linking their ration cards to Aadhar. They should also contact their bank and ensure the account is linked to Aadhar.”

The official rejected the possibility of any other systemic error. She also suggested that beneficiaries could contact their taluk level Food Inspectors to understand the issues with their cash transfer.

You can check the due cash transfer for a ration card and the status of cash transfer here: https://ahara.kar.nic.in/status1/status_of_dbt_new.aspx. You can also contact food inspectors for the five taluks in Bengaluru to know more about cash transfers: Anekal, Bengaluru East, North, South and Yelahanka. Taluk-wise food inspectors can be found here: https://ahara.kar.nic.in/Home/Offices.

Better preparation required?

Until they can sort out the technical difficulties, beneficiaries will continue to lose out on the cash transfer, according to Preethi. Lakshmi or Priya cannot claim cash benefits from July and August, the months where cash transactions failed for them. That money will be lost to them.

Considering the complexity of the process for citizens who are not internet or computer-savvy, I asked Preethi if the Food and Civil Supplies Department should have been more prepared before implementing the scheme. “We have close to one crore beneficiaries in just Bengaluru. If we were to check every beneficiary’s bank account details beforehand, it would take over a year to implement the scheme,” she says.

The official also claims that the Food and Civil Supplies Department had taken steps to make the process smooth. “We organised camps in collaboration with the postal department where we helped close to 20,000 people open bank accounts for the scheme,” she says. Additionally, Preethi points out that the Food department had put out lists of beneficiaries whose cash transactions had failed outside ration shops.

Communication with ration stores

I contacted ten authorised PDS stores in the city and asked if they were given lists of beneficiaries whose cash transfers had failed. All the ration stores said they had not received any such list. Govindraj, manager of a ration store in Ganesh Nagar, says several customers had asked him about the cash transfers. “I tell them that the government will have their data. If they don’t have a bank account, I advise them to make one and get it linked to Aadhar. But we are unable to help them go through the process,” he says.

A ration shop owner from Thindlu, who did not wish to be named, said that he helps beneficiaries check the status of their cash transfers on the Ahaara website but had not received any list from the Food Department.

Manju, a manager of a store in Munnekola, says they had not received any information from the Food and Civil Supplies Department about the cash transfer aspect.

A 2022 report by Azim Premji University showed that the PDS system was far more effective than cash transfers in aiding low-income communities during the lockdown. The report pointed out the need for strengthening and simplifying digital payment systems. This may be a crucial step for the Anna Bhagya scheme to be successful.

My bank account is linked to Aadhar but again npci check is failed in ration cards.. I dnt get any amount in my bank account