Everyday, the advertisement sections of our morning newspapers bear notices of banks auctioning the properties of enterprises that failed to repay loans for more than three months. Everyday, smaller manufacturing companies in Chennai, which had successfully braved the economic distress even during the tsunami and the 2015 floods, are bringing down the shutters for good. And while the COVID-triggered medical crisis and political news routinely eclipse such news, COVID-19 has actually crippled the MSME sector in Chennai (Micro, Small and Medium Enterprises), leaving many entrepreneurs neck deep in debt.

Industrial estates in Chennai that were always abuzz with activity are now eerily quiet. The situation is so grim that even seasoned entrepreneurs find themselves in deep distress. The reasons are many.

K V Kanakambaram is a manufacturer of conveyor rolls used to transport materials in airports and mines. Kanakambaram who owns a firm at the Guindy Industrial Estate is in a spot. He has a deadline to deliver, but the price of steel which was at Rs 45/kilogram just three months back is now hovering around Rs 70.

“It is much more than what I have quoted in the tender. We are incurring huge losses due to the surge in the cost of raw materials,” said Kanakambaram, who is also the President of Guindy Industrial Estate Manufacturers Association.

A web of woes for the MSME sector

It is not just the hike in raw material prices. The pandemic and the lockdown has had serious implications for human resources as well. Migrant workers, comprising the major workforce in the MSME sector in Chennai, went back to their respective home towns and villages when the lockdown was clamped and many did not return. Those who lived in the city also faced problems commuting to their workplace.

“During the lockdown period, two-wheeler movement was restricted. And that’s the most common mode of commute among employees in the small enterprises. According to the lockdown guidelines, owners should deploy buses to pick up employees to the workplace. But, since it is a huge loss for my employer as well, he opted to shut down the glass making unit during lockdown. And for the first time in five years, he did not have resources to pay me for a month,” said Ram Kumar, a migrant from Assam, who works in Avadi.

The medical oxygen crisis during the second wave has also dealt a big blow to the sector. Companies manufacturing automobile components and other industrial goods and equipment in the estates of Guindy, Ekkaduthangal and Ambattur need oxygen for cutting steel. The clampdown on the use of industrial oxygen in the wake of the medical shortage hit fabrication, steel and allied industries so much that they have completely suspended operations over the past two months.

“In such a scenario, it is difficult for entrepreneurs to meet even the fixed costs,” said Vasudevan S, Joint secretary, Tamil Nadu Small and Tiny Industries Association (TANSTIA).

Many of the MSME units sell their products and supplies to Public Sector Undertakings (PSUs) owned by the Central and State Governments. With issues such as the above stalling production, these firms have not been able to deliver orders on time. This in turn attracts penalties from the PSUs. “PSUs hold back 12% of the payment in the name of ‘liquidated damages’ if we don’t deliver on time,” said Kanakambaram.

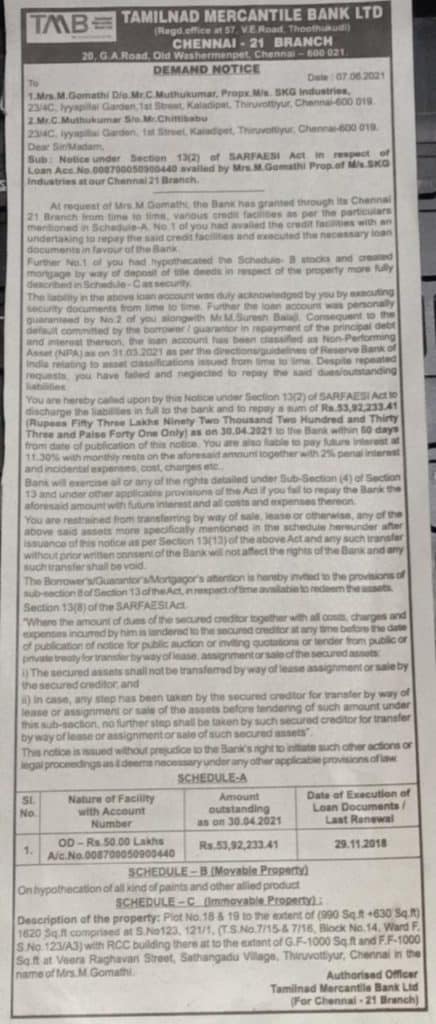

The blow of the SARFAESI Act

The imposition of the norms of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act 2002 has driven the final nail in the coffin of the MSME sector in Chennai and beyond. The SARFAESI act empowers banks to list the loan of a borrower as a ‘Non Performing Asset’ (NPA) and auction their properties (after putting out a notice in the newspapers), if the latter has not made any repayments on loans for three months.

