Owning a house is the dream of a lifetime for all of us. In a city, owning an independent home is impossible even for the upper-middle class. So, an apartment is the only choice available for 90% of urban citizens. The other less attractive alternative is living in the extreme outskirts of the city in an independent house and traveling for longer hours to reach office every day.

Despite the housing market crisis post-2012, apartment prices have not come down. The price of apartments has largely stagnated since 2012 and now there’s an oversupply of inventories. As of 2017, there were 65,000 odd unsold apartment units in Chennai, the average apartments sold per year in Chennai being 12,000. While apartment prices have not increased to match inflation in the rest of the economy, neither have they come down.

In any market, an oversupply of inventory should have brought down the prices. But, it is a complicated situation in the sector, where the builders can’t afford to sell it at a lower price, and are also stuck with the inventories. They are unwilling to bite the bullet and sell these at a loss, although holding unsold stock also translates into loss for them, as they continue to pay interest to banks on loan in the hope that the market will improve.

The need to make housing affordable

Demonetisation and the COVID crisis dealt a decisive blow to the real estate sector. The beginning of the Real Estate Regulation Act has also put an end to builders juggling money from new to old projects. A real-estate loans crisis can potentially trigger a US 2008-style economic crisis in India.

The ILFS default on the payments crisis of 2018 was managed with patchwork, but the threat of real estate loans defaulting is still a 40 billion dollar time bomb, yet to be defused. In the near future, the builders won’t bring the prices of the already built homes any lower, and will continue to build similarly unaffordable homes.

The bulk of the inventory available now is unaffordable to most of the population, which is the crux of the problem. A 2-BHK apartment costs on average Rs 40-50 lakh on the outskirts, meaning longer commute to the office or at least 60-80 lakh in areas closer to the commercial areas and workplaces in the cities. This makes house ownership possible only for those who earn at least 10 lakhs per annum, and makes owning an apartment possible only for the wealthiest 10% population in the city, defined as upper-middle class.

Number of floors permitted in Chennai is one of the lowest in the world

Have you ever wondered why most apartments have only four floors and one floor for parking in Chennai? Thanks to the government’s regulations limiting the number of floors and built-up area via a technical term called FSI or Floor Space Index.

FSI of 1 translates to 1000 sq ft of built-up area in a 1000 sq ft of land (either in the floor as 1000 sq ft, or 2 floors each 500 sq ft, etc). An FSI of 2 correspondingly means you are allowed to construct 2000 sq ft of built-up area in the same 1000 sq ft land (i.e., 2 floors each 1000, or 3 floors each 667).

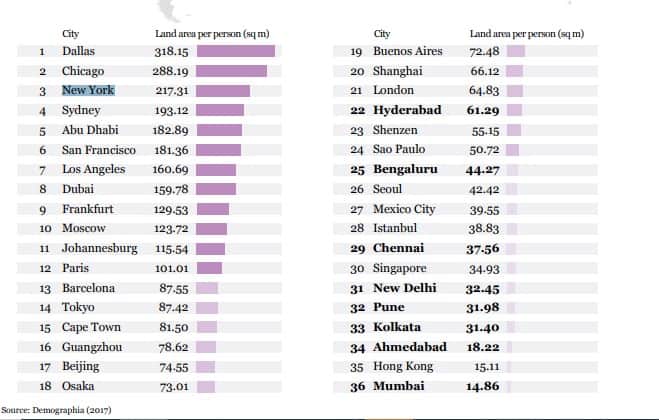

Below is the maximum FSI for Indian and global cities; all Indian cities including Chennai are at the bottom lower end.

Now, let’s dissect the cost of an apartment with some approximation: In a 2-BHK apartment of 1000 sq ft, costing Rs 60 lakh, construction costs amount to around Rs 20 lakh at approximately 2000 per sq ft. Another Rs 15 lakh would go towards shared land cost. The remaining Rs 25 lakh counts towards expenditure elements, such as design, approval (including the unaccounted costs in approval), marketing and profits.

Simply increasing the FSI from 2 to 4 keeps the construction costs the same, but reduces the shared cost towards the land pool by half. It also halves the fixed costs per apartment. Therefore, even if the builder maintains the same profit margins from the project on that land, the price of each apartment could come down by 25% to Rs 45 lakh. While construction costs remain unchanged with FSI, other costs get shared over more units and bring down total costs. Hence higher the FSI, lower the costs. An FSI of 6 would bring down the cost even more than an FSI of 4.

Will the government relax the restriction on FSI and heights?

In Oct 2018, the FSI of ordinary (as per CMDA categorisation) residential projects in Chennai was increased from 1.5 to 2. Despite that smaller projects on less than 10000 Sq ft land won’t benefit from the FSI relaxation Sam Ponraj, an architectural designer, points out that “since the height-related restrictions like the height of an ordinary building and thereby the number of floors remain unchanged, the raise in FSI has been not helpful for most of the projects in the city”.

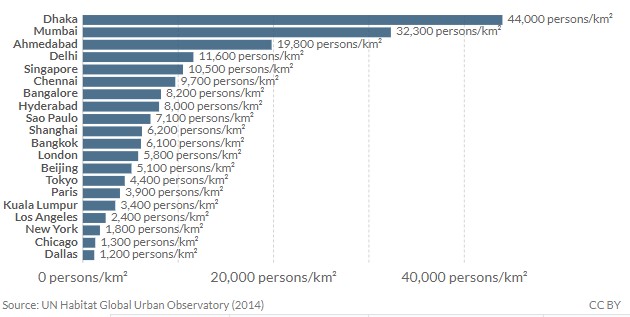

Government concerns over raising FSI arise from the perceived fear that it will result in increasing people density, while the data from IDFC Institute indicates that people choose to live in smaller homes, instead of bigger homes, due to the affordability factor. Population density is a function of scattered opportunities in a state, and low FSI in Chennai has not helped with low density. It has merely translated into cramped living.

Below is the data of per capita living space and population density in various global cities:

Currently with a Rental Yield (rent earned in a year as a percentage of the value of the property) of 2-3%, residential renting is an unviable business in India. While other countries have companies building affordable homes and are in renting business, there is none in India. Making the dream of housing affordable come true is possible only by relaxing the FSI norms.

It’s ironic how a government regulation is costing us 25% of our life savings to own an apartment. While Chennai has grown horizontally, it has remained stagnant in vertical growth. We should reclaim the skies, to help realize the home ownership dream of the city’s residents.

If the FSI is increased what builder will do is increase the number of apartments without reducing the price. he will try to increase the profit but will never decrease the price.

Some of them yes, But few players who does reduce the price will change the dynamic and force others.

You forgot the main reason behind the unnatural cost of homes, corruption. Most construction companies are in bed with politicians as a front for money laundering.

Moreove, hhome ownership shouldbbe discouraged. A house is a bad financial investments and home ownership acts as a perverse incentive which scuttles the equitable growth of the city. Home ownership is a cultural necessarily across the world, but it creates a lot of trouble.