A major source of tax revenue for states is Stamps, or Stamp Duty and Registration Fee. Karnataka, for instance, collected Rs 10,576 crore in Stamps and Registration Fee in 2020-21, which amounts to 11% of the state’s tax revenue, as per the State Finances Audit Report for the year ending March 2021

Stamp Duty is a tax payable on legal documents/instruments that function as evidence of the transaction that has taken place. It could be:

- Fixed (adoption deed, divorce etc.) or

- Ad-valorem i.e, a proportion of the Market Value (MV). MV is defined in the Karnataka Stamp (KS) Act, 1957, as the price a property would have fetched if sold in the open market on the date of execution of such instrument or the consideration stated in the instrument, whichever is higher. of the property on instruments recording transactions such as sale, exchange, a mortgage with possession, etc.

One way to be aware of issues of impropriety and poor performance in local government bodies and departments is to track the audit reports from agencies like the Comptroller and Auditor General of India (CAG).

This article is the eighth in the Series: Understanding Public Project Audits, by experts from the Indian Accounts and Audit Service.

In order to have objectivity in the determination of the market value of immovable property registered at the Sub-Registrar Offices (SROs), the state government prescribes rates referred to as Guidance Market Value (GMV). GMV is an important control to ensure that documents are not registered below a minimum value, in order to reduce the tax payable. GMV is determined through a prescribed process which includes the Central Valuation Committee (CVC) and Valuation Sub-Committees (VSC). The government also issues certain instructions in order to rationalise the process of fixing GMV.

The Office of Accountant General (Audit) II Karnataka, conducted a performance audit to examine the following:

- Whether the GMV was revised in a timely manner.

- Whether the methodology including assessment criteria, valuation methods and addressing of public opinion was adequate to capture values reasonably close to the actual transaction values that prevailed in the market; and

- Whether the system devised for the implementation of Guidance Value was effective in optimising revenue collection.

The Performance Audit covered the period 2013-18 and was conducted in 11 out of 34 District Registrar in the state and two SROs under each of them.

The central theme of the report was that year after year, a routine 8-10% increase in GMV was resorted to rather than an objective evaluation of different factors that affect the land price. Thus, the final values notified did not appear to be very well thought out.

The Audit Report opined that a realistic estimation of GMV through a detailed analysis of the documents available from all possible sources would enable a more realistic estimation of transaction values. Thus, an innovative approach was adopted by using other documents relevant to immovable property transactions i.e Sale-Agreements, Deposit of Title Deeds, documents available with the Land Revenue Department (valuation made for lease/grant of government lands), banks and other financial institutions (loan documents, sale/construction Agreements, Bank Valuation etc.) and developers and builders advertisements and brochures. Some of these documents, especially those available with banks are not auditable in the normal course.

Thus, our audit went beyond its normal zone of comfort in pursuing this line of enquiry. Here are our findings.

Read more: Understanding undervaluation notices

What did the Sale Agreement say?

An actual sale is generally preceded by a sale agreement between an owner and a prospective buyer. This document tends to disclose the actual value of the transaction since it acts as a guarantee for the consideration passed on until the transaction is finalised.

The audit analysed 484 sale agreements and corresponding deeds and found that in 405 sale deeds (84%), the GMVs were less than the consideration stated in the sale agreements. Out of these 405, only 62 sale deeds were registered for the same consideration shown in the sale agreements, whereas the remaining 343 sale deeds were registered at rates as per the prevailing GMVs.

The difference between the consideration stated in the sale agreements and that of the sale deeds in respect of these 343 sale deeds was Rs 61.10 crore, on which the Stamp Duty and Registration Fee of Rs 4.06 crore could have been realised. Since the sale agreements were instruments enforceable in a Court of Law and had a high possibility of capturing the real market value, the sale agreements could be considered indicators of GMVs.