“Entrepreneurs find it tough to pay the rent for office space, salaries for employees and even current bills. How can they repay loans under the current circumstances?” questioned C K Mohan, Former General Secretary, TANSTIA, adding that a majority of the MSME will cease to exist if the provisions of the SARFAESI Act come into force and NPA norms are not relaxed temporarily.

While the six-month moratorium on loans last year supported the entrepreneurs to an extent, the absence of the same during the second wave of COVID and lockdown has placed them in a more vulnerable situation. “We are not happy with the relief package that was offered last year. The emergency credit line that was extended got exhausted in managing the worker’s ESI, PF, and filing of GST. These loans hardly helped us to revive or revamp the MSME sector. The emergency credit line loans were repaid within 6 months. But no such package was offered this year,” said Vasudevan.

Well aware of the financial doldrums in which the sector finds itself now, banks are unwilling to give loans to small entrepreneurs. “I made many attempts with private and national banks to get a loan. As my loan got rejected despite a good CIBIL score (a consumer credit rating that helps in approval of loans), I had no choice but to approach non-banking financial companies that levy an interest of 20-23%,” said Virarajan Kumar, who started a catering business this year.

Read more: For migrant workers in Chennai, second COVID wave brings déjà vu

Help needed to tide over the crisis

There is no documented data about the exact spread of the MSME sector in Chennai, but experts say there are approximately 42 lakh organised and unorganised units in Tamil Nadu. Chennai accounts for 25 to 30 percent of these units. “47,086 entrepreneurs from Chennai filed the Udyam Registration Certification between June 2020 to March 2021 at the Udyam registration portal, Union MSME Ministry. But the actual number is double than that is registered officially, as many very small-scale industries and vendors do not come under the ambit of GST Registration,” said Vasudevan S of TANSTIA.

Vasudevan added that the turnover from the MSME sector accounts for 30 to 40 percent of Tamil Nadu’s GDP. As losses for the sector augur ill for the state exchequer, the state government has also intervened. Recently, Tamil Nadu Chief Minister M K Stalin wrote to the chief ministers of twelve states to support his request to the central government for a moratorium on repayment of loans by MSMEs.

While this is a welcome move, there is a lot more that the sector needs in the state. Regulation of raw material prices, relief packages for workers and entrepreneurs, allowing the movement of MSME employees during lockdown are a few of their long list of demands. Based on a letter from TANSTIA to the Chief Minister of Tamil Nadu, some of their most crucial demands may be listed as below:

- In case of state and central government orders, delay penalties should be waived and an additional time of six months should be given to deliver orders.

- As most enterprises have come to a standstill, the union government should bear the employers’contributions towards Employees State Insurance (ESI) and Provident Fund (PF) for the next three months.

- Loans should be restructured with a longer repayment schedule and NPA norms should be on hold for the next 2 years. It may, however, be noted that the Supreme Court recently disposed of a writ petition seeking fresh loan moratoriums, extension of time period under restructuring scheme and temporary stay on the declaration of NPA.

- Banks usually charge interest of around 10-12% on loans for MSME, on which the latter seeks a rebate under the present circumstances

- PSUs in Tamil Nadu should prioritise giving contracts to the MSMEs in the state to help the sector recover.

Apart from these suggestions, “The government should encourage export incentives of 15% for the MSME. Currently, the export incentive is a meagre 1.8%. Good export incentives for the sector would also fetch the government much-needed foreign exchange,” S Vasudevan said.

Reducing the GST charged on food and cold storage products (it is currently 18 %) and decreasing the income tax rate from 25% to 15 % and 20% for micro and small industries respectively are other long-pending demands.

Loss of livelihoods

The overall economic constraints that enterprises face directly affects the livelihood of employees. It is vicious cycle. The fear of contracting virus and loss of livelihood prompted many employees to quit jobs and move to their hometowns, even it means living without any regular income. “I wanted to be close to my family as the cases peaked in Chennai. Who will take care of me if I contract the deadly virus?” questioned Amar Prakash R, a migrant worker from Andhra Pradesh, who was working in a spice-making unit in Pattabiram.

But then this urban-rural migration has caused a severe shortage of manpower for the MSME sector in Chennai, hitting production and business, and therefore adding to the financial distress of entrepreneurs. As a result, many were left with no option but to reduce their staff. “Sustaining business operations became impossible due to the lockdown restrictions, migrant crisis and the slowdown in economic activity, I had to fire 15% of my regular employees. I have had to downsize my business in order to save it,” said an employer from SIPCOT industrial estate.