Value mentioned in Title Deeds with banks

Banks and other financial institutions disburse loans to purchasers of properties based on the amount required for the purchase. This loan is sanctioned on the security of the property and the purchaser enters into an Agreement for Deposit of Title Deeds (DTD) with the bank. The value of the property declared in DTDs tends to be more realistic. However, the value declared in the corresponding sale deeds usually tends to be the value prescribed as per GMV.

The audit verified the value of the property declared in 339 DTDs with the value declared in its corresponding sale deeds and noticed a drop of 12.61% to 57.51% in the values stated in the sale deed vis-a-vis the values as per DTD, with a consequent revenue impact by way of loss of Stamp Duty and Registration Fee of Rs 3.79 crore.

Higher values furnished by Land Revenue Department

During the estimation of values, one of the inputs is the values furnished by the Land Revenue Department. The audit compared the information given by the department with the GMVs and noticed that the GMVs notified by the CVC were far less than the values furnished by the Revenue Department (42% to 92% ) in five test-checked villages.

Higher values declared under TDS

As per Section 194(IA) of the Income Tax Act, any person buying immovable property for consideration exceeding Rs 50 lakh has to deduct tax at source (TDS) at 1% of the sale consideration, if the seller’s PAN is provided. Else, 20% of the sale consideration is to be deducted as tax.

Audit noticed that the TDS and PAN details of the parties concerned were not being captured by the department in the software (KAVERI) used for the registration of documents at SROs. On verification of the TDS certificates in all the 30 cases (where evidence for TDS deduction was found), the Audit noticed five cases (16.66% of the audited sample) wherein the sale consideration shown in the documents was lesser than the mandated 1% was deducted and paid to the Income Tax Department by the purchaser. This resulted in the undervaluation of properties by Rs 285.33 crore and consequent short-levy of Stamp Duty and Registration Fee of Rs 18.82 crore.

The audit recommended that the KAVERI software be modified and capture of PAN/TDS details and cross-checking of information made mandatory.

Prices mentioned in developers’ ads and brochures to be considered

The prices quoted by builders/developers are arrived at after factoring all components of pricing and depicting the values based on prevalent market conditions. The CVC, in its instructions, had directed that the prices quoted by builders/developers in their advertisements be considered as one of the factors during estimation.

Though an element of the bargain may have to be allowed in respect of such instruments, prices quoted by builders/developers serve as near-realistic sources for capturing current market trends. The audit verified the GMVs estimated by the department and compared them with the brochure price (base price) quoted by the builders in respect of 35 projects.

In 27 projects (77.14% of the audit sample) in three districts, it was noticed that the GMVs notified were far less and were only between 30 and 62% of the base price quoted by the developers. The consequent undervaluation in these cases amounted to Rs 965.46 crore and the loss of Stamp Duty and Registration Fee was Rs 63.72 crore.

Read More: How does Akrama Sakrama affect you?

Underestimation of the value of sites

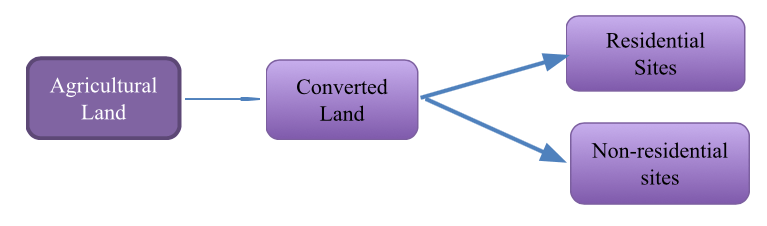

Transactions involving land development happen at various stages, with a progressive increase in value.

In many cases, the values of residential sites determined during estimation by the CVC were less than the GMVs fixed for converted lands which were not developed. In 121 villages in Bengaluru (urban and rural) for the years 2016-17 and 2017-18, the values of residential sites were underestimated by 12 to 78% and the revenue impact worked out to Rs 79.40 crore.

Deletion of specific rates during subsequent revisions

There is a separate instruction for the valuation of properties abutting National Highway (NH), State Highway (SH), Ring Road and other Main Roads. Agricultural land and other sites abutting NH, SH or Ring Roads in the jurisdiction of Bengaluru (Urban) and Bengaluru (Rural) districts were assigned higher rates till 2016-17. With effect from April 2017, though the specific higher values continued for agricultural properties, the entries pertaining to residential properties were deleted resulting in a reduction of GMV to the general village rate specified during 2017-18.

CVC stated that certain survey numbers of certain villages were dropped so that unauthorised registrations could be checked and GMV close to market value could be notified. However, in absence of specific rates, SROs registered the properties at general GMV applicable to the village.

A comparative study of GMV Notification under three District Registrars in Bengaluru (Urban) and Bengaluru (Rural) revealed that this decision of the CVC affected 315 villages. The resultant undervaluation of properties during 2017-18 when compared to their value during 2016-17 ranged from 10 to 140%.

| In one sample village | |

| Year | Considerations of Sale-Deeds Registered |

| 2016-17 | 52,144 per sq. m. to 78,488 per sq. m. |

| 2017-18 | 22,000 per sq. m to 44,000 per sq. m. |

In nine sale deeds which were registered in 2017-18, the aggregate undervaluation of these properties compared to their GMV during 2016-17 worked out to Rs 3.64 crore and the consequent loss of SD and RF at 6.60% worked out to Rs 24 lakhs in just one village for just nine sale-deeds.

Failure to earmark special areas of enhancement

In order to achieve GMV close to the prevailing market value, it is important to identify special areas of enhancement within a jurisdiction, like NH, Ring Road, new residential projects, etc., and assign values to properties in the vicinity of the same.

Non-inclusion of survey numbers to properties abutting Ring Roads

In Bengaluru (Urban), the CVC identified survey numbers attached to Ring Roads in 70 villages. Cross-verification of the survey numbers in each of these 70 villages with the relinquishment deeds for Ring Roads revealed that in around 500 cases, there was no indication that the plots were abutting Ring Roads resulting in undervaluation.

In 21.22% of the audited sample, the properties were situated in the survey numbers which were omitted as they would have indicated the properties as abutting the Ring Road. The registered value of the properties in these cases amounted to Rs 451.09 crore as against Rs 874.59 crore applicable resulting in undervaluation of properties and consequent short-levy of Stamp Duty and Registration Fee of Rs 10.48 crore.

Absence of specific GMV for new projects

New projects coming up in the jurisdiction of the SROs/VSCs need to be brought to the notice of the CVC so that specific GMVs can be notified. In 57 out of 76 apartments registered at general GMVs of the respective villages between 2015-16 and 2017-18 in three districts, the registered value of flats was Rs 1,176.09 crore which was lesser than the base price quoted by the Developers i.e Rs 1,911.88 crore by a significant margin (between 20 and 61%). Thus, omissions on the part of SROs to refer these projects to CVC for notifying GMV had resulted in the loss of revenue of Rs 48.56 crore on the differential value of Rs 735.78 crore.

The Audit observations involving Rs 158.36 crore revenue forgone/short-levied pointed out in the Audit Report are based on the test-checked offices only. Similar errors/omissions may exist in other unit Offices as well. The CVC assured that the issues pointed out by Audit had already been taken cognizance of and will be addressed in the GMVs of 2018-19 which, however, are yet to be issued (December 2018).

The Audit Report was presented to the state legislature on October 10th, 2019 and can be accessed here.

[The authors are from the Indian Audit & Accounts Service. Views expressed are personal.]

Excellent educative article regarding the loss to the exchequer due to undervaluation of real estate in urban areas. Honestly I was looking for the percentage of undervaluation. For example if a property is worth Rs. 3 crores, would it be registered at 60% of the value with loss of 40% since stamp duty is paid only on 60%? If such a percentage is available kindly share from your research. But certainly an excellent article. Kudos.